Want unlimited access to top ideas and insights?

Federal stimulus payments may have been critical to helping many taxpayers make it through the first year of COVID, but they also were a huge source of errors on tax returns.

In the year to Dec. 31, 2020, almost 88% of all errors on individual income tax returns involved the Recovery Rebate Credit, according to most recent IRS data available. They accounted for a total of 11.3 million mistakes; for comparison, the next five most common errors combined account for just over 1.2 million mistakes.

The massive number of RRC errors dwarfed the more common mistakes; for instance, errors involving adjusted gross income amounts accounted for 33% of all mistakes in 2019, but only 2.2% in 2020.

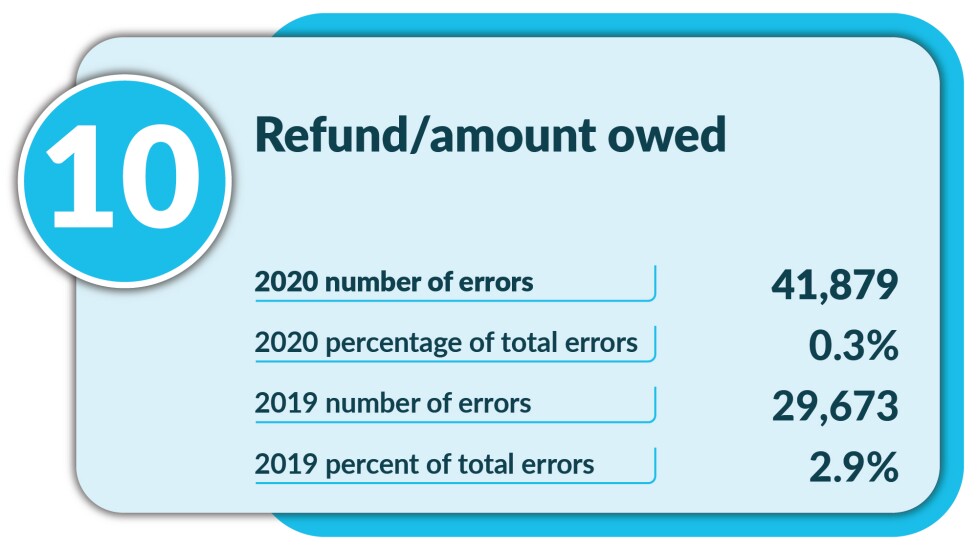

Scroll through to see the top math errors on individual returns, and how they changed during the first year of COVID.