-

Trump suggested he could exert pressure on Attorney General Pam Bondi and Treasury Secretary Scott Bessent, saying there had "never been anything like it."

February 5 -

Senators Ron Wyden and Elizabeth Warren want to know if the DOJ plans to defend the IRS against Trump's $10 billion lawsuit over the leak of his tax returns.

February 4 -

The pros and cons of Trump's pitch to move from quarterly financial reporting to semiannual are not as clear-cut as either side thinks.

January 30 -

President Trump and Senate Democrats reached a tentative deal to avert a disruptive government shutdown as the White House continues to negotiate with Democrats.

January 30 -

The lawsuit by a sitting president against the government he leads puts Trump in a highly unusual position in the case.

January 30 -

Alt5 replaced its auditor last month less than three weeks after hiring it, bringing on L J Soldinger Associates as its third audit firm in under two months.

January 29 -

The Internal Revenue Service and the Treasury said the payment of $1,776 for members of the military announced by President Trump last month would not be taxed.

January 20 -

The measures could include tariffs, new taxes on tech companies or targeted curbs on investments in the EU.

January 20 -

The California governor wants to restart offering tax rebates for electric vehicles that are purchased in the state.

January 12 -

Right now, cannabis businesses operating legally under state law still can't deduct basic costs like rent, salaries or marketing.

January 7 Friedlich Law Group

Friedlich Law Group -

The bipartisan bill aligns the deadline for claiming prior-year refunds or credits with the extended filing period granted to taxpayers hit by natural disasters.

January 2 -

Brazilian President Luiz Inacio Lula da Silva wants his U.S. counterpart to arrest the Florida resident accused of being the South American country's biggest tax debtor.

December 10 -

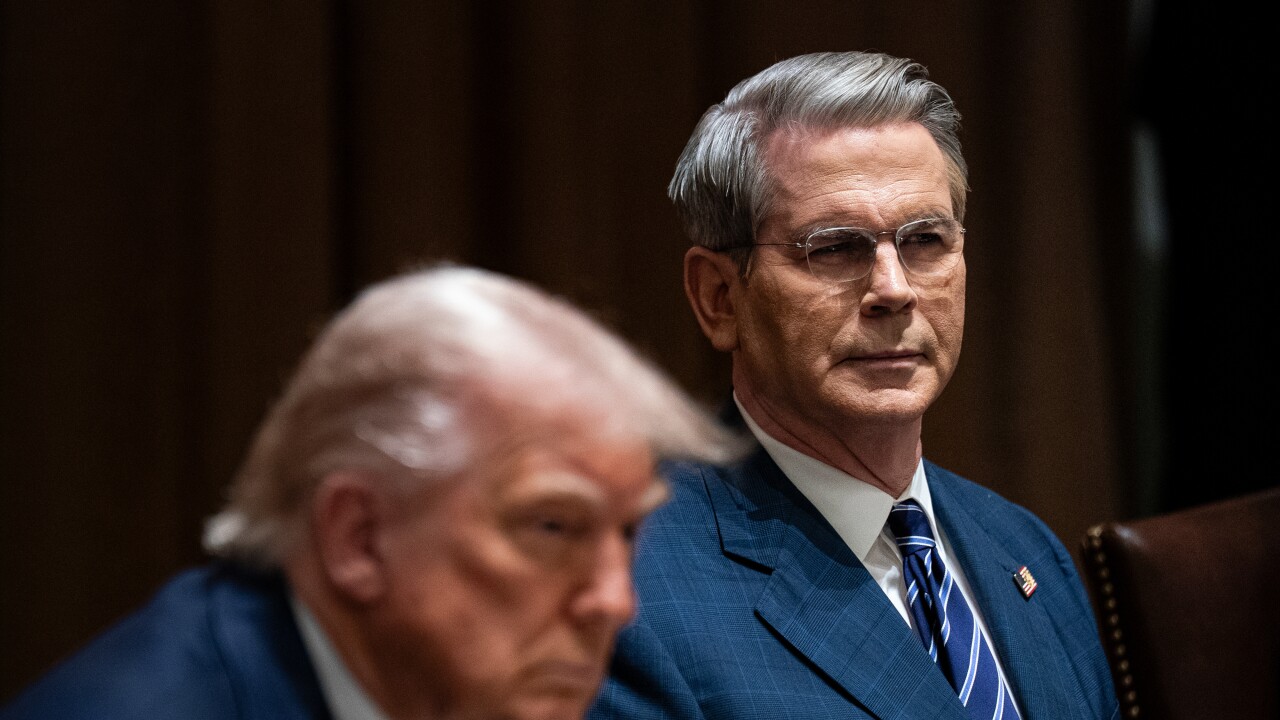

Trump's aides are discussing making the Treasury chief the top White House economic advisor, in addition to his current job, plus acting IRS commissioner.

December 4 -

The initiative from the president's tax law has drawn support from corporate and financial leaders.

December 3 -

The law requires the IRS to provide a clear explanation of tax-filing errors to taxpayers on its math error notices.

December 1 -

Republicans are divided on whether to extend premium tax credits, loathed by the GOP's right flank because of the costs and lingering opposition to former President Obama's legislative achievement.

November 26 -

The president's comments come as Senate Republicans prepare to hold a vote on extending the tax credits, which are slated to expire at the end of this year.

November 20 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

President Trump's idea of mailing $2,000 "dividend" payments from tariffs to citizens marks a throwback to the stimulus checks distributed during COVID.

November 12 -

The Treasury Secretary said he hadn't spoken to the president about this idea but "the $2,000 dividend could come in lots of forms, in lots of ways.

November 10