-

As the U.S. retirement savings crisis continues to grow, legislators are taking steps to ensure all employees have access to formal retirement savings programs.

May 23 Paychex

Paychex -

Democratic presidential candidate Bernie Sanders introduced legislation that would impose a tax on trades of all stocks, bonds and derivatives in the U.S., a move he says would help curb Wall Street speculation and help finance his campaign promise to provide tuition-free college and cut student debt.

May 23 -

The proposed regs were a long time in coming, but generally taxpayer friendly. Here are seven key updates.

May 22Holthouse Carlin & Van Trigt LLP -

If you have wealthy clients who need these kinds of services, it can be a gold mine for CPAs, according to John Napolitano.

May 19 -

The Schedule D instructions had the older, higher tax rates for investors that were changed by the 2017 tax law.

May 16 -

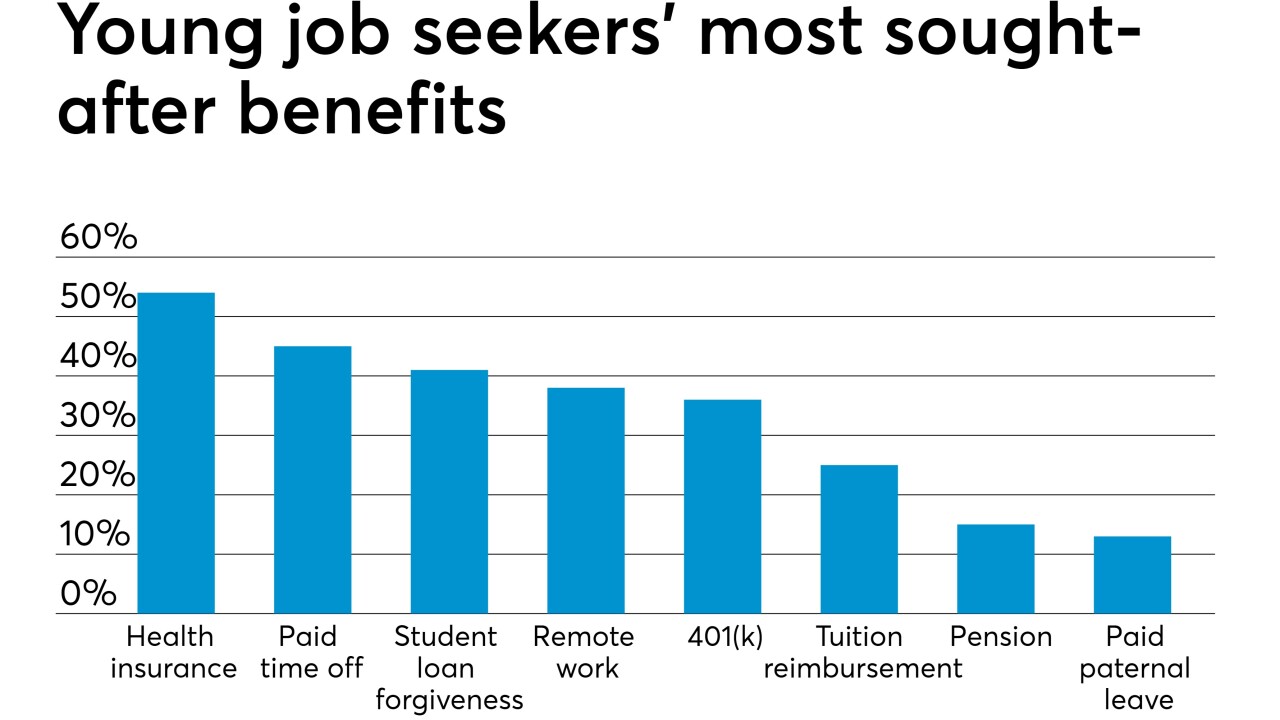

A poll conducted on behalf of the American Institute of CPAs found that young job seekers consider student loan reimbursement to be a bigger concern than retirement.

May 16 -

It's time to treat environmental, social and governance metrics with the same rigor as financial metrics.

May 15 Bailard Wealth Management

Bailard Wealth Management -

The bipartisan legislation aims to expand retirement savings by offering more tax incentives to individuals and small businesses.

May 14 -

Is quarterly reporting really valuable enough to investors to justify the time and cost spent to compile the reports?

May 10 Thomson Reuters

Thomson Reuters -

The Internal Revenue Service has issued final regulations upping user fees on enrolled agents and enrolled retirement plan agents.

May 10