Can't Hide from Taxes

Wesley Snipes

(photo by Nicolas Genin)

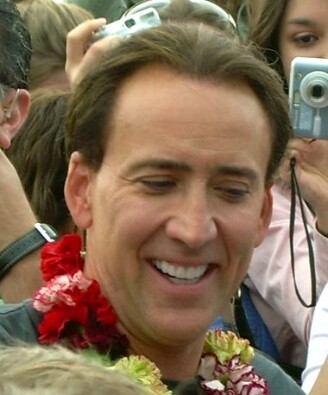

Nicolas Cage

(photo by Kristin Standafer)

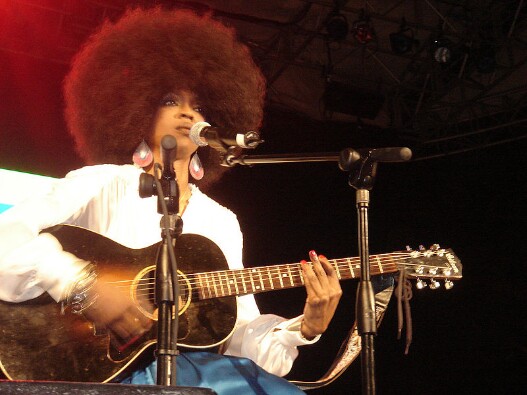

Lauryn Hill

(photo by Lisa Liang)

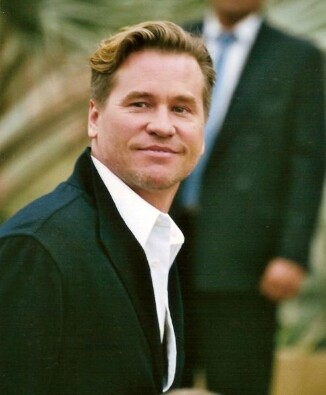

Val Kilmer

(photo by Georges Biard)

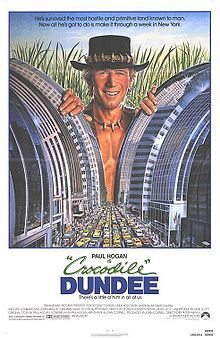

Paul Hogan

R, Kelly

Anna Nicole Smith

(photo by Toby Forage)

Lindsay Lohan

Lil' Kim

(photo by Windy Jonas)