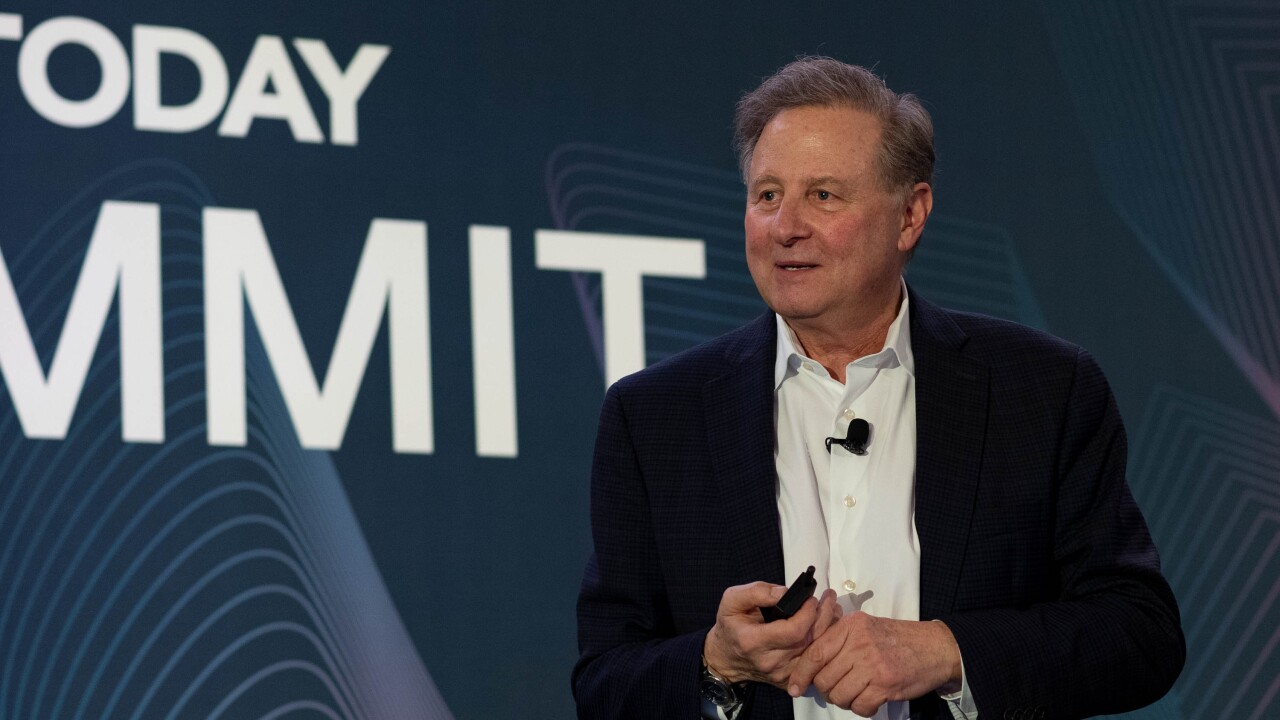

Dave Camp, the former Republican chairman of the tax-writing House Ways and Means Committee who spearheaded an effort at tax reform in Congress, has joined PricewaterhouseCoopers as a senior policy advisor based in PwC US’s Washington National Tax Services practice.

The Michigan representative led the Ways and Means Committee for four years until retiring from Congress earlier this year. In his role at PwC, he will continue to focus on the economic, tax, international trade and health care policy issues that were his responsibility as Ways and Means Committee Chairman and his passion during the 24 years he served in the House.

“Dave Camp is a luminary in his field, and we are honored that he has chosen to join PwC,” said PwC US chairman and senior partner Bob Moritz in a statement. “His commitment to removing barriers to trade and ability to work on a bipartisan basis resulted in the enactment of significant trade agreements. His vision regarding the critical need for tax reform as the catalyst for U.S. competitiveness has paved the way for the changes our economy needs over the next few years.”

As Ways and Means Chairman, Mr. Camp served as part of the House Republication leadership and played a major role in the formation of policy on a wide range of issues. He was engaged in the committee’s work on tax, international trade, Medicare, Social Security and fiscal policy issues for more than two decades. In December 2014, he introduced the Tax Reform Act of 2014, the most comprehensive tax reform proposal since the mid-1980s. The Camp proposal may influence the direction of business and international tax reform in the future.

“Dave’s willingness to take on the herculean task of developing the most comprehensive tax reform proposal since the mid-1980s is testament to his ability to do what others considered impossible,” said PwC US vice-chairman and tax leader Mark Mendola. “Chairman Camp's bill will serve as the foundation for the tax reform discussion that lies ahead of us. His impact on tax policy has been enormous. I know our clients look forward to hearing his insights, learning more about his innovative thinking and seeking his assistance in effecting change, qualities that served him so well in Congress.”

In addition to chairing the Ways and Means Committee, Camp was a member of the Joint Committee on Taxation for six years, serving as chairman in 2011 and 2013 and vice chairman in 2012 and 2014. He also served on the National Commission on Fiscal Responsibility and Reform, created in February 2010 to identify policies to improve the U.S. fiscal situation after the deep economic downturn. While on the Commission, Camp co-led the Tax Reform Working Group and was a member of the Mandatory Spending Working Group. Afterward, he was one of 12 members of the bipartisan Congressional Joint Select Committee on Deficit Reduction, formed in 2011.

In his role at PwC, the firm said Camp would provide his perspective to PwC clients on federal policy issues, including tax reform, the economy and the impact of proposed policy changes on businesses. He will help also PwC clients navigate the legislative and regulatory process to develop strategies and advance policies to improve economic growth and competition in global markets. In addition, Camp will provide insight on the global business environment, including issues specific to Organization for Economic Cooperation and Development initiatives on international tax reform.