Central Figures

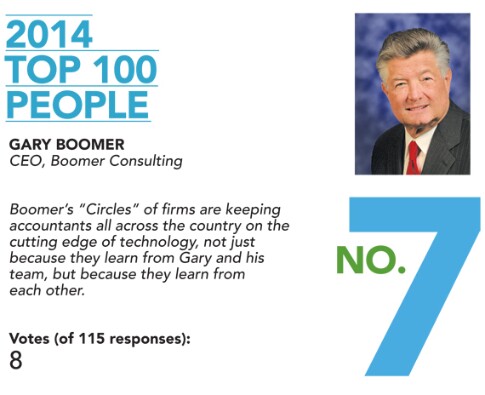

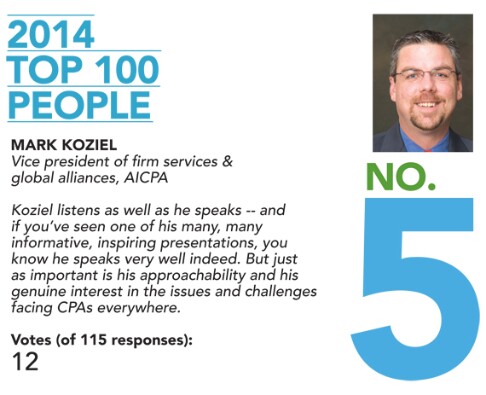

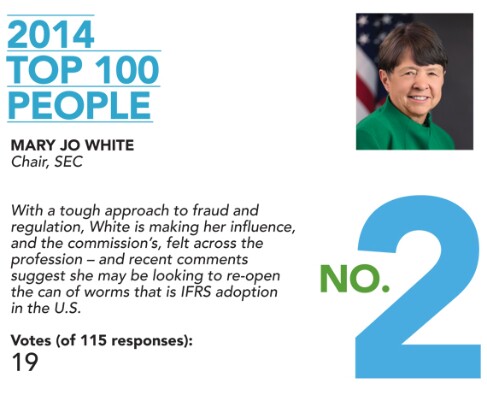

Each year as part of our Top 100 Most Influential People in Accounting list, we ask candidates for the list to name who they think are the most influential people in the field and here they are, ranked by the number of votes they received from the 115 candidates.

Jennifer Wilson

Brad Smith

Ron Baker

Gary Boomer

Mark Koziel

James Doty

Tom Hood

Russell Golden

Mary Jo White