-

The pandemic-related tax provision permits more people to deduct donations to qualifying charities on their 2021 federal income tax return.

December 14 -

Five tips can help charities carry out effective fundraising programs.

December 14 The Bonadio Group

The Bonadio Group -

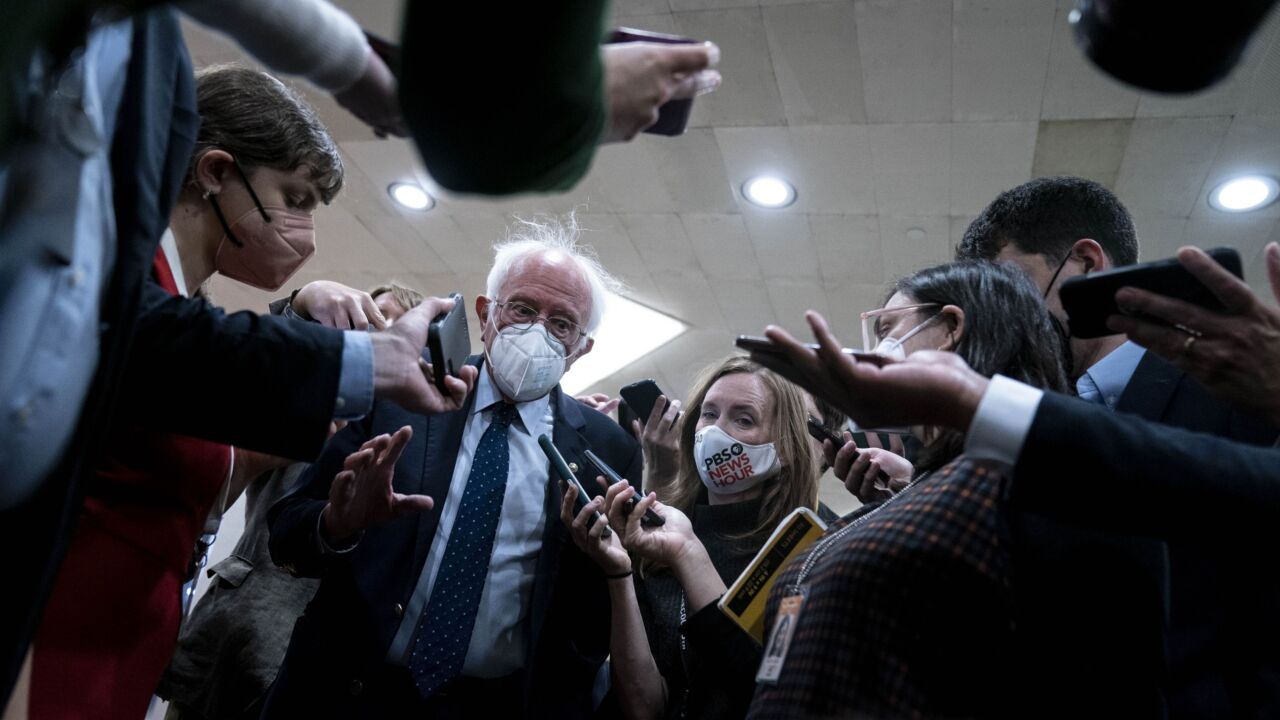

Key negotiators continue to clash over the specific income limits for one of the unresolved issues in President Joe Biden’s economic agenda.

December 8 -

Eliminating the revenue-raising R&D amortization provision in the 2017 tax reform is the best way forward for U.S. innovation.

December 3 TaxOps Minimization

TaxOps Minimization -

Senate Democrats negotiating an expansion of the state and local tax deduction aren’t near a deal, raising the prospect that talks will spill into next week — and potentially next year.

December 3 -

Here's a rundown of the most important changes poised to take effect five weeks from now, and how to take advantage of them or at least minimize the pain they could cause.

December 1 -

Dueling proposals would deliver large tax cuts to the wealthy while failing to do much for middle-income households, according to a new analysis from.

November 19 -

Well-off professionals in costly areas of the U.S. are set to get a windfall from competing plans to change the deduction limit for state and local taxes.

November 17 -

New guidance on the temporary 100% deduction is available in Notice 2021-63.

November 16 -

Lawmakers representing high-tax areas are pushing to make the SALT deduction on federal income taxes a priority.

November 12 -

The service released its annual inflation adjustments Wednesday, including the standard deduction amount for individual and married taxpayers.

November 10 -

Middle-class households in New Jersey and other high-tax states would benefit from an expansion of the deduction, a key House Democrat said.

November 8 -

That Rothko, Basquiat or Banksy hanging in the front hall may be a great way to get a tax break.

November 2 -

The spending package could still include a measure to expand or temporarily remove the cap on the deduction on state and local taxes.

October 20 -

Democrats risk settling for a less generous expansion of the state and local tax deduction than previously hoped after President Joe Biden conceded that lawmakers will have to scale back his economic agenda to get it enacted.

October 5 -

High-earning taxpayers would face much smaller tax hikes — or even cuts — if Democrats decide to restore the federal deduction for state and local taxes in legislation that’s now moving through the House.

September 17 -

House Democrats are considering a two-year repeal as one of their potential paths to undoing the $10,000 cap on the federal deduction for state and local taxes.

September 14 -

The stumbling block is scrapping the deduction limit without losing progressives wary of a tax cut that would overwhelmingly benefit the wealthy.

September 9 -

The institute is asking Congress to expand the deduction to include accounting firms and other businesses excluded under the Tax Cuts and Jobs Act.

August 26 -

Most advisors don’t know about the tax benefit for qualified small business stock, which can put millions of dollars tax-free into an entrepreneur-client’s bank account.

August 9