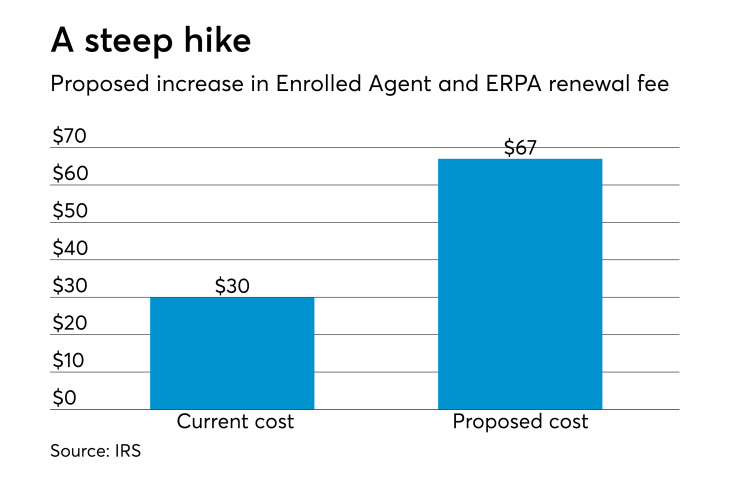

The IRS has proposed regulations to increase user fees for enrolled agents and enrolled retirement plan agents from $30 to $67.

The proposed regulations, which will be published today in the

Besides raising the renewal user fee, the regs would remove the initial enrollment user fee for enrolled retirement plan agents, because the IRS stopped accepting new ERPAs in 2016, due to declining numbers of applicants.

The IRS projects that it will cost roughly $2.7 million to process applications between 2018 and 2020, including the cost of background checks and tax compliance checks. To arrive at the proposed $67 fee, it added approximately $1.8 million in overhead for an overall cost of $4.5 million, and then divided that by an expected 68,343 applicants.

The deadline for public comments is Jan. 18; a public hearing is scheduled for Jan. 24.