The Securities and Exchange Commission issued a 500-plus-page

With publicly traded companies responsible for

The SEC will review comments from the public during the next 60 days, and may revise its proposal before holding a vote to finalize the rule.

Here are five key takeaways from the SEC’s plan:

1. Why now?

Scientists are clear: There is “a brief and rapidly closing window of opportunity” to forestall catastrophic changes to climate conditions that allowed the modern economy to develop, according to

Propelled by scientists’ warnings and the actual, accruing damage from fires, floods, heatwaves and more intense storms, investors are demanding that companies address these threats commensurate to their scale and in line with traditional financial regulation. Transparent climate data, investors reason, should guide public markets toward urgent decarbonization.

2. Everybody’s doing it

The U.S. is playing catch-up with other parts of the world that have enacted corporate climate rules. In the U.K., the biggest companies will start reporting their climate-related risks next month for the first time, putting the nation on track to be the first in the Group of 20 countries to make such disclosures mandatory.

Lawmakers in Switzerland plan to require some companies to start reporting their climate-related risks in 2024. In the European Union, the rulemaking will likely involve companies having to provide detailed reports about their emissions and plans to transition to cleaner fuels. And last year, New Zealand was the first nation to pass rules requiring corporate climate disclosure.

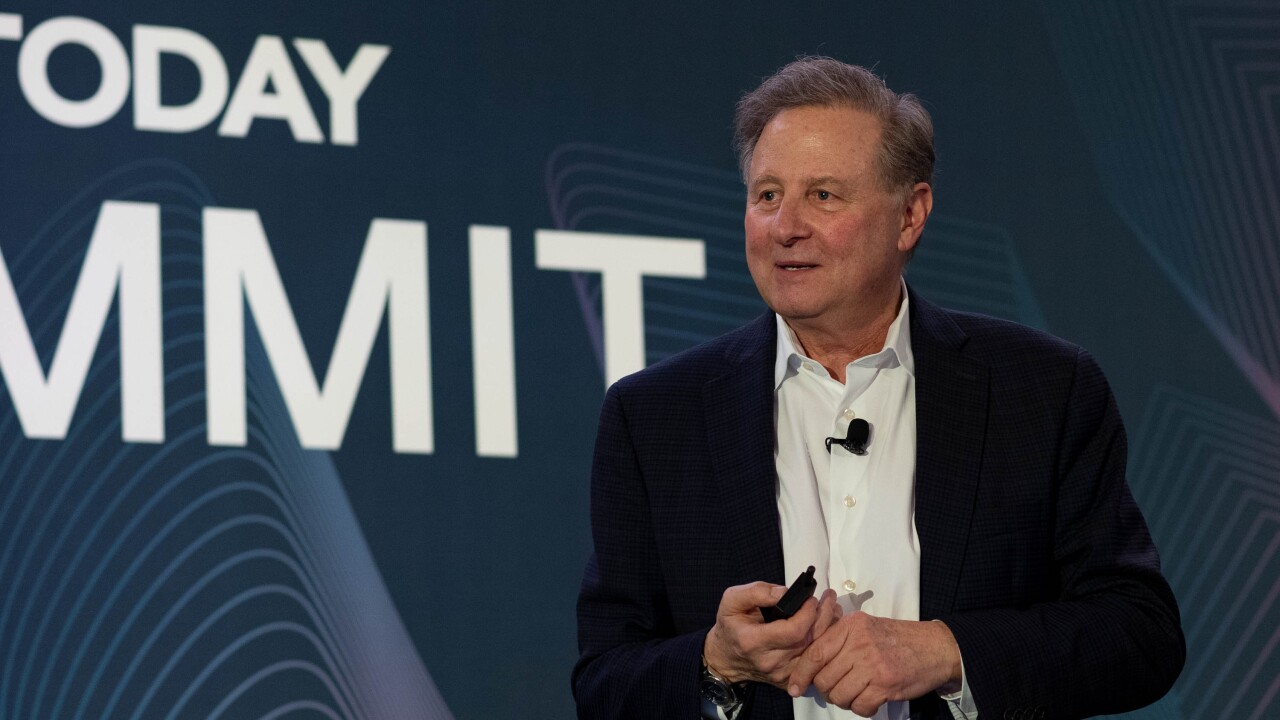

Thomas Gorman, a Washington-based partner at the law firm

3. Defining scope

Many companies already report not only the emissions they’re directly responsible for, through direct combustion (Scope 1) or purchased power or heat (Scope 2) — but also emissions from their supply chains and products. Those emissions,

About 1,500 U.S. companies voluntarily disclosed their Scope 3 emissions last year, according to CDP, a nonprofit that operates the world's largest database of corporate emissions data. Calculating Scope 3 can be a challenge because data are disparate and there are many ways they can be measured. These figures are particularly important to investors in heavy emitters.

The SEC plan makes Scope 3 disclosures dependent on how material they are to a company’s business. A universal Scope 3 mandate would prevent the creation of an emissions loophole where companies could hide some of their Scope 1 or 2 emissions by assigning them to external service providers, said Madison Condon, an associate professor of law at Boston University whose work is cited in the SEC draft.

The SEC drew on several popular frameworks for presenting this information, and used the

4. An eye on offsets

The SEC’s proposal would require disclosure on how and how often companies purchase carbon offsets to neutralize some of their emissions. Recent years have seen enormous demand for offsets — and raised

Climate activists have long fought against offsets because they can distract companies from cutting their emissions directly. The inclusion shows the importance of “requiring companies to disclose any reliance on carbon storage or removal or other offsets in their transition plans, since these accounting tricks can often serve to obscure their true climate impact,” said Ben Cushing, a campaign manager at Sierra Club.

5. Count on litigation

Critics of the proposal are in no short supply, including from within the SEC itself. Commissioner Hester Peirce, who voted against the measure, said its “action-packed 534 pages” fails to include a rationale for why the SEC’s existing materiality guidance is insufficient.

Legal debates over the proposal began long before Monday’s release.

The SEC will move ahead with its rulemaking, but “the real question is how far will the requirements go?” Dorsey & Whitney’s Gorman said.