Source: Interim tax data, Treasury Inspector General for Tax Administration

Source: Interim tax data, Treasury Inspector General for Tax Administration

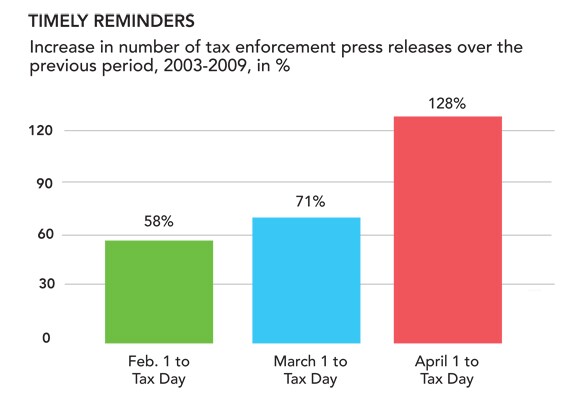

Source: "When Is Tax Enforcement Publicized?" Blank and Levin

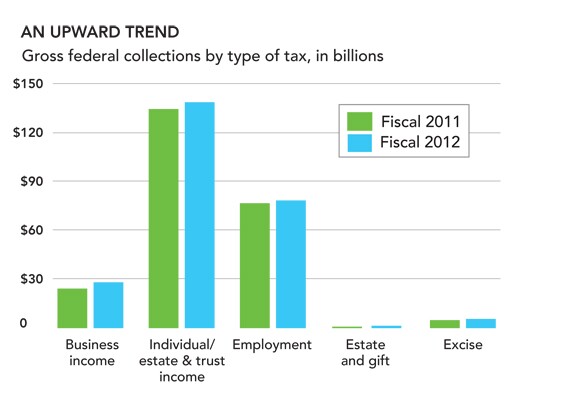

Source: IRS Data Book 2012

Source: IRS Data Book 2012