-

The Internal Revenue Service is giving employers more leeway in claiming the Work Opportunity Tax Credit to hire people in underprivileged areas who face significant obstacles to employment for jobs in summer youth and community programs.

August 16 -

36 million taxpayers should start seeing their second CTC payments today, though the IRS had some caveats.

August 13 -

Congress is weighing a proposal to end the tax break next month to pay for the bipartisan infrastructure plan.

August 4 -

The problem with some tax credits; a PPP forgiveness portal; crypto replies; and other highlights from our favorite tax bloggers.

August 3

-

Changes to the Child Tax Credit may require a second look as the system gets simultaneously simpler and more complex.

August 3 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

The bipartisan infrastructure bill would end a tax break Congress crafted to help businesses struggling during the pandemic but relatively few companies have claimed.

August 3 -

Employers can claim tax credits equivalent to the wages paid for providing paid time-off to employees to take a family or household member or certain other individuals to get vaccinated for COVID-19.

July 29 -

Roughly 4 million or more households are likely to fail to get the funds because they don’t appear on a prior tax return.

July 29 -

The Internal Revenue Service’s Criminal Investigation division is cautioning taxpayers and tax professionals to beware of scams related to the expanded Child Tax Credit in which fraudsters are trying to steal money and personal information.

July 22 -

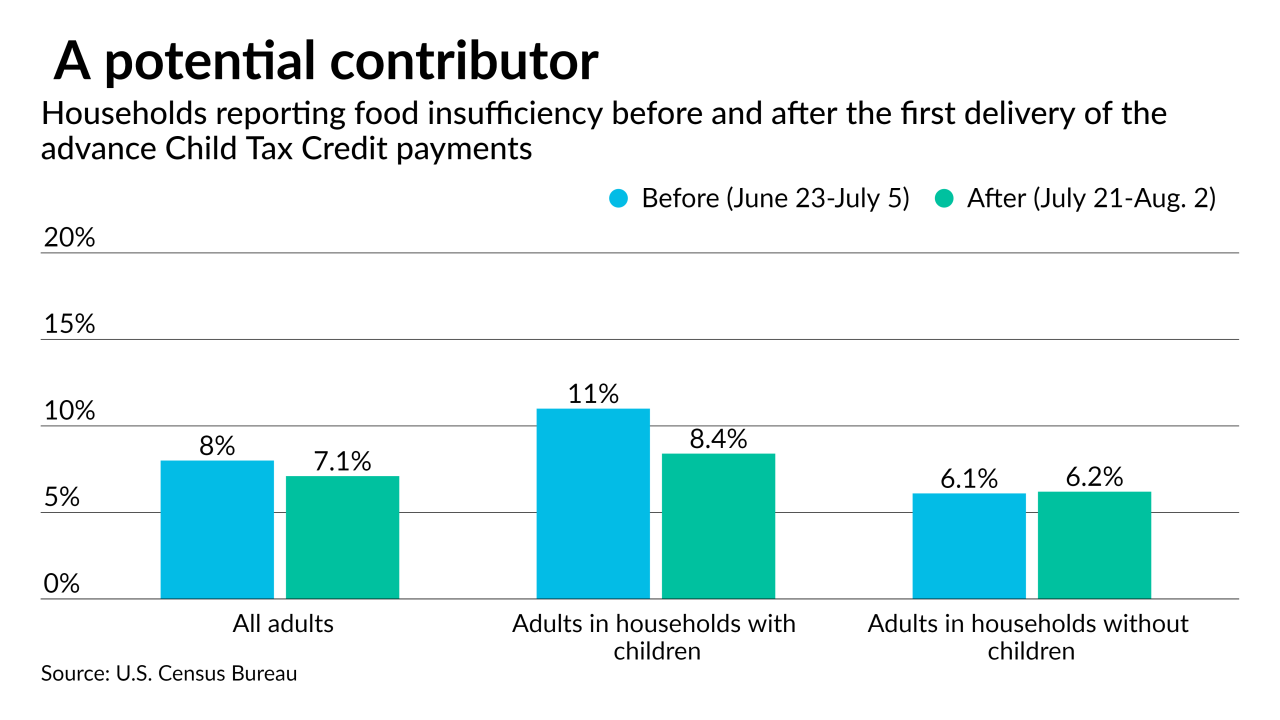

The IRS and the Treasury started disbursing advance monthly payments Thursday of the expanded Child Tax Credit in a program that aims to lift millions of families out of poverty.

July 15 -

Democratic leaders want voters in key states to know which party is responsible for the checks Americans with young children are set to start receiving on Thursday.

July 15 -

Over 500 government entities improperly applied for advance payments of employer tax credits last year during the COVID-19 pandemic and needed to repay them, according to a new report.

July 13 -

The IRS needs to clarify that service firms qualify for the credits, writes Julio Gonzalez.

July 8 Engineered Tax Services

Engineered Tax Services -

The Internal Revenue Service is planning to host events this weekend in a dozen cities to help people who usually don’t file a tax return register for monthly Advance Child Tax Credit payments.

July 7 -

Infrastructure fantasies; trouble with the U.S.-Malta Treaty; the future of contactless prep; and other highlights from our favorite tax bloggers.

July 6

-

Compliance audits, the new wrinkles of CTC, marijuana and more were key topics at a recent stakeholders meeting with the service.

July 6 -

Practitioners have plenty of time to advise clients on multiple savings opportunities.

June 28 -

A bipartisan group of lawmakers is proposing to boost affordable housing by 2 million units over the next decade by expanding a key tax credit.

June 28 -

Companies and their advisors first need to determine who has the authority to grant such tax benefits.

June 23 McGuire Sponsel

McGuire Sponsel -

Clients could end up having to pay back the money next filing season.

June 21