-

Proposed regs from IRS finally address the reporting threshold confusion that has plagued tax practitioners since 2021.

February 5 Friedlich Law Group

Friedlich Law Group -

Here are four things your business clients should be doing today.

January 21 Bookkeeper360

Bookkeeper360 -

Statehouse skirmishes: the Gold Card; how returns get prepared; and other highlights from our favorite tax bloggers.

January 16

-

-

There have been significant changes in the way in which the IRS is now dealing with R&D tax credits and viewing how they're documented.

December 16

-

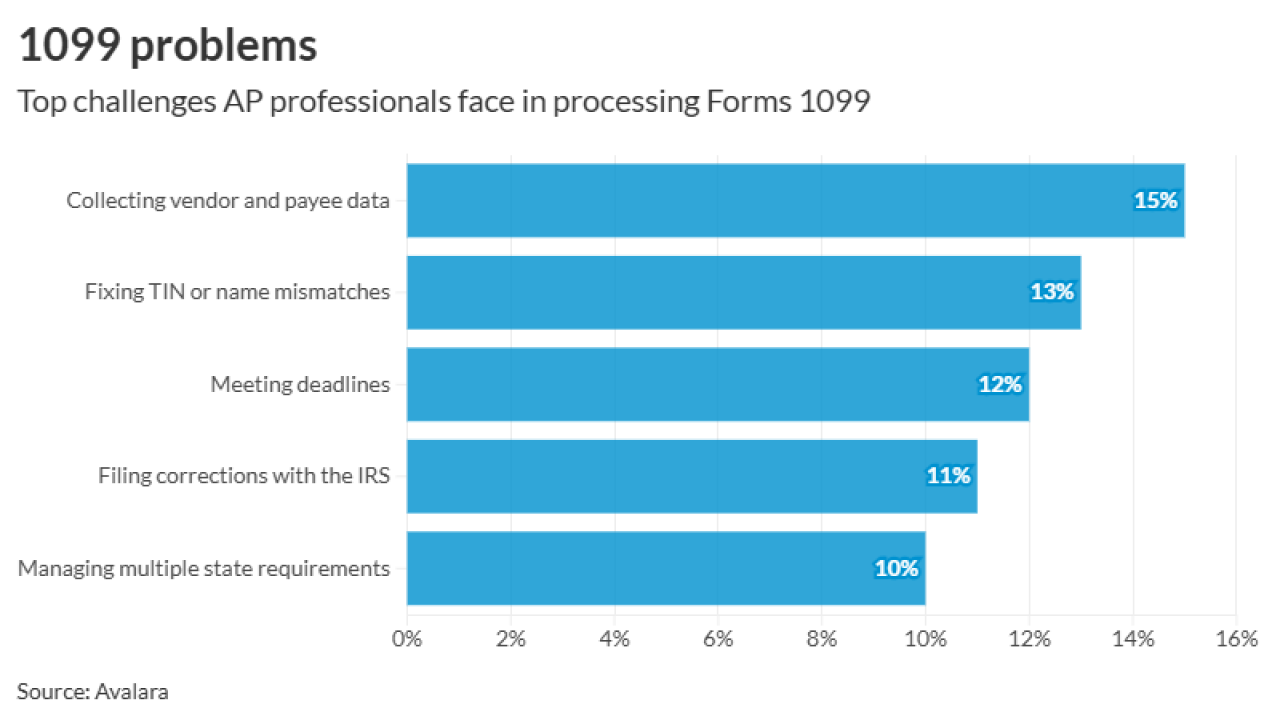

Approximately three-quarters of businesses haven't yet automated their 1099 information reporting for their taxes, according to a new report from Avalara.

December 4 -

The Internal Revenue Service has posted guidance in the form of questions and answers on digital asset broker reporting on the new Form 1099-DA.

November 6 -

Fact Sheet 2025-08 goes into detail regarding the dollar threshold for filing Form 1099-K under the One, Big, Beautiful Bill Act.

October 24 -

The Internal Revenue Service is taking steps to make sure taxpayers and tax preparers can reflect OBBBA changes in 2025 tax returns.

October 9 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

The Internal Revenue Service has posted a draft version of Schedule 1-A that will be used next tax season when claiming new tax breaks.

September 15 -

The Internal Revenue Service has released a draft version of the 2026 Form W-2, Wage and Tax Statement, with new fields for the exemptions on tips and overtime.

August 26 -

Former DOGE member Joe Gebbia's mandate as the nation's first chief design officer may include redesigning income tax forms.

August 21 -

Forms 2290 are due on the last month of the month a truck or applicable vehicle was put in service, according to the IRS.

August 13 -

The Internal Revenue Service won't be changing information returns and withholding tables for 2025 for the OBBA, but changes are coming next year.

August 7 -

The IRS has extended the deadline for reporting income paid to non-resident aliens, foreign corporations, and other foreign entities.

April 14 -

The IRS has made significant changes to Form 6765, 'Credit for Increasing Research Activities,' with new requirements set to take effect this tax year.

March 20 Source Advisors

Source Advisors -

The regulatory environment for digital assets will have significant implications for state-level reporting requirements.

March 19 Sovos

Sovos -

At the same time, the Internal Revenue Service is planning to close over 100 in-person Taxpayer Assistance Centers.

March 3 -

Major changes are afoot for companies that want to claim the research tax credit.

February 20 -

Millions more taxpayers will be receiving the Form 1099-K in the mail this year for the first time if they were paid $5,000 or more last year.

January 31