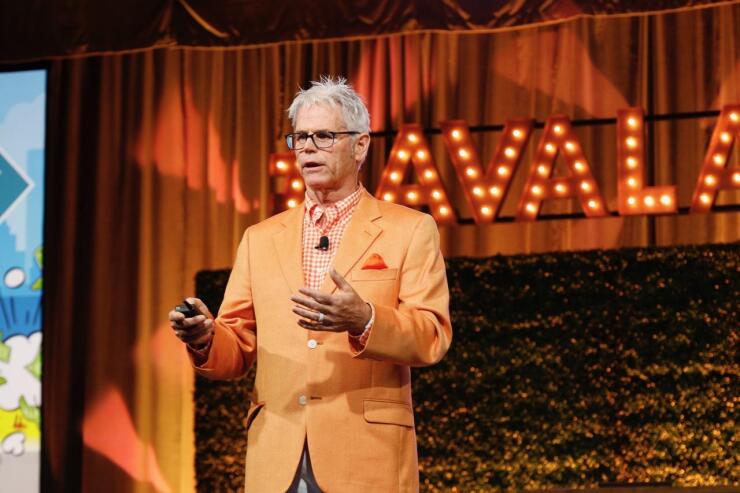

The many ramifications of the Supreme Court’s Wayfair decision, combined with the vast expansion of the digital world, have made sales taxes and tax professionals more important than ever, according to Avalara co-founder and CEO Scott McFarlane.

“2018 was the Year of the Tax Professional,” he told the more than 900 attendees at the tax solutions provider’s Avalara Crush19 conference, being held this week in Huntington Beach, California. “People assume sales tax is easy — it’s just a rate, right? But they forget that it’s not. It affects everyone, and it’s being amplified by e-commerce, by mobility, and by the digitization of the economy.”

What’s more, 2018 was just the beginning, since the factors that are making tax compliance complex are only increasing.

“We’re closer to solving death than we are to solving taxes,” McFarlane said.

In his keynote to the conference, Avalara chief product officer Sanjay Parthasarathy picked up the theme: “The role of the tax professional has never been more important — or more exposed, or more complex,” he said.

Two key trends that Parthasarathy highlighted were the explosion in online commerce, and its increasing globalization.

“Globalization for the past few decades has been about the supply chain, but recently it has become more about the demand side,” he said, noting that business-to-consumer cross-border e-commerce is expected to surpass $1 trillion by next year, while Amazon processed as many as 800 transactions a second on its Prime Day.

“We estimate that there are 10 billion product listings around the world — that’s close to infinite choice, and instant gratification,” he said. “With infinite channels, it’s getting harder to say where the sale originated.”

Sales tax issues will only get more complex in future, he suggested, pointing out that Amazon has patented “anticipatory shipping,” where they ship products before someone orders them, based on predictions made with artificial intelligence. As another example of future complications, he offered the whole realm of 3-D printing: “What’s the sales tax rate going to be when you download and print an item?”

A third trend driving the rising relevance of indirect taxes is the evolving attitudes and strategies of governments.

“The 30-year trend in lowering taxes has left a lot of governments with deficits,” Parthasarathy explained, “and they’re looking to indirect taxes, homing in on out-of-jurisdictions sellers.”

With as much as $10 billion in uncollected sales tax in the U.S., and $50 billion in VAT fraud in the European Union, governments at all levels are scrambling to find new ways to collect, and new areas to collect from.

“Governments are trying to keep up with the changes, like Wile E. Coyote chasing the Roadrunner,” said McFarlane. “More and more, governments are going to place themselves in the middle of a transaction. We think that’s ridiculous in our country, but governments around the world are trying to find out where the transactions are, so they can get paid in the end. Someday, sometime, maybe sooner than we think, we’re going to see that in the United States.”

In the pipeline

As part of his keynote, Parthasarathy and the Avalara team also highlighted a number of new solutions that the company is rolling out or adding to existing products, including:

- A nexus threshold map, available now, that lets users know on a state-by-state basis where they stand in terms of seller thresholds for online commerce;

- Customizable tax rules for marketplace transactions, available now;

- New tools in Avalara’s CertCapture, available for now, for managing W8 and W9 forms;

- Avalara Consumer Use Tax, which will launch later this year to help users better manage their consumer use tax obligations; and,

- Integration of item classification and customs duty calculation into AvaTax, coming later this year.

The company is also working on integrating artificial intelligence capabilities into its solutions, according to Parthasarathy, who actually joined Avalara when it acquired his AI startup, Indix.

To start, the company will aim to use AI to ease the onboarding process for new customers. “It takes weeks to get a single product catalog up and running,” Parthasarathy explained.

“AI is the most exciting area for us, because it brings true scale to what we’re doing,” said McFarlane. “The onboarding process is going to be the first big application — clients taking their product codes and mapping them to a tax code.”

There are plenty of other applications for AI beyond that, though — including using it to search for new or changing regulations and tax rates around the world.

“AI isn’t just for product classification but also for new tax rules and rates; it will be used to automate content acquisition as well,” Parthasarathy said.