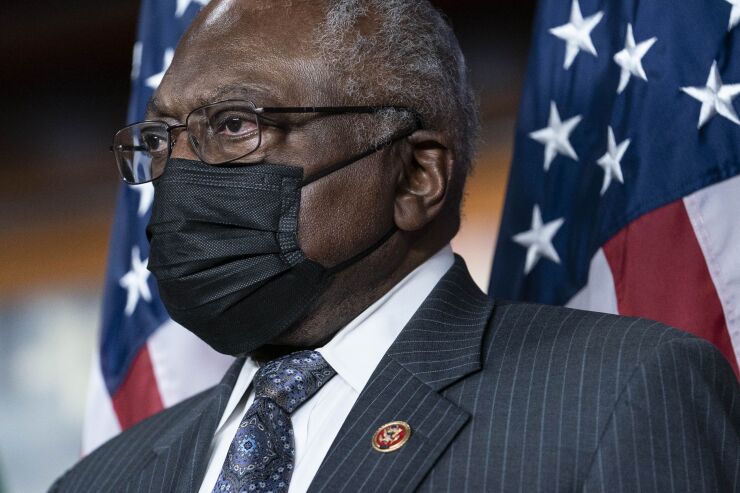

Lawmakers should closely study who is benefiting from a deduction on state and local taxes, or SALT, before making changes to the tax break, the No. 3 House Democrat James Clyburn said.

Clyburn, who is in charge of rounding up votes to support his party’s legislation in the House, is facing a split among Democrats over whether President Joe Biden’s infrastructure and social spending package should also include a repeal of the $10,000 cap on SALT deductions, a key priority for Democrats from high-tax states.

“We have to take a look at exactly what we are doing here,“ Clyburn said in an interview with David Westin on Bloomberg’s “Balance of Power” program. “We ought to take a look at the impact of whatever the tax structure is and what it will have on ordinary working people and do the things that are necessary to protect them in their attempts, especially those who are trying to get into the middle class.”

Clyburn’s comments address the split among Democrats over the SALT deduction. Lawmakers from states like New Jersey, New York and California say the $10,000 limit on the tax break hurt residents of their districts, where housing costs and incomes are higher compared to other parts of the country. Several have said they would oppose Biden’s infrastructure package unless it addressed the SALT cap.

But Republicans are against lifting the cap, which was part of their 2017 tax bill, arguing that doing so would reward government spending in Democratic-run states. Some Democrats also are critical. New York Representative Alexandria Ocasio-Cortez recently criticized the SALT deduction as “a giveaway to the rich.”

Clyburn said that Democrats should take a holistic view when crafting the legislation and that the cost of repealing the SALT cap shouldn’t mean sacrificing other spending on programs for lower-income Americans.

“I’m also sympathetic to the fact that these same families don’t have broadband,” Clyburn said. “You can’t get sufficiently educated or adequately educated without broadband.“

Biden’s $2.25 trillion infrastructure proposal calls for spending $100 billion to bring high-speed broadband to all Americans. Repealing the SALT cap would cost about $88.7 billion for 2021, with the vast majority of those benefits going to high-income households, according to the non-partisan Joint Committee on Taxation.

Representative Norma Torres, a California Democrat, said that the SALT deduction is important for state and local governments to fund infrastructure projects on their own, because the deduction softens the blow of higher state taxes on residents.

“I think at the very least we should allow for an exemption in federal taxes for those tax dollars spent on projects that are a priority to the community,” such as transportation and housing, she sad in an interview with Bloomberg News. “The federal government has not provided sufficient funding. We should not be penalized for that.”

Biden is set to release the second portion of his economic agenda in the coming days focusing on social programs funded by taxes on the wealthy. The proposal is unlikely to include any changes to expand the SALT deduction. That will likely be added as the bill is negotiated in the House.