Sen. Ron Wyden, D-Oregon, the top Democrat on the Senate Finance Committee, has written a

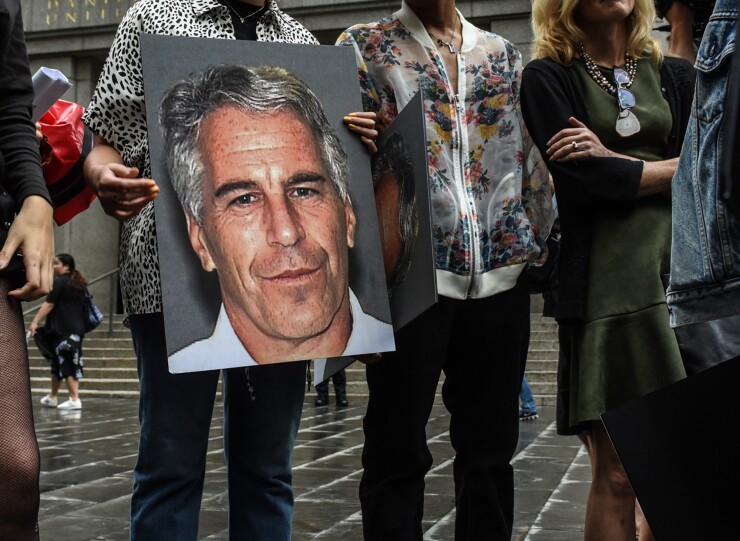

The controversy over the convicted sex trafficker has dominated Washington in recent weeks, even though Epstein committed suicide in jail in 2019.

Wyden pointed out that Epstein was paid hundreds of millions of dollars for tax planning, even though he wasn't an accountant or tax attorney.

"Epstein lacked any professional training or certifications in accounting or tax law, yet was chosen by very wealthy people to execute very complex tax-related financial transactions," Wyden wrote. "Despite this glaring lack of qualifications that might lead anyone to double check Epstein's work, it appears that the IRS failed over the course of many years to audit major tax transactions involving Epstein. It is unthinkable that transactions amounting to tens of millions of dollars paid to a known criminal for the purpose of helping a mega-wealthy individual dodge billions in taxes were never audited or investigated."

Wyden asked the IRS to provide a list of all audits or investigations conducted by the IRS related to transactions involving Epstein, including any payments to Epstein for tax planning, along with the status of those investigations and the end result of the audit. He also requested a determination as to whether the IRS has evaluated the full scope of any so-called tax planning Epstein provided to wealthy and powerful associates.

Wyden also wants an analysis of whether, at any point in the last eight years, Epstein's tax planning has been evaluated by IRS professionals and whether the IRS has determined if the value of the services appropriately matched his reported compensation.