Source:

Source:

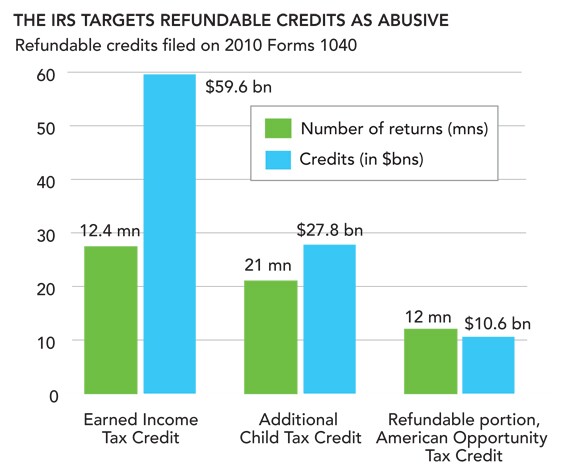

For 2010, three refundable credits were most prominent for the 142 million individual returns filed.

Source:

Source:

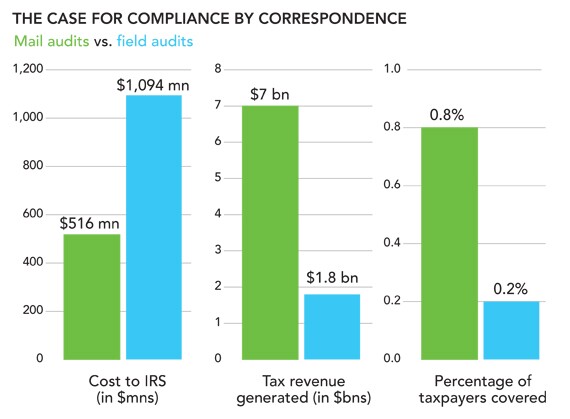

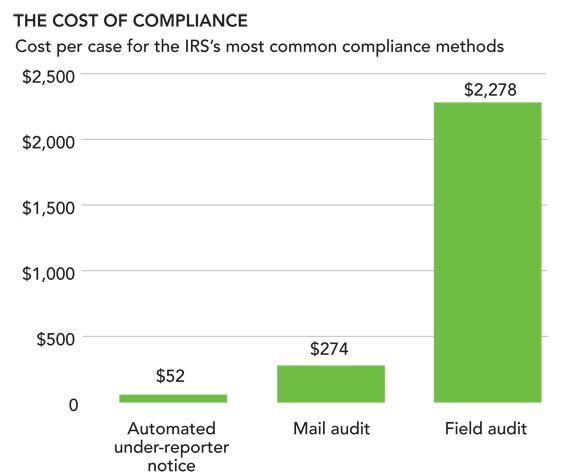

The chart above compares the costs of the three most common compliance methods used by the IRS to curb under-reporting.

Source:

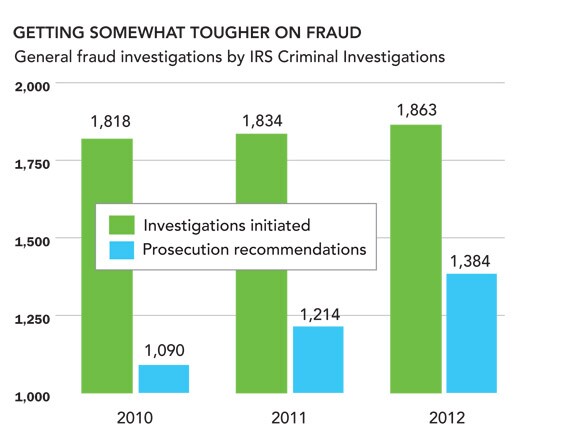

Source: IRS Statistical Data

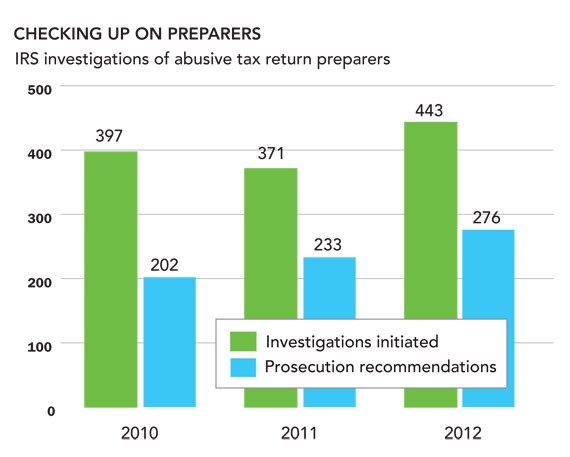

Source: IRS Statistical Data

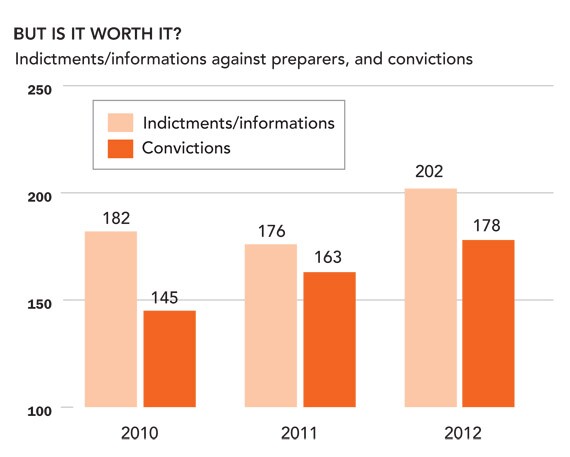

Source: IRS Statistical Data