The Top 10 Retirement Issues

July 22, 2014 1:53 PM

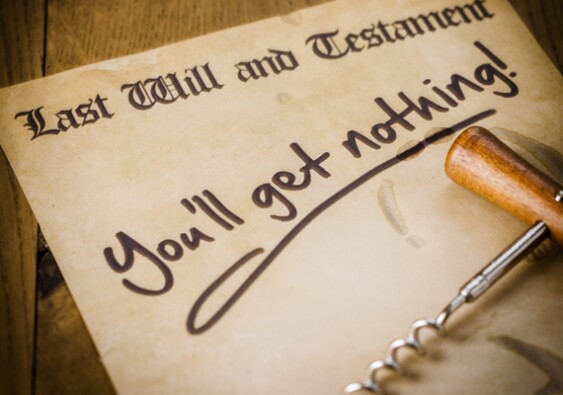

From rising health care costs to changes in the critical factors changing estate planning, its a handy guide to the new landscape of retirement.

More information, as well as resources for financial planners, are available at the