Holders of donor-advised funds increased their disbursements last year in response to urgent demands for greater charitable contributions to cope with the COVID-19 pandemic.

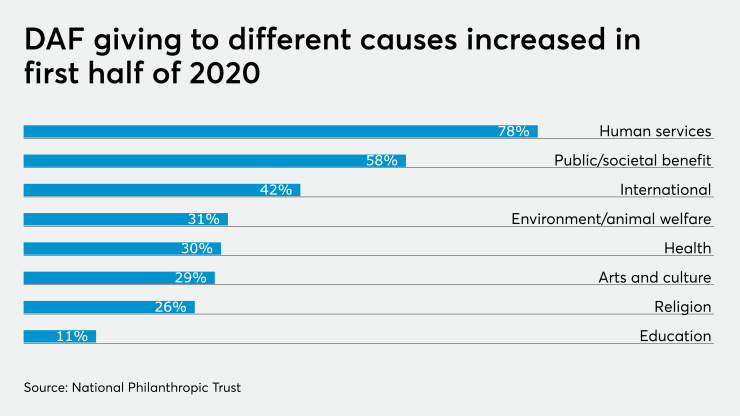

The number of DAF grants in eight charitable subsectors increased in the first half of 2020 compared to the same period in 2019, according to a

The pandemic spurred a wave of donations last year and this year as organizations issued urgent appeals for funds and pressed DAF investors to release more of the funds they had been holding. DAFs typically pay out an average of 20 percent or more each year, and averaged a 22.9 percent payout rate in 2019, according to the NPT.

“As people were losing their jobs and becoming employed less frequently, and couldn’t go to school and daycare, I think that Americans who weren’t so disadvantaged, people who have been able to keep their jobs and had donor-advised funds, were seeing the suffering going on,” said National Philanthropic Trust CEO Eileen Heisman. “They used their donor-advised funds to address the medical issues that COVID brought on, seeing that families had difficulties with working, daycare, food pantries, all those things we saw. Those of us who were at home working were recognizing that our local community members weren’t as lucky as we were. We were all locked in the house for a while. Going online and looking at their donor-advised fund balance and then looking at all the problems, I think people said, ‘You know what, I should give some of this away.’ And they did. So we saw those big jumps, and I think it says a lot about Americans’ generosity.”

The value of DAF grantmaking to qualified charities reached $8.32 billion last year, according to the NPT report, a 29.8 percent increase compared to 2019. Human services and health charities saw the most significant increase in the dollar value of grants, at 78.9 percent and 54.2 percent respectively. On the other hand, arts-focused groups saw a decline of 9.0 percent in giving last year.

Nevertheless, the number of DAF grants to charities totaled 1,298,787 million in 2020, representing a 37.4 percent increase compared to the same period in 2019, much of it attributable to the COVID-19 response from donors.

The NPT, which is the largest national, independent public charity that manages DAFs and one of the main grantmaking institutions in the U.S, also released its

The value of grants from DAF accounts to qualified charities totaled $27.37 billion in 2019, representing a 15.4 percent increase from $23.72 billion in 2018. The NPT noted that 2019 was the first year grants from DAFs exceeded $25 billion and the second year grants exceeded $20 billion. Since 2010, the value of grants to qualified charities from DAFs has increased 198.8 percent.

Contributions to DAF accounts totaled $38.81 billion in 2019, a 7.5 percent increase from $36.10 billion in 2018. Charitable assets in all DAF accounts totaled $141.95 billion, a 16.2 percent increase from $122.18 billion in 2018. The number of DAF accounts in the U.S. totaled 873,228 in 2019, a 19.4 percent increase from the 731,607 DAF accounts in 2018. In the past 10 years, the number of DAF accounts grew nearly 300 percent.

Ease of management of DAFs, thanks to technology tools like mobile apps and online banking, along with the emergence of workplace giving accounts and lower contribution minimums have contributed to the increase in popularity of DAFs over the years. Tax law changes from the Tax Cuts and Jobs Act of 2017 may have also helped spur greater interest in DAFs in 2019.

“Maybe more people gave to the DAFs more than they would have because of the standard deduction changes,” said Heisman. “Maybe that incentivized them to bunch their contributions. I think some of the increase was that, and some of it was the market was really high that year. That was before COVID. We find that donors are more generous when the markets are high. Americans are philanthropic in a general way, and a donor-advised fund is probably the easiest way to have an organized tool around that. If you look at the ease, the tax changes, and the market values being high, it’s the perfect confluence of factors that make people generous.”

People without a DAF may have increased their charitable contributions too in response to the urgent needs of the pandemic. Last year, Congress provided a tax incentive by allowing taxpayers to claim up to a $300 above-the-line deduction for charitable contributions for 2020, even if they don’t itemize and just take the standard deduction. For the 2021 tax year, couples who are married and filing jointly can claim up to $600 in charitable contributions when they file their taxes next year.

DAF giving last year was spurred by the sheer amount of need around the U.S. and other parts of the world because of the pandemic. “Usually a lot of these disasters we’ve seen in the past have been localized,” said Heisman. “There’s a hurricane someplace, or a fire or something, but there has never been in my lifetime a global pandemic. You could give money to almost any community organization anyplace in the country where there are human services or the arts or medical, and there’s an excellent chance that community either was going to be hit by COVID or already was and the needs were there. I think Americans stood up to the challenge, and said, ‘We can’t fix everything, but can we help the people who live near us or people we know from the hometown where we grew up?’ Then there were donors who were contributing to medical research because they wanted to help develop a vaccine. There was a range of what people were using it for, to help their favorite charities stay afloat if because of COVID they couldn’t have fundraisers anymore, so they decided to make an extra grant to them. I think the confluence of all those factors got people to give generously, both in the number of grants and also the volume of grants.”

Instead of in-person events, many charities have turned to virtual fundraising events, either over Zoom or a similar video-conferencing service.

“People were learning on the job about how to do that,” said Heisman. “If you look at fundraising literature, there’s a lot about how to have a good online event. Before COVID you would have laughed about that topic, but now it’s a serious topic because now charities need to find ways to survive.”