-

The basics of the car loan interest deduction is that it must be a new vehicle assembled in the United States, with the loan being a first lien on the vehicle.

February 4 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

Notice 2026-11 from the IRS provides guidance on the permanent 100% additional first-year depreciation deduction provided by the One Big Beautiful Bill Act.

January 15 -

Tax season is starting as a number of new provisions of the One Big Beautiful Bill Act take effect.

January 8 -

Right now, cannabis businesses operating legally under state law still can't deduct basic costs like rent, salaries or marketing.

January 7 Friedlich Law Group

Friedlich Law Group -

The tax deduction applies to new cars assembled in the U.S. purchased from 2025 through the end of 2028.

January 2 -

The proposed regulations relate to the new deduction for interest paid on vehicle loans incurred after Dec. 31, 2024, to purchase new made-in-America vehicles for personal use.

December 31 -

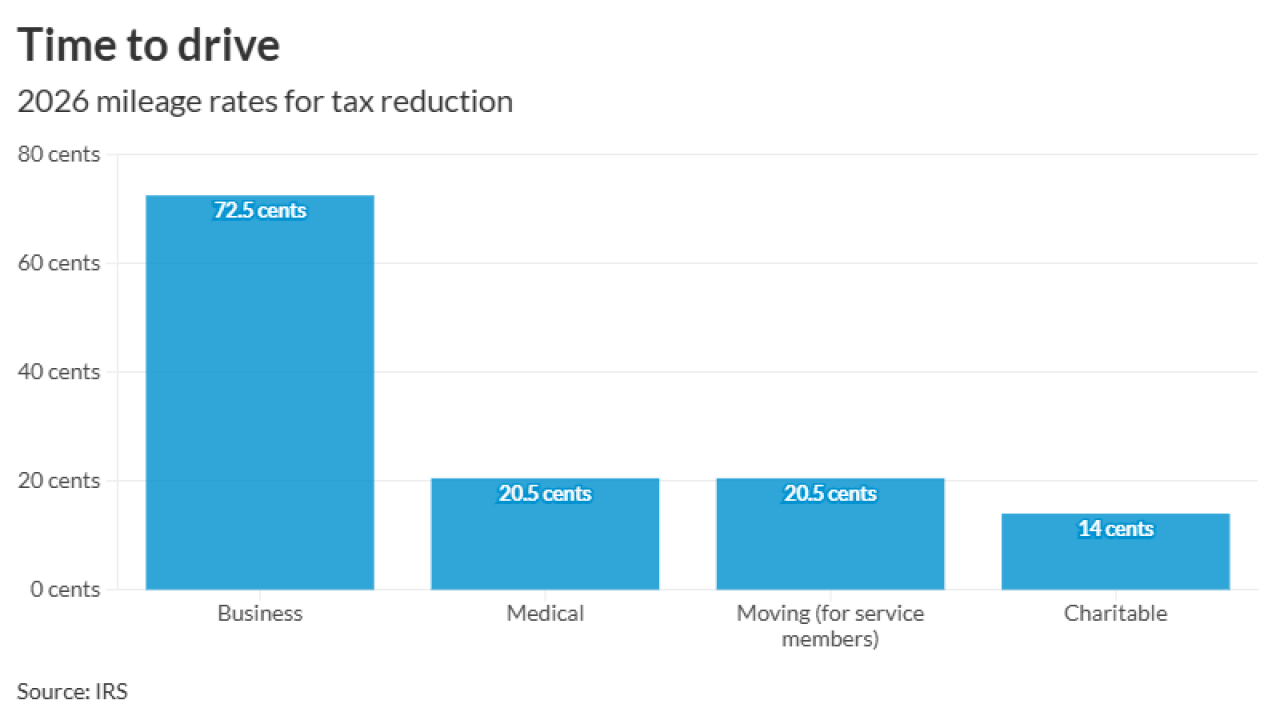

According to IRS Notice 2026-10, however, some other mileage rates will go down.

December 29 -

With no guidance available, tax practitioners and their clients have to figure out how much risk they want to take.

December 16 -

Wealthy taxpayers in high-tax states like California, New York and New Jersey are the biggest winners, as are workers who collect tips or overtime, and seniors.

December 15 -

That guidance basically asks employers to use their best efforts to provide documentation; no penalties will be imposed on those who were unable to document qualified tips and overtime.

December 11 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

Planning around SSI COLAs; holiday business deductions; complex decisions of inheritance; and other highlights from our favorite tax bloggers.

December 3

-

Just in time for Giving Tuesday, there's some good news for charities, thanks to the One Big Beautiful Bill Act, but also some new caps and limits.

December 2 -

In Notice 2025-69, the IRS and the Treasury offer clarifications and examples of how to claim the One Big Beautiful Bill Act deductions.

November 24 -

The One Big Beautiful Bill Act offers a striking example of how policy design can favor businesses over individual taxpayers, particularly young professionals.

November 21 University of Colorado Boulder

University of Colorado Boulder -

Notice 2025-57 explains how businesses should report interest to car purchasers so they can deduct it under the OBBBA.

October 22 -

The American Institute of CPAs is asking for more flexibility for taxpayers who wish to claim tax deductions for overtime and tip income under the OBBA.

October 21 -

The Trump administration's tax bill has created the opportunity to deduct domestic R&E expenses

October 15 -

The Internal Revenue Service is taking steps to make sure taxpayers and tax preparers can reflect OBBBA changes in 2025 tax returns.

October 9 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

Notice 2025-54, announces the special per diem rates for the special transportation industry rate, the rate for the incidental expenses-only deduction, and the rates and list of high-cost localities.

September 24 -

Congress did not simply extend the Tax Cuts and Jobs Act provisions starting in 2026 with the One Big Beautiful Bill Act; it also modified some of those provisions effective in 2025.

September 23 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting