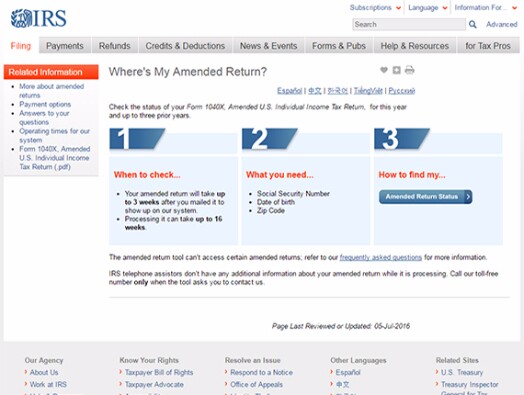

Time for revisions

With that in mind, we offer these 10 tips from the Internal Revenue on when, why and how to change a previously filed tax return.

You can see a text version of this slideshow

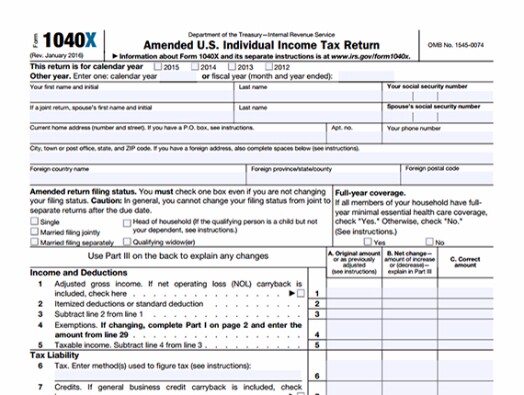

1. Use the right form

2. Know when to amend

More reasons are included in the Form 1040X.

3. Know when not to amend

4. Each year on its own

5. More is more

6. Refund first, amend later

7. Feel free to pay now

8. Double-checking Obamacare

9. Filing deadlines