Cryptocurrency

Cryptocurrency

-

Proposed regulations aim to making it simpler for digital asset and crypto brokers to provide the Form 1099-A electronically, instead of sending paper copies.

March 5 -

After saying for years that major accounting firms were unwilling to provide auditing services, Tether Holdings SA received a sign-off from Deloitte on the first-ever reserve report for its USAT stablecoin that was launched to comply with new U.S. regulations.

March 3 -

Lawmakers in Congress have their eyes on several pieces of tax-related legislation that may or may not get passed this year, though the upcoming November midterm election is bound to affect any possibility of the bills advancing.

February 26 -

New reporting rules around stablecoins are coming thick and fast; in this episode, two experts from the AICPA discuss the new rules and what they mean for accountants and clients.

February 23 -

The IRS can broaden the audit, and, in the wrong fact pattern, frame the issue as deliberate concealment rather than poor recordkeeping.

February 16 -

The Joint Chiefs of Global Tax Enforcement issued a pair of advisories on how OTC crypto trading desks and payment processors can hide criminal activity.

February 16 -

Alt5 replaced its auditor last month less than three weeks after hiring it, bringing on L J Soldinger Associates as its third audit firm in under two months.

January 29 -

The American Institute of CPAs updated the criteria for stablecoin reporting amid heightened focus on stablecoin oversight.

January 12 -

Strategy adopted an accounting change that requires valuing the firm's crypto holdings at market prices, which is why it's expected to book such a big hit.

January 2 -

Simply having a finance team with a traditional accounting skill set will not suffice in this new phase of the digital economy.

December 31 -

Whether crypto tax legislation is coming; don't miss QSBS savings; Bears on the move; and other highlights from our favorite tax bloggers.

December 30 -

A small financial-technology company tied to a Trump family crypto project has fired its auditor, the latest sign of turmoil at the Las Vegas-based firm.

December 30 -

Unlike equity investors, who must plan around the 31-day exclusion window, cryptocurrency holders can sell and repurchase in the same session.

December 26 -

The draft, a mix of bill text and policy aims, would exempt transactions of regulated stablecoins that consistently maintain a value between $0.99 and $1.01 from capital gains.

December 22 -

Plus, Ramp touts 1099 solution; Certinia's winter release includes automation, insights, operations; and other accounting tech news and updates.

December 12 -

Planning around SSI COLAs; holiday business deductions; complex decisions of inheritance; and other highlights from our favorite tax bloggers.

December 3 -

The Financial Accounting Standards Board decided to add a project to its technical agenda related to the accounting for cryptocurrency asset transfers.

November 19 -

The International Accounting Standards Board discussed adding new projects to its agenda, along with ongoing work on the equity method and intangible assets.

November 19 -

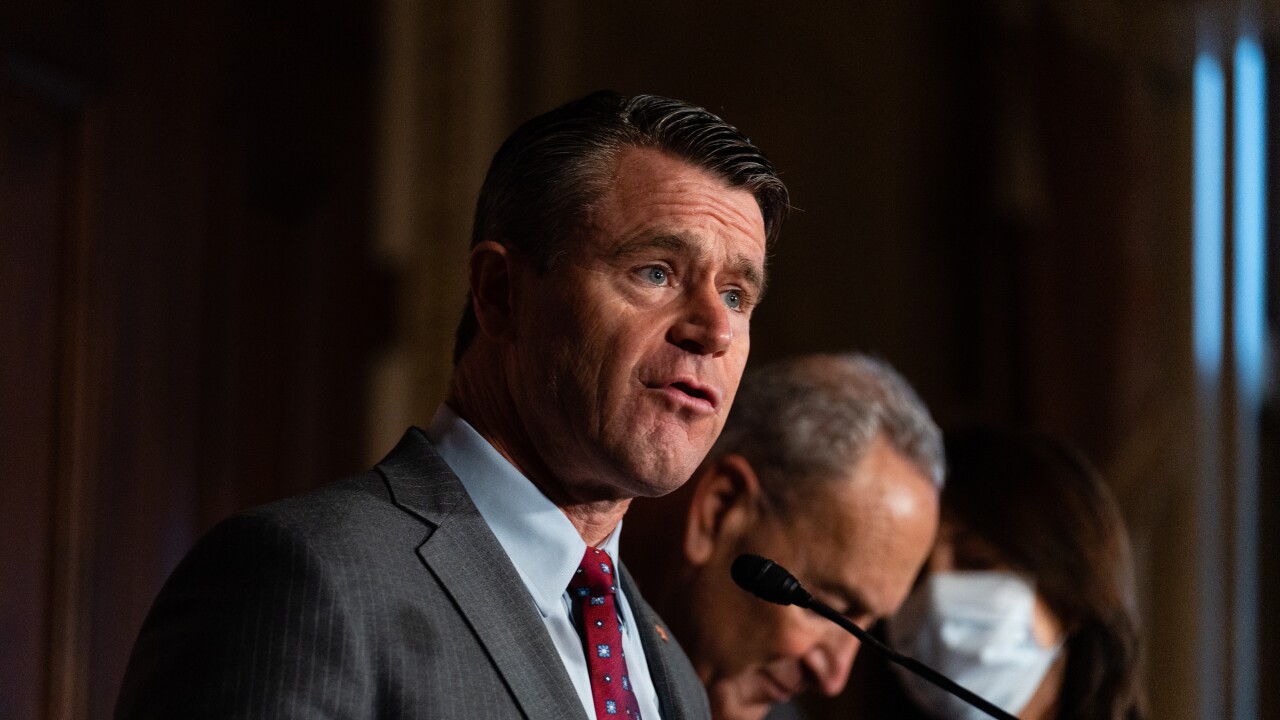

Senator Todd Young is urging the IRS to reconsider guidelines on the tax treatment of rewards crypto owners collect for locking assets on a blockchain network.

November 19 -

The Internal Revenue Service has provided a safe harbor for certain trusts enabling them to stake their digital assets without jeopardizing their tax status.

November 11