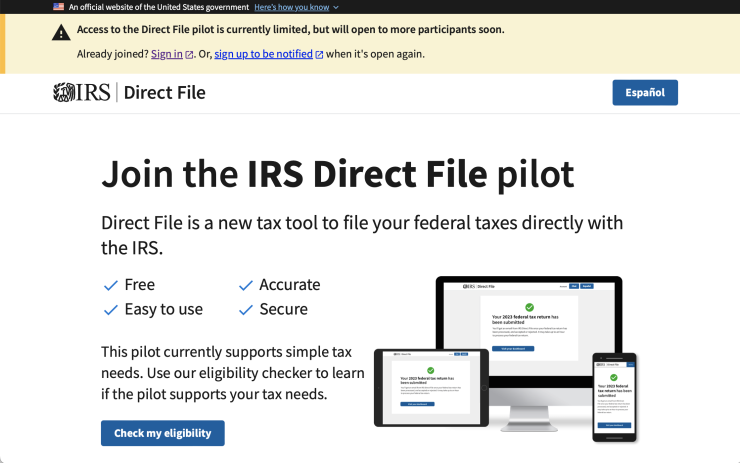

The Treasury Department reported increasing usage of the Internal Revenue Service's free Direct File tax-filing system that they've been pilot testing in a dozen states this tax season.

"In the three weeks since IRS Direct File launched, we've seen steadily increasing interest from taxpayers in using this new free tool," said a Treasury official in an email Friday afternoon. "In each week since Direct File launched, we've seen growth over the previous week. Sunday, March 31, was our best day ever for Direct File usage, until Monday, April 1, which far surpassed it — setting new records for visitors to Direct File, new users, and returns accepted. As more people hear about Direct File, more people are eager to use it to file their taxes."

On Monday, the IRS updated the system, adding the ability to automatically import key information from a taxpayer's online account from last year to validate the return before accepting it, according to

The IRS

So far, according to the Treasury, taxpayers using Direct File have claimed more than $30 million in refunds and saved millions in estimated filing fees. California, Texas, Florida and New York have the highest number of accepted returns to date.

Since the launch of Direct File on March 12, taxpayers have used the live customer support available nearly 14,000 times, with average wait times for assistance consistently ranging between 10 and 20 seconds and less than a minute during peak use.

The Treasury and the IRS have also been surveying users of Direct File, and so far the response from taxpayers has been overwhelmingly strong, according to the Treasury.

"When given the opportunity, taxpayers want to tell the IRS about their experience with Direct File," said the Treasury official.

However, the tax software industry has not been pleased by the program, and some lawmakers in Congress have also been pushing back.

"Direct File is not free tax preparation, but rather a thinly veiled scheme where billions of taxpayer dollars will be unnecessarily used to pay for something already completely free of charge today," said Intuit spokesperson Tania Mercado in an email last month. "Today 100% of Americans — regardless of their income level or tax complexity — can file their federal and state taxes completely free of charge. Whether people are simple filers like those eligible for IRS Direct File, or complex filers with gig work and investments that IRS Direct File excludes, there is a filing option available today so every American can easily and accurately file their taxes with confidence." The TurboTax maker also posted a

House Ways and Means Committee Chairman

The American Coalition for Taxpayer Rights, a group of tax prep companies that has been lobbying against Direct File, pointed out Monday that the IRS and the Treasury have downgraded their goals for the program. They noted that an estimated 19 million Americans were supposed to be eligible for direct file,