-

House Republicans should slow down their consideration of a tax-overhaul bill after investigative reports Sunday alleged offshore tax-avoidance by U.S. multinational companies including Apple Inc. and Nike Inc., congressional Democrats and tax-advocacy groups said.

November 6 -

The House tax-writing committee begins debate Monday on the GOP’s proposed overhaul, kicking off four frantic days for lobbyists and lawmakers to revise a bill that represents President Donald Trump’s final hope for a signature legislative achievement this year.

November 6 -

President Donald Trump and congressional Republicans billed their tax overhaul for months as a benefit primarily for the middle class, but what they delivered Thursday was designed more to favor large corporations and some closely held businesses.

November 3 -

House Republican leaders began rolling out a tax bill Thursday that contains sweeping changes for business and individual taxes, including a measure to cut the corporate tax rate to 20 percent.

November 2 -

U.S. companies that have accumulated trillions of dollars of overseas earnings would be taxed on that stockpiled income at a rate as high as 12 percent under the tax-overhaul bill that House Republicans released Thursday.

November 2 -

House Republican leaders plan to unveil a tax bill Thursday that would cut the corporate tax rate to 20 percent and leave it there—abandoning an earlier plan to phase out the rate cut over time, said a person familiar with discussions on the bill.

November 2 -

Treasury Secretary Steven Mnuchin is resisting a gradual phase-in of the proposed 20 percent corporate rate out of concern the move wouldn’t boost economic growth as much as he’s anticipated, according to a Trump administration official and another person familiar with Mnuchin’s thinking.

November 1 -

Tax chief Kevin Brady has announced a plan to ‘work through the night’ on the bill.

November 1 -

President Donald Trump said Tuesday that “some people have mentioned” phasing in a proposed corporate tax-rate cut as part of broad tax-overhaul legislation that’ll be released Wednesday, but “we’re not looking at that.”

October 31 -

House tax writers have completed about 90 percent of the tax bill they plan to release this week, Ways and Means Chairman Kevin Brady said Monday—but the last part may be the hardest.

October 31 -

House tax writers are discussing a gradual phase-in for the corporate tax-rate cut that President Donald Trump and Republican leaders want—a schedule that would have the rate reach 20 percent in 2022, according to a member of the chamber’s tax-writing committee and a person familiar with the discussions.

October 30 -

Cutting the corporate tax rate to 20 percent would boost U.S. economic growth by 3 to 5 percent over time, according to an analysis produced by President Donald Trump’s White House.

October 27 -

President Donald Trump sought to rally support for his effort to overhaul the nation’s tax code on Tuesday at a conservative policy group that helped write the plan.

October 18 -

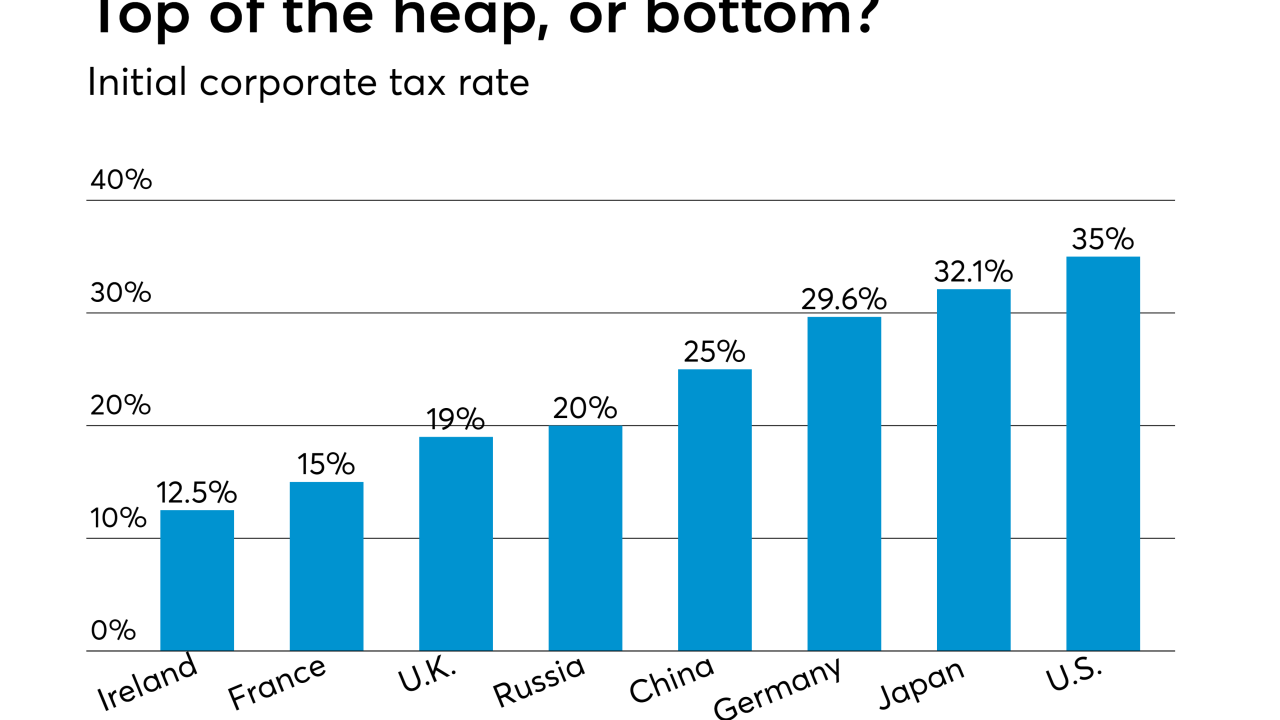

If tax reform lowers U.S. rates, it could spark a race to the bottom.

October 17 -

A group of seven Senate Democrats and one independent has written a letter to the Financial Accounting Standards Board asking FASB to require multinational corporations to disclose their taxes, profits, and revenues on a country-by-country basis, echoing a recent letter from a group of House lawmakers.

October 17 -

Cutting the corporate tax rate to 20 percent, as President Donald Trump has proposed, would increase average household income by at least $4,000 a year, according to estimates in a White House study.

October 17 -

Certain transactions will be subject to new guidelines, and more questions.

October 13 -

The U.S. tax code is uncompetitive and overly complex, and it’s time for politicians and special interests to set aside partisan interests and pass reform legislation, JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said.

October 11 -

The tax reform framework released last month by the Trump administration and Republican leaders in Congress could provide tax cuts or tax increases, depending on how the details are ultimately finalized.

October 10 -

On the last page of a nine-page tax plan that calls for slashing business rates, President Donald Trump and congressional Republicans proposed a little-noticed, brand-new tax that may hit companies like Apple Inc. and Pfizer Inc.

October 2