-

Those impacted by storms and flooding have until February to file many returns.

September 28 -

The vast majority of advance payments of the CTC went to eligible families, but millions of taxpayers who should have received the money did not, while millions of others who didn't qualify got them.

September 28 -

A group of Republicans on Congress' main tax committees sent a letter to the Internal Revenue Service and the Treasury, backing a request from the AICPA.

September 28 -

In many cases, those impacted by the hurricane will have until Feb. 15 to file.

September 20 -

Following FEMA's disaster declaration, the IRS is pushing back some deadlines to help local taxypayers.

September 9 -

The agency issued billions of dollars in tax refunds to companies claiming net operating losses for prior years after passage of the CARES Act, but did little to examine the claims.

September 7 -

The Internal Revenue Service has been slow in processing employer tax credits and tax refunds that businesses were supposed to receive.

September 6 -

The agency is making progress on its backlog of unprocessed tax returns, as it's asked by the Institute to extend its recent penalty relief through the end of the year.

September 1 -

The tax agency will automatically issue the refunds or credits for most of the fees by the end of September.

August 25 -

The service is providing relief to most individual and business taxpayers who filed their 2019 or 2020 returns late due to the pandemic.

August 24 -

The IRS is granting postponements to St. Louis and a number of nearby counties.

August 11 -

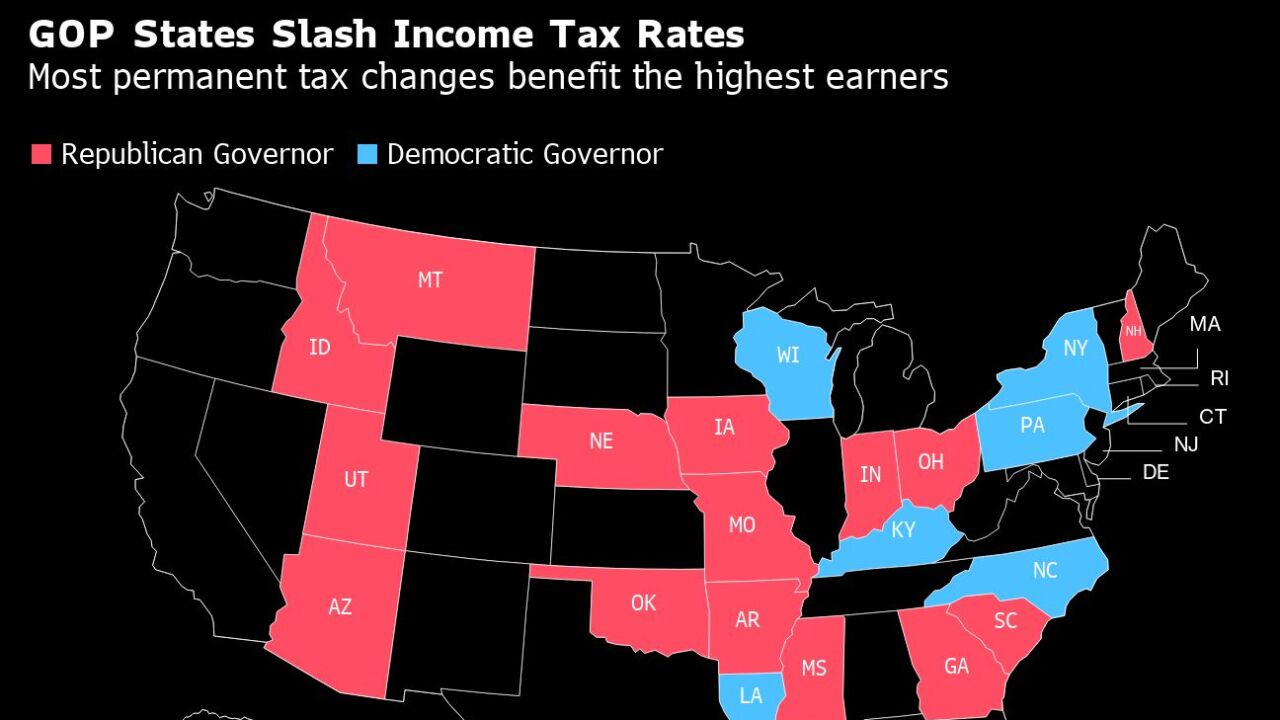

More than half of U.S. states are using record budget surpluses to fund their biggest collective tax break in decades.

August 10 -

Small business owners have been hampered by complicated tax forms and processes that kept them from claiming pandemic-related tax credits and payroll tax deferrals.

August 3 -

The IRS announced extensions for any area designated by FEMA.

August 2 -

The service had to set up the online portal quickly to allow parents to claim advance payments, but the rollout had some hiccups and over 1,300 taxpayers suffered ID theft.

July 28 -

The institute sent a letter to House lawmakers urging them to include a disaster provision in a bipartisan retirement bill that’s already part of the Senate version of the legislation.

July 27 -

The relief is only available for jointly filed income tax returns, according to the Tax Court.

July 27 -

The president said he’s aiming to decide this week whether to move to suspend the federal gasoline tax.

June 21 -

New Jersey will expand its planned property-tax relief program, providing more than $2 billion to more than 2 million households, Governor Phil Murphy said.

June 17 -

Newly released IR-2022-89 can help business clients avoid tax trouble.

June 8 Tri-Merit Specialty Tax Professionals

Tri-Merit Specialty Tax Professionals