Economic optimism among business executives who are also CPAs cooled down slightly in the second quarter of the year.

The AICPA’s quarterly Economic Outlook Survey polls CEOs, CFOs, controllers and other CPAs in U.S. companies who hold executive and senior management accounting roles, and found a drop in optimism about the larger economy and the growth prospects for their own companies compared to the first quarter of the year.

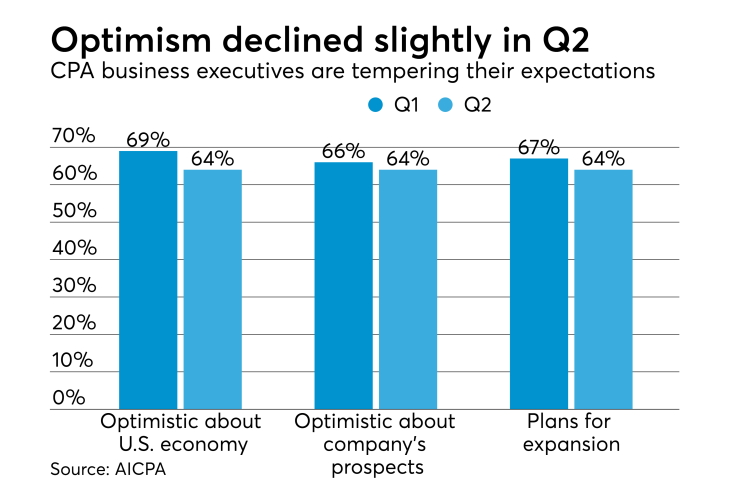

The CPA executives who expressed optimism about the 12-month outlook for the U.S. economy declined from 69 percent in the first quarter—a 13-year high for the survey—to 64 percent. Survey respondents also scaled back a bit on optimism about their own company’s prospects (66 percent to 64 percent, quarter over quarter) and their organization’s plans for expansion (67 percent to 64 percent). Both optimists and pessimists see more uncertainty in the economic climate.

In terms of hiring, 40 percent of the CPA business executives polled indicated they had too few employees. Twenty-four percent said they planned to hire immediately, a major improvement from the 19 percent who said a year ago they planned to hire right away. Another 16 percent indicated they need more staff, but are still hesitant to hire.

There is a growing sense of a tightening labor market among the survey respondents. Asked to list their top challenges, business executives rank “availability of skilled personnel” No. 2 on the list and “staff turnover” at No. 6 on the list. Those categories ranked in third and ninth place, respectively, in the first quarter.

“Staff turnover has been a rising concern since the end of 2016, and we’ve seen steady perceptions of a shrinking talent pool over several quarters,” said AICPA managing director Arleen R. Thomas in a statement. “That sets the stage for a competitive hiring situation and potentially higher salary and recruitment costs for companies.”

Revenue and profit expectations for the year ahead declined quarter over quarter. The CPA business executives polled now anticipate revenue growth of 3.9 percent in the next 12 months, compared to 4.3 percent in the previous quarter. Profits are expected to grow 3.2 percent, down from 3.5 percent in the first quarter.

IT remains the biggest category for planned spending over the coming year, with an anticipated growth rate of 3.2 percent.

Sixteen percent of the survey respondents anticipate the Trump Administration’s proposal to lower corporate income taxes will be signed into law this year, while 33 percent expect it to be enacted before the 2018 midterm elections.

Twenty-four percent of the CPA executives indicated a reduction in the rate of federal corporate income taxes to the 15 to 20 percent range would be “significantly positive” for their company’s bottom line, compared to 18 percent in the previous quarter. Overall, 60 percent said a lower tax rate would be positive to some degree, compared to 51 percent last quarter.

The top-ranked category for investment of potential tax savings from a corporate rate reduction is increased capital expenditures (46 percent).