-

Key negotiators continue to clash over the specific income limits for one of the unresolved issues in President Joe Biden’s economic agenda.

December 8 -

Senate Democrats negotiating an expansion of the state and local tax deduction aren’t near a deal, raising the prospect that talks will spill into next week — and potentially next year.

December 3 -

Negotiations over the deduction hit a new snag with two key lawmakers at odds over whether the plan should raise revenue for other spending priorities.

November 30 -

Coming brackets; rising expatriations; meeting behavior and aftermaths; and other highlights from our favorite tax bloggers.

November 23

-

Dueling proposals would deliver large tax cuts to the wealthy while failing to do much for middle-income households, according to a new analysis from.

November 19 -

Well-off professionals in costly areas of the U.S. are set to get a windfall from competing plans to change the deduction limit for state and local taxes.

November 17 -

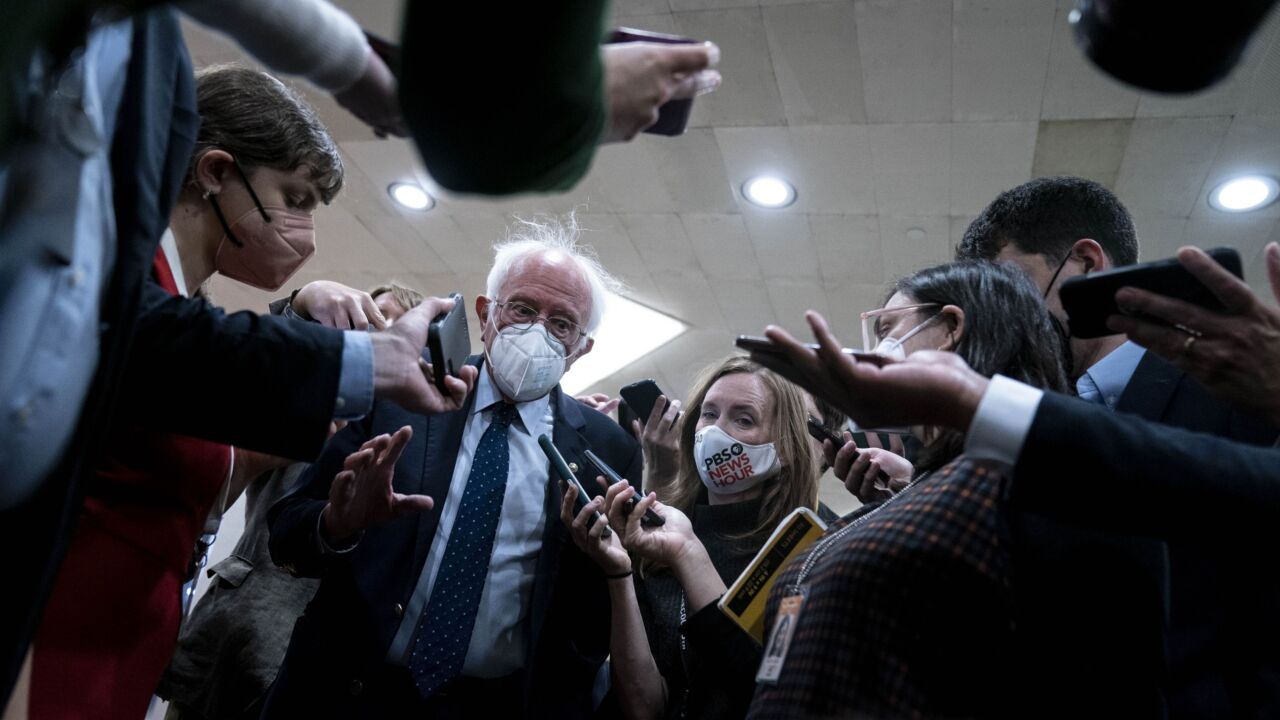

Sen. Bernie Sanders is working on a proposal to set an income threshold for an unlimited state and local tax deduction.

November 17 -

Despite a host of issues, they aim to vote this week on the roughly $2 trillion tax and spending bill.

November 15 -

Lawmakers representing high-tax areas are pushing to make the SALT deduction on federal income taxes a priority.

November 12 -

Infrastructure and crypto; how pros would tackle tax policy; withholdings and non-resident employees; and other highlights from our favorite tax bloggers.

November 9

-

Middle-class households in New Jersey and other high-tax states would benefit from an expansion of the deduction, a key House Democrat said.

November 8 -

There were last-minute changes on modifying the SALT deduction and a provision allowing Medicare to negotiate drug prices.

November 5 -

Congressional Democrats floated fresh proposals on how to increase the federal deduction on state and local taxes, but House and Senate lawmakers were at odds over whether the very rich should be allowed to take the tax break.

November 4 -

Democrats have found new urgency to pass the roughly $1.75 trillion tax and spending plan as well as an infrastructure bill with $550 billion in new spending after being stung by a Republican sweep of statewide races in Virginia.

November 4 -

The move would help offset the benefits from a proposed expansion of the federal deduction of state and local taxes.

November 3 -

An adverse court ruling leaves wealthy states with fewer options.

November 2 -

The outline of the tax and spending bill provided a breakthrough after a long standoff between moderate senators and progressive Democrats.

November 1 -

Influential lawmakers still want various tax provisions in the bill.

October 28 -

The spending package could still include a measure to expand or temporarily remove the cap on the deduction on state and local taxes.

October 20 -

What pros are making; getting clients to pay; keeping the SALT cap; and other highlights from our favorite tax bloggers.

October 5