-

Here are four core moves that advisors are considering right now for clients as they gear up to file their federal tax returns.

February 1 -

The Big Four firm announced salary bumps for approximately 30,000 employees.

January 25 -

Accountants go meta; muddy start to the season; the controller as preparer; and other highlights from our favorite tax bloggers.

January 11

-

Understanding how gifted money will impact the student’s FASFA is critical.

January 11 -

With Senate tax writers in agreement with the House to ban the favored tax-free strategy, wealth advisors have a narrow window to make moves.

December 15 -

New forms’ questions; taxpayers behaving badly; why people leave; and other highlights from our favorite tax bloggers.

December 14

-

Starting advisory services; those who do also teach; the IRS is hiring; and other highlights from our favorite tax bloggers.

December 7

-

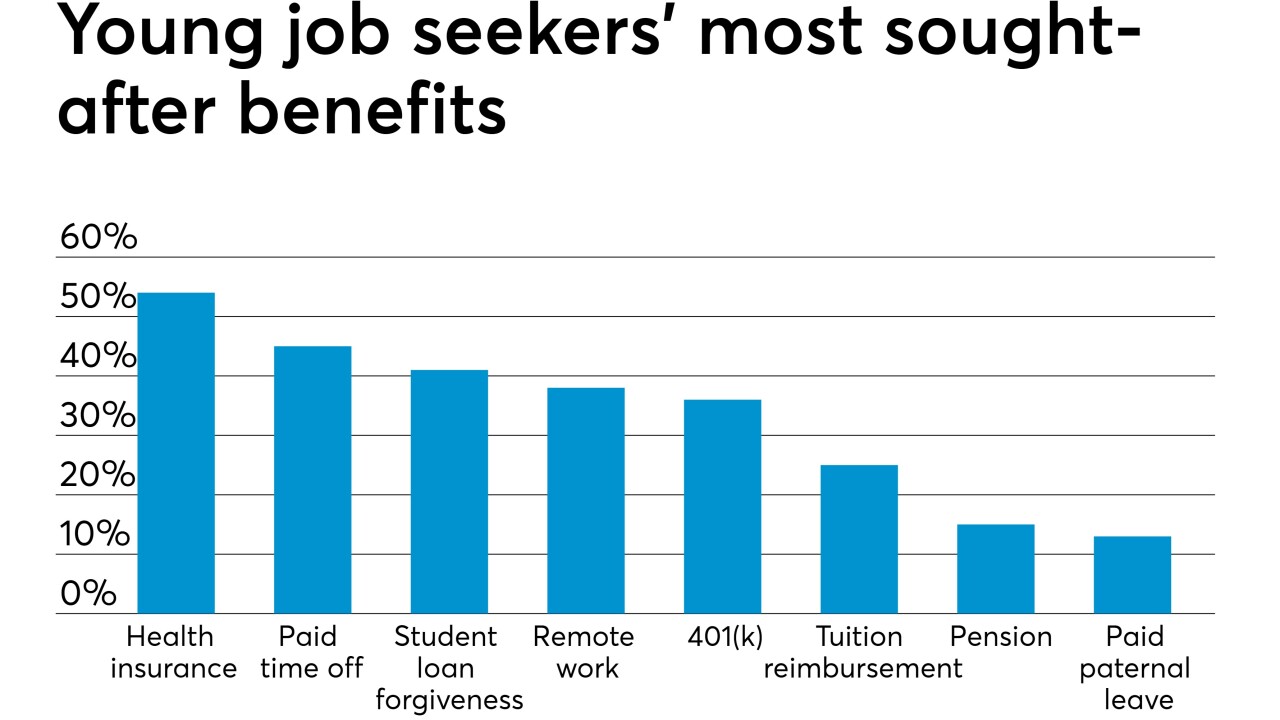

Grant Thornton has increased its employee benefits to attract new talent and keep staff from leaving for other firms, including absorbing employee premium increases associated with its medical benefits for 2022 to offset inflation.

December 2 -

The Big Four, other firms and related accounting businesses were recognized for their generous paternal leave and support for new parents.

December 2 -

-

Coming brackets; rising expatriations; meeting behavior and aftermaths; and other highlights from our favorite tax bloggers.

November 23

-

The Internal Revenue Service is strengthening the identity verification and sign-in process for its online self-help tools after a number of high-profile data breaches.

November 17 -

H&R Block adds employee benefits; REDW tax manager earns community service award; and more.

November 12 -

The service lifted the limit from $19,500 as part of its annual inflation adjustments.

November 4 -

KPMG U.S. chair and CEO Paul Knopp outlined a wide range of upgrades to employee benefits in a LinkedIn post.

October 25 -

Offering clients the option to work with a professional employer organization can help increase overall efficiency and profitability by offloading the key administrative tasks necessary to running a business.

October 13 Paychex

Paychex -

Buyback fallacy; change proposed for quarterly taxes; solidifying client relationships; and other highlights from our favorite tax bloggers.

September 14

-

The American Institute of CPAs has released a set of questions and answers to help auditors of benefit plan financial statements deal with this complex field and a revised standard.

September 14 -

The number of accounts with balances of at least $1 million grew 84% year over year, while the number of seven-figure IRAs jumped more than 64%.

August 19 -

The service is alerting practitioners about some of the warning signals of taxpayer identity theft.

August 17