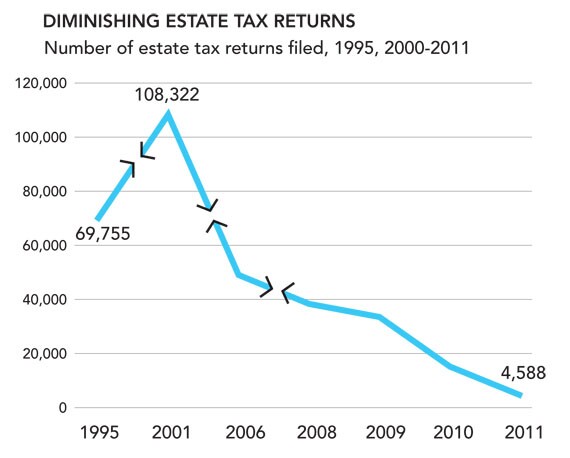

Source: IRS.gov

Source:

Source:

Source: IRS.gov

Source:

Source:

The IRS has long offered alternative dispute resolution, but says use has declined in recent years, and it hopes to make it more attractive and accessible.

Turns out clients are as mistaken about tax preparers as they are about taxes.

Lindsay Stevenson's transformation team drives innovation for Top 50 Firm BPM

Its investigators identified a scheme to improperly claim COVID relief tax credits.

Thomson Reuters announced the release of CoCounsel, a generative solution within Checkpoint Edge meant to help tax professionals with complex research.

$28 million in grants are available for Low Income Taxpayer Clinics, with a particular emphasis on states and counties that aren't currently covered.