Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

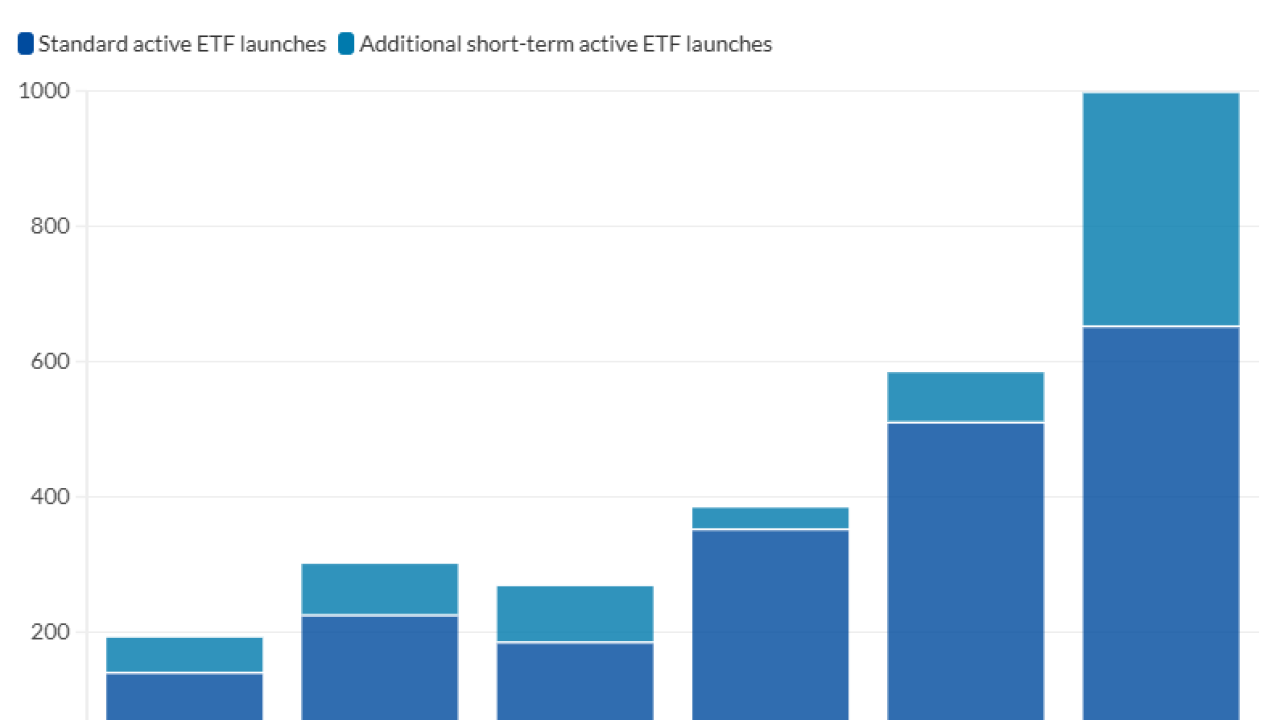

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

Steve Lockshin and Michael Kitces tied what they view as some mistaken assumptions around fees to the competitive need for more estate planning services.

December 11 -

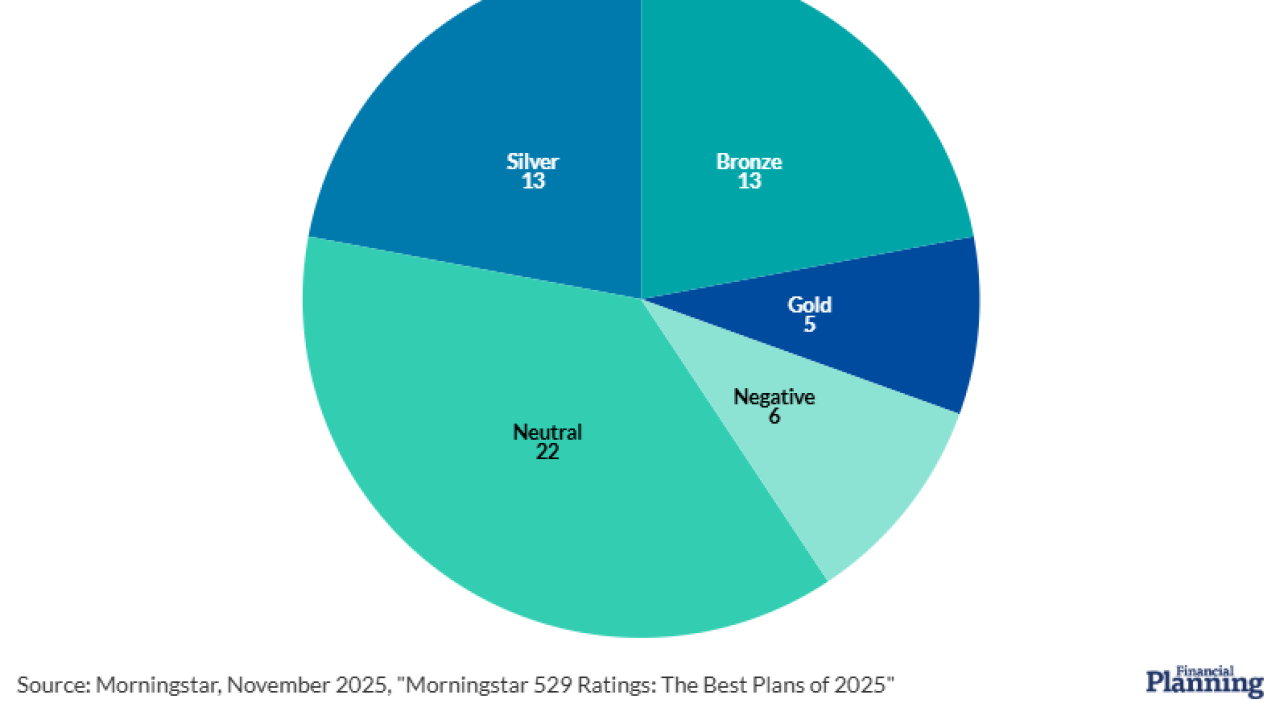

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

December 8 -

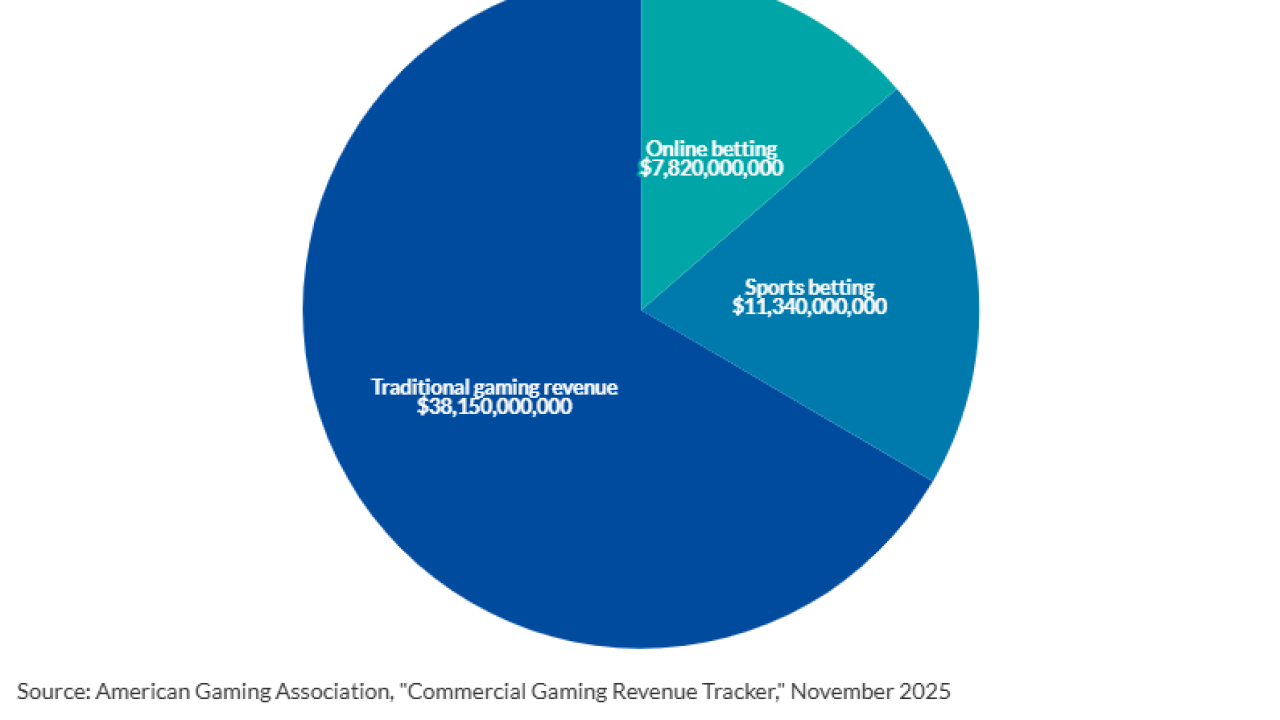

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 11 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

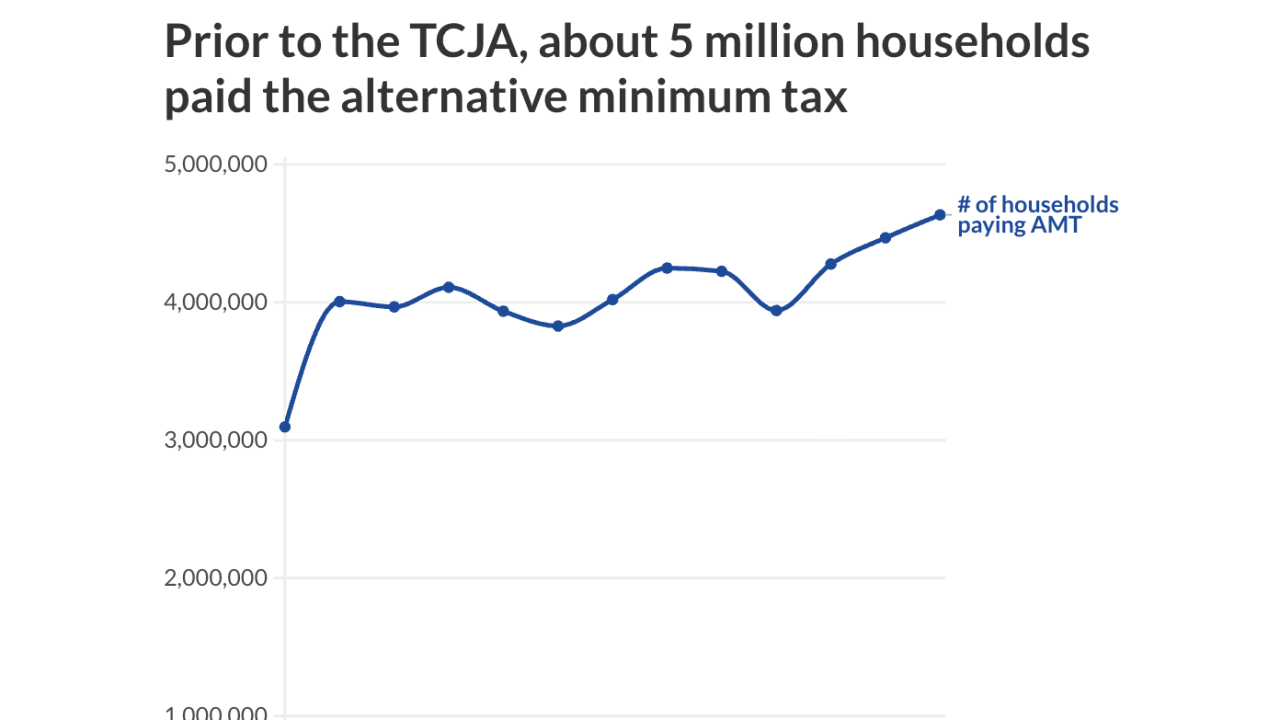

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

The fact that many financial advisors say they do not provide tax planning belies how much value they may add through that service, according to an expert.

October 14 -

While stock values get the most attention after the Fed cuts rates, they affect trusts, too. Some beneficiaries of entities without flexible distribution provisions could take a big hit.

September 29 -

The new tax law won't completely eliminate the complicated tax incentives for food on the job, but experts suggest businesses may change up their menus.

September 22 -

The numbers look gaudy, but potential estate taxes and prohibitions on future strategies make the big retirement accounts much less appealing, two experts said.

September 15 -

A limited federal tax credit, an above-the-line deduction for non-itemizers and restrictions on those of itemizers represent three of the biggest shifts under the new law.

September 11 -

Cerulli's research based on a survey of wealth and asset management firms suggest that firms have only just begun to address clients' comprehensive planning needs.

September 8 -

The use of multiple entities as a means of shifting a high net worth client's yearly income could help rack up bigger breaks, with some caveats.

August 25