-

The Internal Revenue Service is giving extra time to companies that make and sell sport fishing and archery equipment to file and pay their excise taxes due to the novel coronavirus pandemic.

August 7 -

Dress like a professional wherever you work.

August 7 L&H CPAs and Advisors

L&H CPAs and Advisors -

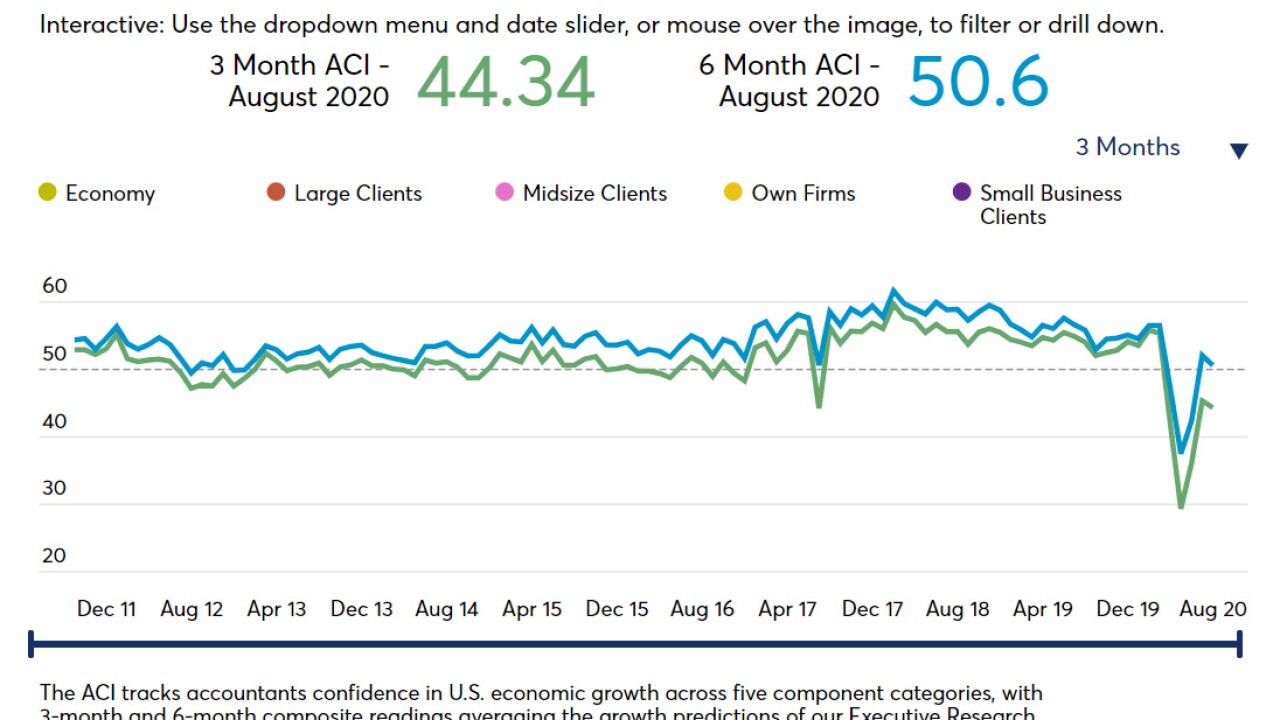

The economy showed signs of recovery despite the spread of the coronavirus across many parts of the country.

August 7 -

The COVID-19 pandemic flipped our working world on its head.

August 6 Breakaway Bookkeeping and Advising

Breakaway Bookkeeping and Advising -

U.S. Senator Bernie Sanders said he will introduce legislation to tax what he called the “obscene wealth gains” from billionaires during the coronavirus crisis.

August 6 -

Democrats are demanding more Republican concessions to meet an end-of-the-week deadline for a deal on pandemic relief, and one of the chief White House negotiators warned there is little time left for negotiations.

August 6 -

The Internal Revenue Service is sending $500 payments to the children of some stimulus relief recipients who hadn’t gotten that part of the aid package after lawmakers complained that the agency wasn’t moving fast enough.

August 6 -

Bento for Business, a spend management system, is looking to assist small and midsize businesses with surviving through the COVID-19 pandemic.

August 6 -

-

Robotic process automation has been spreading across accounting and finance departments, according to an IMA report.

August 5 -

The American Institute of CPAs joined with more than 170 organizations in asking congressional leaders to allow businesses to write off expenses associated with loan forgiveness under the Paycheck Protection Program.

August 5 -

Job growth slowed in July as a result of the novel coronavirus pandemic.

August 5 -

The living room is the new conference room, and it could lead us down a sticky path when it comes to taxes.

August 5 Tax & Accounting Professionals business of Thomson Reuters

Tax & Accounting Professionals business of Thomson Reuters -

White House and Democratic negotiators driving toward a deal on a final massive virus relief package by the end of the week still must overcome a raw mix of election-year pressures, internal GOP splits and a profound lack of trust between the parties.

August 5 -

Granting and forgiving loans in different years can create problems.

August 4 -

President Donald Trump said he is “talking about” doing a payroll-tax cut through an executive action, but doing so could result in hefty tax bills for employers later if the idea doesn’t get mired in legal challenges before then.

August 4 -

The emergence of new coronavirus hotspots, especially in the South and West, had a major impact, according to a new report from payroll giant Paychex.

August 4 -

In today’s COVID-19 world where nothing seems normal, and “new normals” are popping up in every business operation, service businesses are trying to make up for lost income and rising expenses in creative ways that will lessen the financial impact of COVID-19.

August 4 BPM

BPM -

Maxwell Locke & Ritter is pursuing the same staffing strategy — and the same values — through the pandemic.

August 4 -

The six largest credit card issuers have set aside billions of dollars worth of reserves in response to the novel coronavirus as well as the adoption of the Financial Accounting Standards Board’s new credit losses standard.

August 3