The Internal Revenue Service's Criminal Investigation unit has been investigating bogus claims for the Employee Retention Credit and educating tax professionals about the problems they can encounter with it.

As of Jan. 31, 2024, IRS CI has initiated 374 investigations involving more than $2.95 billion of potentially fraudulent Employee Retention Credits in tax years 2020, 2021, 2022 and 2023, according to a spokesperson. Eighteen of the 374 investigations have resulted in federal charges to date. Of those 18 cases, 11 investigations have resulted in convictions, six have been sentenced, and the average sentence has been 24 months.

CI special agents are hosting a series of educational sessions aimed specifically at tax professionals about the ERC at IRS CI field offices across the U.S. The sessions are taking place this month as part of a nationwide initiative to ensure tax professionals have the latest information about ERC claims and understand ERC eligibility criteria.

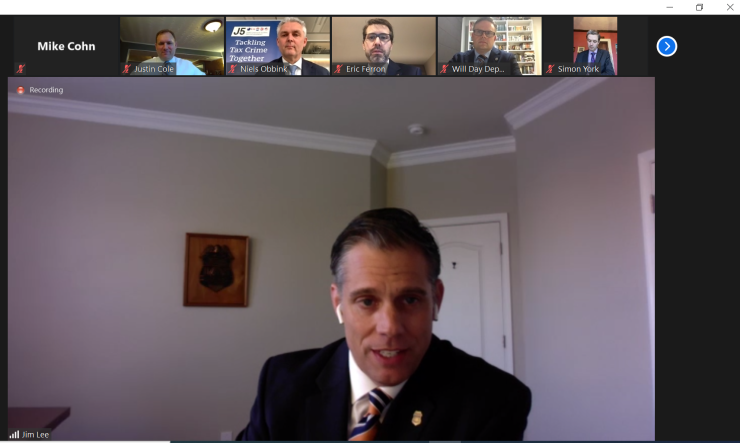

"During the COVID-19 pandemic, tax credits and loans were extended to struggling businesses," stated IRS CI chief Jim Lee, who

IRS CI special agents will walk attendees through ERC eligibility criteria, documentation requirements to receive ERC claims, and best practices for compliance and accurate reporting. The events are taking place in 23 U.S. states and the District of Columbia and are specifically targeted at tax professionals who have claimed ERCs for their clients on previous years' tax returns. Invitations to attend are arriving through the U.S. Postal Service.

Businesses that filed an ERC claim in error may be able to participate in the

The IRS recently highlighted

Last September, the agency imposed a

Tax legislation that was

IRS Commissioner Danny Werfel was asked by Rep. Drew Fergsuon, R-Georgia, about the ERC provisions of the legislation during a House Ways and Means Committee hearing last Thursday.

"The legislation that's under consideration would prohibit ERC claims from coming in after a date certain," Werfel replied. "One of the things that impacts our ability to make sure that we're getting to the eligible claims, among the ineligible, is the size of the inventory … Once we issued the moratorium, the influx of claims dropped in half, but I think we got 17 to 20,000 last week. That inventory is growing, and it's growing with a lot of ineligibility. Helping us pause the incoming at this point, so we can find those that have submitted that are eligible. We need that help."