-

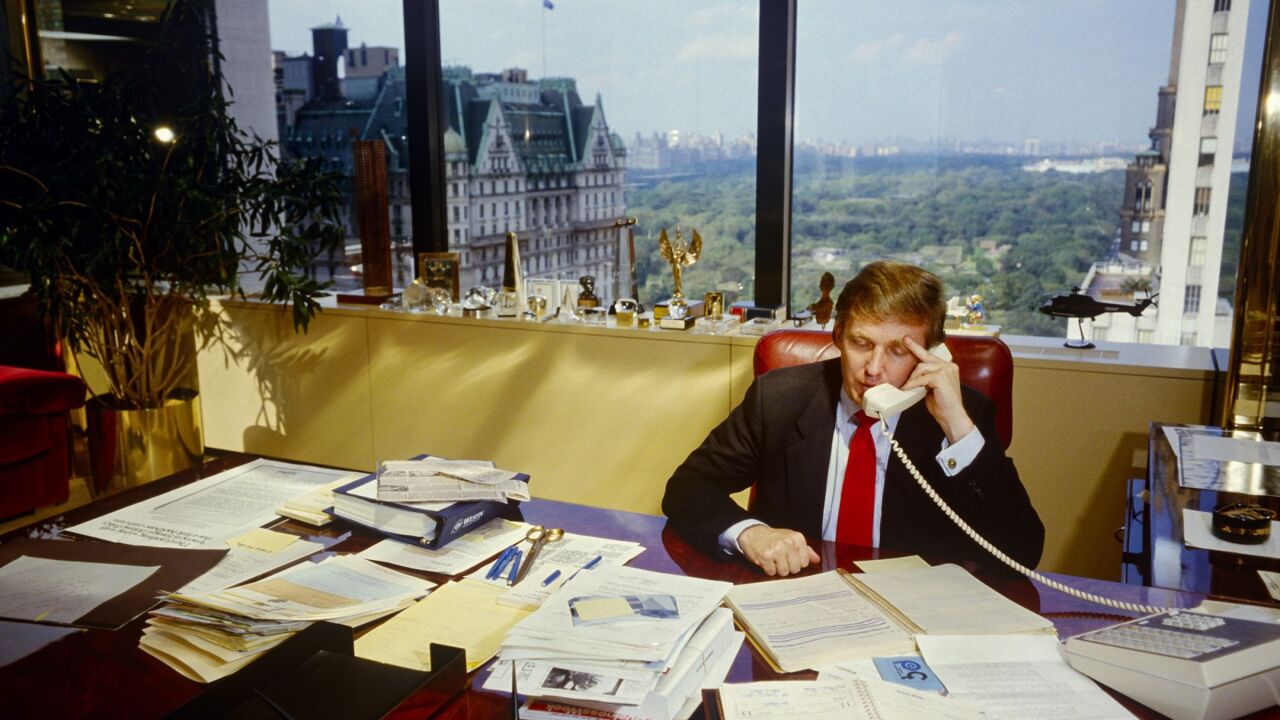

Donald Trump, his older sons and his daughter Ivanka are among those who may be called to testify.

October 25 -

"ERC mills" are encouraging applications for the tax credit from businesses that may not qualify for the pandemic relief program.

October 24 -

One of Donald Trump's most loyal deputies will testify against the Trump Organization, in a trial that threatens to reveal the inner workings of the real estate empire.

October 24 -

The deal brings to an end the investigation into suspicions of laundering of tax fraud proceeds.

October 24 -

Credit Suisse Group AG will aim to settle a tax fraud and money laundering case in France on Monday that saw coordinated raids in five countries from Australia to the U.K.

October 21 -

Thanks, cuz; golf fees but no income; the mix master; and other highlights of recent tax cases.

October 20 -

The Internal Revenue Service's Criminal Investigation unit has been working with the Justice Department to uncover billions of dollars in fraud related to pandemic relief programs.

October 20 -

COVID cons; no IRA, no school, no problem; plane stealing; and other highlights of recent tax cases.

October 13 -

While it's true that many companies qualify for the employee retention tax credit, there is significant concern about abuse and fraud.

October 7 KBKG

KBKG -

Run but can't hide; lack of support; Romanian holiday; and other highlights of recent tax cases.

October 6 -

The Criminal Investigation unit in Mexico City helped locate 79 criminals in Mexico, Belize, El Salvador, Guatemala and Honduras in the past fiscal year.

October 6 -

Sheldon Whitehouse, D-Rhode Island, and Roger Wicker, R-Mississippi, introduced bipartisan legislation to put more responsibility on accountants and other financial professionals to safeguard against money laundering and other crimes.

October 3 -

No more flying Coach; under the bar; last scheme in Clarksville; and other highlights of recent tax cases.

September 29 -

M.Y. Safra Bank must produce information to the Internal Revenue Service about customers who may have failed to pay taxes on cryptocurrency transactions through prime dealer SFOX Inc., a U.S. judge ruled.

September 23 -

Repeat business; bar none; installment plan; and other highlights of recent tax cases.

September 22 -

New York Attorney General Letitia James filed a sweeping lawsuit accusing Trump of inflating his asset values by billions of dollars to obtain favorable loan terms and other financial benefits.

September 22 -

Federal investigators are uncovering billions of dollars in fraud tied to pandemic relief programs.

September 21 -

Shah was named as the mastermind of the scheme in which pension plans filed for tax returns to which they weren't entitled, because they never paid the taxes to begin with.

September 16 -

Kin capers; Easy money; just feeling frivolous; and other highlights of recent tax cases.

September 15 -

A survey by the ACCA and IFAC revealed divergent attitudes worldwide.

September 13