Despite the widespread belief that small businesses are a target for IRS audits, nearly a third of small-business owners think they overpay their taxes, according to a survey by B2B research firm Clutch of over 300 small-business owners and managers.

“If they think they’re paying too much, they’re questioning the accuracy of their tax return,” said Roger Harris, president of Padgett Business Services. “They’re somehow missing a deduction, or there are parts of the code they just don’t know about. If a business owner did their own accounting and bought a piece of equipment in October 2017, what’s the chance they knew the rules for the new 100 percent bonus depreciation?”

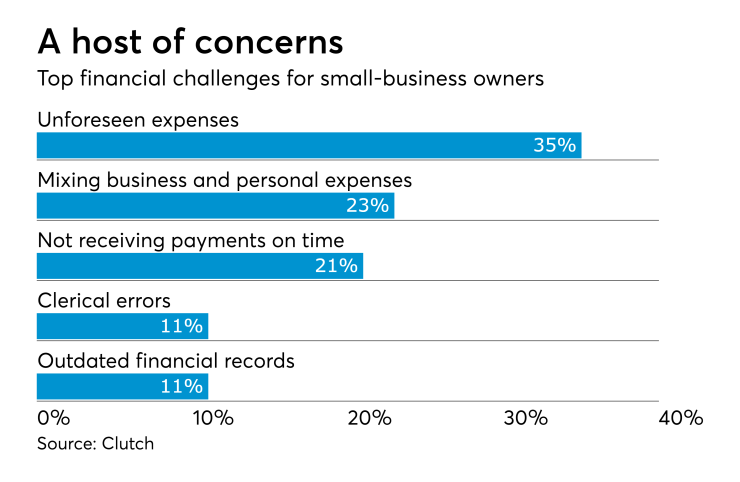

The small businesses in the survey listed unforeseen expenses (35 percent) as their top financial challenge, followed by the mixing of business and personal finances (23 percent) and the inability to receive payments on time (21 percent). Clerical errors in financial records, and outdated financial records, were both listed by 11 percent of respondents.

The majority of small businesses in the survey said they use the accrual method for tracking finances, although the smallest businesses, with fewer than 10 employees, were more likely to use the cash basis method.

“Actually, use of the cash method versus the accrual method has nothing to do with number of employees but with revenue,” said Harris. “In fact, the Tax Cuts and Jobs Act increased the ability to use the cash method for businesses with up to $25 million in annual revenue. Cash accounting is available to many businesses, and many small businesses prefer it because it’s simpler. They like taxable income to track as closely as possible to their checkbooks. In fact, most of our clients would be happy with a simple profit and loss financial statement: Money in minus money out equals money left, or what some of them call ‘my money.’”

“But the accrual method creates expenses that sometimes aren’t yet paid and sometimes defers costs that are already paid, and defers them into the future,” he continued. “In that case, taxable income can vary dramatically from using the cash method.”

“The cash method is easier for everyone to understand,” he said. “Money in is income, money out is expense, and what’s left is your money, which is what you pay taxes on.”

Most use a hybrid method — accrual for income because they have inventories, and cash for expenses, according to Harris.

“If I asked what method of accounting they use, most small-business owners would just stare at me,” Harris said. “But if I explained it to them and they made a pick, most would choose cash. I would be stunned if I asked a small-business owner without giving a choice, and anyone said ‘accrual.’ Most of them wouldn’t even know the term. If you go to the coffee shop in your building and ask the owner what method they use, they won’t know what you’re talking about.”

“In a classroom or to an accountant, the accrual method is favored,” said Harris. “But in the eyes of most owners, if they don’t have the money it’s not income, and if they haven’t paid money, it’s not an expense.”

Surprisingly, the survey found that more than a quarter — 27 percent — of small-business owners and managers said they do not have a separate bank account for their business. Naturally, established businesses are more likely to have separate bank accounts than start-ups. Nearly 80 percent of small-business owners of five years or more said they have separate accounts, compared to 68 percent of small-business owners of two years or less.