The Securities and Exchange Commission eased up dramatically on accounting and enforcement activity last year during a period of transition at the SEC, but the Public Company Accounting Oversight Board increased its enforcement amid a shakeup at the PCAOB.

A

"While the overall decline in the level of enforcement activity in 2021 was not surprising, we did not expect to see such a sharp decline in settlements," said Cornerstone Research senior vice president Elaine Harwood, who co-authored the report and heads the firm’s accounting practice, in a statement. "The median settlement by firms in SEC enforcement matters was only $200,000, which means that half of the accounting and auditing cases that settled last year were for that amount or less."

Total SEC settlements amounted to $158 million, of which $151 million were against firms. The total monetary settlements against individuals, however, nearly doubled since 2020 to $7 million. The highest settlement was for $62 million, but that was well below the maximum settlement in either 2019 or 2020. In 11 of the 49 settlements, the SEC reported that it considered the respondent's self-reporting, cooperation, and/or remedial efforts as it set penalties and other remedies.

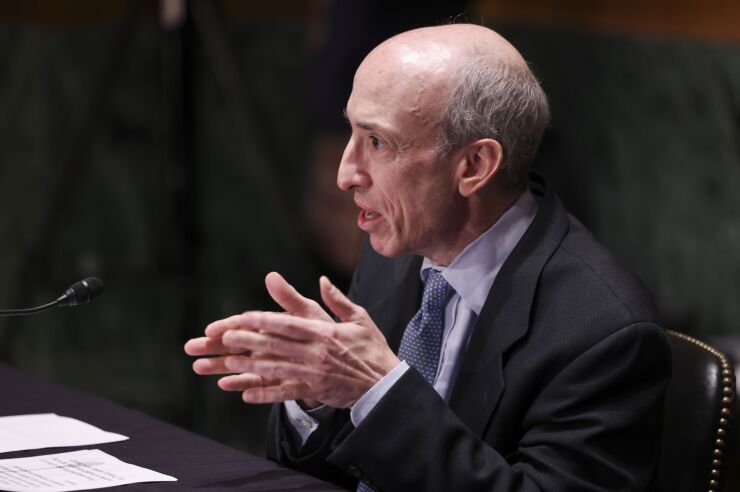

Both the SEC and the PCAOB had changes of leadership last year under the new Biden administration, with former Commodity Futures Trading Commission chair Gary Gensler taking over as SEC chairman following the departure of former chair Jay Clayton (and after commissioner Allison Herren Lee spent four months as acting chair), while PCAOB chair William Duhnke was ousted and three other board members were replaced. Erica Williams, a former SEC official, was sworn in as PCAOB chair in January (

"After Chair Gary Gensler took office, the SEC accounting and auditing enforcement activity in 2021 progressed at a greater pace compared to the activity in the early months of the prior administration under then-chair Jay Clayton," said Simona Mola, report co-author and senior manager at Cornerstone Research, in a statement. “Despite the overall decline in the 2021 level of enforcement activity relative to last year, Gurbir Grewal, director of the SEC's Enforcement Division, has publicly pledged that the division will focus future efforts on ‘restoring trust’ in the financial markets, and that we can expect ‘aggressive use’ of remedies that deter misconduct, including larger monetary penalties, to protect investors and the marketplace."

Of the 34 SEC enforcement actions last year, 19 referred to announced restatements and five referred to announcements of material weaknesses in internal control over financial reporting. The two most common allegations, each involving one-third of the actions in total, pertained to a company’s revenue recognition and internal accounting control violations.

The percentage of SEC actions in 2021 referring to announced restatements and/or material weaknesses in internal control was significantly higher than the pre-pandemic average. Nevertheless, only 37% of the actions referring to restatements alleged improper revenue recognition, down from 83% the prior year.

PCAOB enforcement record

The PCAOB publicly disclosed 18 audit-related enforcement actions last year — a 38% increase from 13 in 2020 — but still well below pre-pandemic levels. Of the 15 individual and 11 firm respondents that settled with the PCAOB in 2021, monetary settlements were imposed on 18 of them (69%). Monetary settlements amounted to approximately $1.1 million.

Despite pandemic-related restrictions on travel, the percentage of PCAOB actions involving non-U.S. respondents in 2021 (33%) returned to pre-pandemic levels and was comparable to the 2016–2019 average (31%).

"While PCAOB enforcement activity remained low overall in 2021, the 13 actions finalized in the third quarter equaled the total number of PCAOB actions in 2020 and could mark the start of an upswing in enforcement," said Alison Forman, report co-author and principal at Cornerstone Research, in a statement. "During a speech in December, Patrick Bryan, director of the PCAOB's Division of Enforcement and Investigations, stated that his division will ‘hit the ground running’ in 2022.”