The International Financial Accounting Standards Foundation is pushing forward on a proposal to set up an international sustainability standards board it would oversee along with the International Accounting Standards Board.

The IFRS Foundation said Monday that its trustees met last week to discuss the feedback they had received on the

The announcement comes amid growing pressure from international financial regulators for greater consistency in the reporting of environmental, social and governance matters by companies as more investors pour money into ESG funds. Up to now, various organizations have been setting up different standards and frameworks, but last fall five of them — the Sustainability Accounting Standards Board, the International Integrated Reporting Council, the Global Reporting Initiative, the Climate Disclosure Standards Board and the Carbon Disclosure Project — announced plans to harmonize their standards and frameworks to provide more consistency. SASB and the IIRC also announced plans to combine later this year under the oversight of a new organization to be called the Value Reporting Foundation, possibly with the addition of the CDSB (

“Due to the urgent need for better information about climate-related matters, the new board would initially focus its efforts on climate-related reporting, while also working towards meeting the information needs of investors on other ESG (environmental, social and governance) matters,” said the IFRS Foundation in a statement.

The new international sustainability standards board will also focus on information that’s material to the decisions of investors, lenders and other creditors. It will take into account the work of the other standard-setters, but more directly the new board would build upon the well-established work of the Financial Stability Board's

The IFRS Foundation trustees plan to publish a “feedback statement,” summarizing the responses they received to their consultation proposal, explaining how that feedback played into their decisions. They will then publish for public comment the proposed changes to the IFRS Foundation's constitution that will be needed to formalize the establishment of a new board, including its composition. The trustees will then continue to engage with the IFRS Foundation’s Monitoring Board of international financial regulators to stay informed about their views of the proposed changes. Any changes to the constitution will be subject to a public consultation with a 90-day comment period.

The trustees intend to make a final determination about a new board in advance of the United Nations Climate Change COP26 conference in November 2021, including a detailed analysis of the feedback they receive on the requirements for success outlined in the 2020 consultation and other conditions to be satisfied before that consideration.

The International Federation of Accountants issued a statement expressing its support for the steps announced Monday by the IFRS Foundation. “IFAC continues to support the ongoing rationalization of a coherent global system,” IFAC CEO Kevin Dancey said in a statement. “The IFRS Foundation is uniquely qualified and positioned to lead here, including engagement with existing sustainability-related initiatives and standard setters from key jurisdictions. IFAC looks forward to providing input to the forthcoming IFRS Foundation constitution consultation and encourages our member bodies and stakeholders to take an active interest in these next steps.”

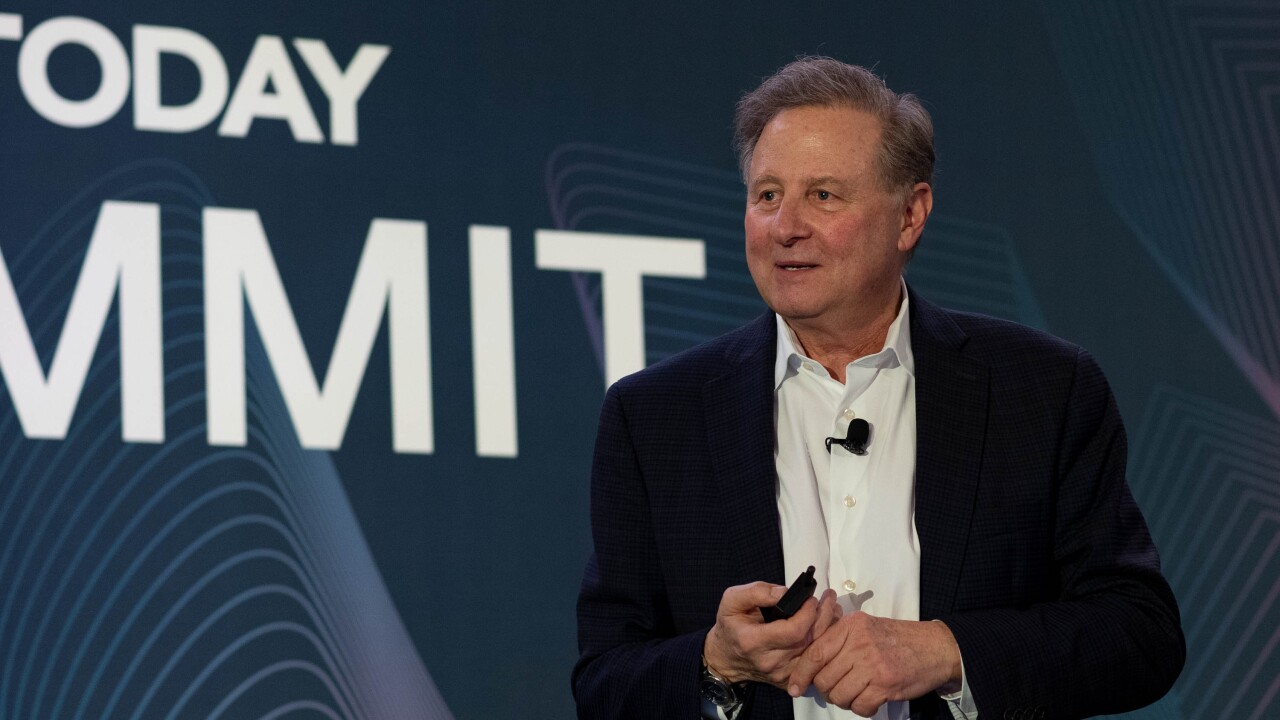

Accounting firms like KPMG can benefit from the move to an international standard-setter. “I’m really pleased about the IFRS announcement,” Larry Bradley, KPMG’s global head of audit, told Accounting Today. “It’s gaining momentum. It’s moving quickly. Frankly, I think that’s what’s really needed. It looks like they’re headed toward an announcement in November, and all the steps are moving in the right direction. I think the IFRS Foundation is uniquely and appropriately positioned to take on this task.”

He envisions a role for the other standard-setters to play within a future international sustainability standards board. “They’ve done a significant amount of work,” said Bradley. “At one time, I was KPMG’s representative on the IIRC about seven or eight years ago for a couple of years. Having that level of background was helpful for me. Clearly there’s a large amount of independent bodies — the SASB, the IIRC, the GRI, the CDP and the like — and they’ve all done good work. But some of it is complementary, some of it perhaps a bit overlapping. That’s why I’m really happy to see the foundation take this on because I think it will generate simplification and consolidation, which a lot of people are looking for. These organizations have done really good work in the past. This will give the IFRS Foundation an opportunity to leverage off of some of the foundational work that’s already been done. There are subject matter experts that reside within the various other entities that can and should be leveraged.”