-

On the run; Talent for fraud; relative chips in; and other highlights of recent tax cases.

May 28 -

Yacht happening; going, going, gone; grey and bootleg; and other highlights of recent tax cases.

May 21 -

A fuel and his money; see ya labor; low miles but high taxes; and other highlights of recent tax cases.

May 14 -

Gave at the office; mortgage and mining; rotten to the corps; and other highlights of recent tax cases.

May 7 -

The U.S. Supreme Court agreed to review a ruling that critics say would give the Treasury Department and Internal Revenue Service a sweeping shield from challenges to their regulations.

May 4 -

Red-handed; marina fees and airline tickets; similar patterns; and other highlights of recent tax cases.

April 30 -

Scrap rap; the roof caves in; and other highlights of recent tax cases.

April 23 -

Where grass is not greener; MS KO; brother’s keeper; and other highlights of recent tax cases.

April 16 -

Fate sealed; insults to injury; thanks, dad; and other highlights of recent tax cases.

April 9 -

Over the Topps; a thirst for fraud; the sky is limited; and other highlights of recent tax cases.

April 2 -

The Internal Revenue Service issued a warning urging taxpayers to beware of scammers calling and emailing them about the stimulus payments they are expecting as a result of last week’s CARES Act.

April 2 -

Quite an education; food for thought; Motion denied; and other highlights of recent tax cases.

March 26 -

Dying to steal; just getting behind; apple and the tree; and other highlights of recent tax cases.

March 19 -

The IRS cautioned tax professionals about a new version of a phishing email scam targeting them.

March 18 -

Businessman Lev Dermen, 53, was found guilty Monday as part of a scheme to cheat the IRS out of $512 million through a program designed to promote clean fuels.

March 18 -

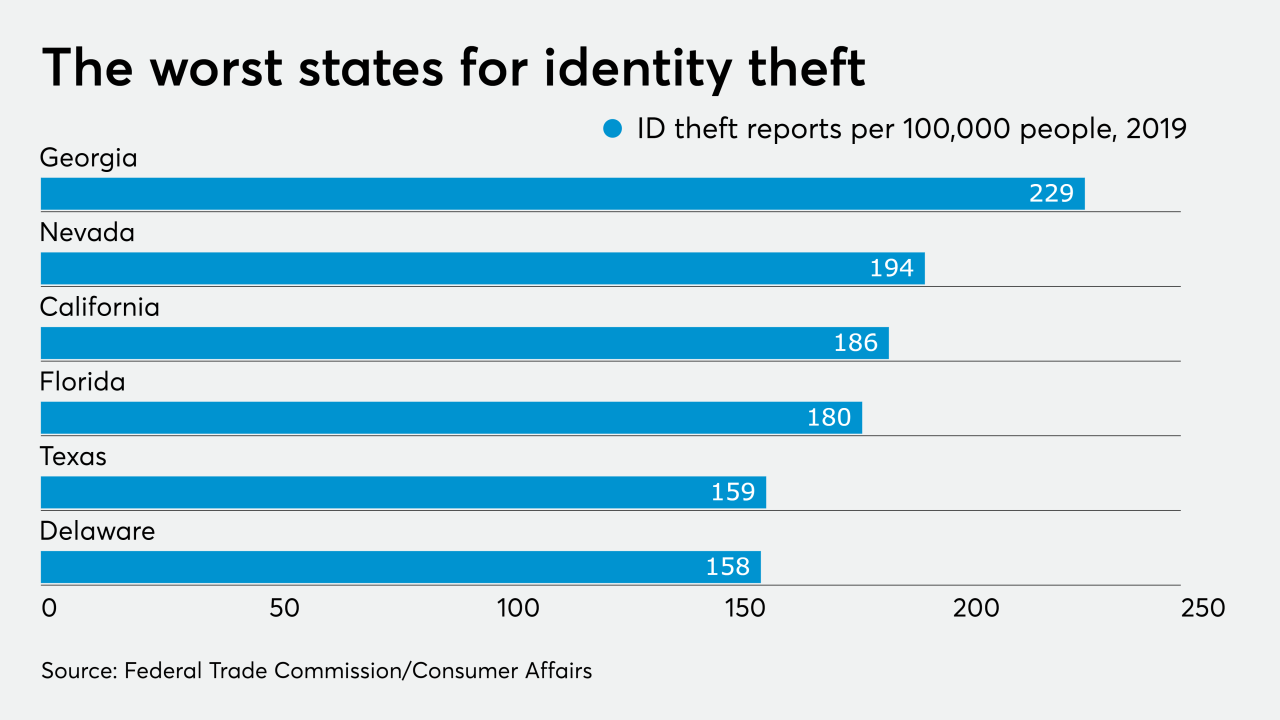

Practitioners are working on education, prevention and remediation.

March 13 -

No kidding; Time’s up; jailbird; and other highlights of recent tax cases.

March 12 -

Criminal Investigation veteran Damon Rowe will launch the new effort to fight the unscrupulous.

March 6 -

Papers trail; House of cards; trickle down; and other highlights of recent tax cases.

March 5 -

Spook central; short of a grand; a low bar; and other highlights of recent tax cases.

February 27