-

Between sunsetting provisions, wealth tax proposals and much more, Nov. 5 will have serious consequences in tax.

October 4 -

A look at the tax policy positions of the Republican and Democratic vice presidential nominees.

August 27 -

Taxpayers can now conduct all interactions digitally and the service says that it is better equipped to address tax evasion and scams.

August 23 -

Expiring provisions and a misunderstanding of how tax law is made top the list of client worries, practitioners say.

July 18 -

This year's Greenbook proposals contain some greatest hits, including a higher corporate minimum tax.

June 19 -

The SALT cap is one of several tax issues to be confronted next year, with key portions of Trump's 2017 tax cuts expiring at the end of 2025.

June 13 -

R&D amortization requirements are becoming a major issue for many companies, causing a significant tax burden they may not be able to handle.

May 2 McGuire Sponsel

McGuire Sponsel -

Sens. Cassidy and Warren teamed up to introduce legislation aimed at making math error notices from the IRS easier to understand.

April 25 -

Senate Republicans don't want to hand President Joe Biden an election-year victory on the legislation, which includes both child and business tax breaks, lawmakers and aides have said.

April 4 -

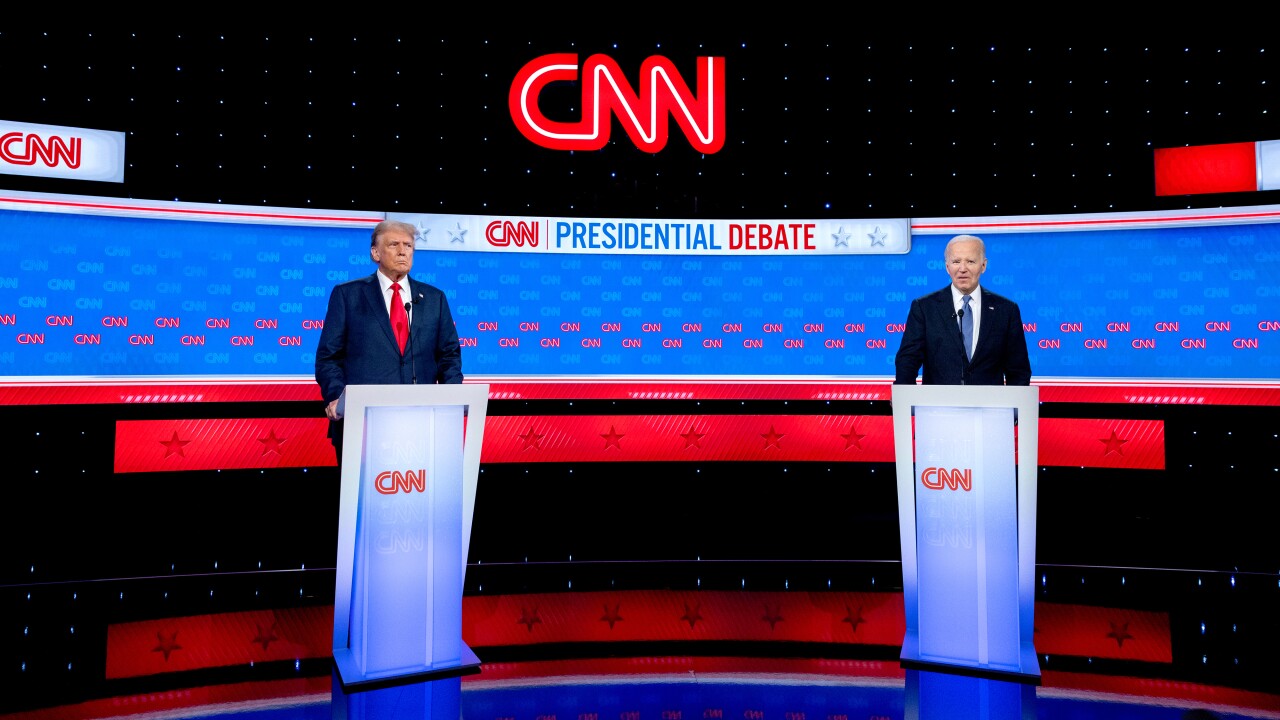

Both Donald Trump and Joe Biden have begun laying out their visions for the Tax Code.

March 25 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting