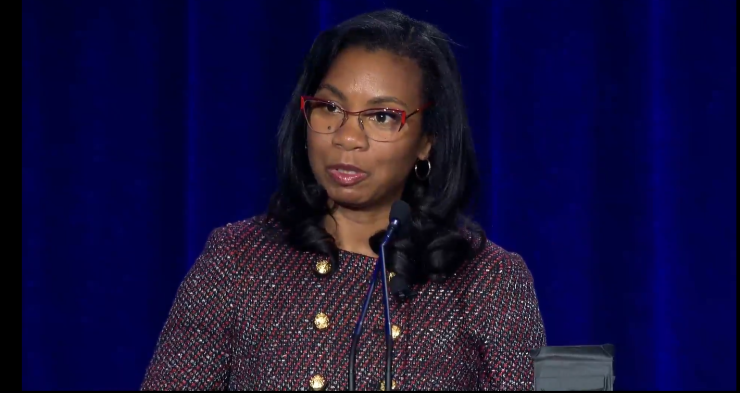

Public Company Accounting Oversight Board chair Erica Williams is departing next Tuesday, July 22, after reportedly being asked to resign by the new chair of the Securities and Exchange Commission. Her agency narrowly avoided an effort recently to eliminate it by transferring its responsibilities to the SEC.

Last month, the

Williams was originally

"The dedicated staff of the PCAOB are among the most talented and hardworking professionals with whom I have had the opportunity to work, and it has been my honor to serve alongside them," Williams said in a statement Tuesday. "The PCAOB plays an essential role in protecting the investments and retirement savings of workers and families across the country while helping to ensure our capital markets remain the envy of the world. With high economic uncertainty increasing the risk of fraud, the PCAOB's mission is as important as ever. It's critical the expert PCAOB staff continue to be empowered to carry out their work of ensuring American investors are protected."

Williams was reportedly asked to resign by Atkins, according to

No immediate successor was named. "I know you have questions about what is next for PCAOB leadership," Williams said in an email to PCAOB staff, according to the WSJ. "Unfortunately, I do not have the answers you deserve."

Gensler and his predecessor Jay Clayton had also overhauled the leadership and composition of the PCAOB during the the

The PCAOB listed several of Williams' accomplishments during her tenure, which included:

- Securing complete access to inspect and investigate firms headquartered in China for the first time in history and bringing record enforcement actions against China-based firms;

- Launching a concentrated effort to improve audit quality that helped lead to significant improvements in deficiency rates across audit firms;

- Increasing transparency in inspection reports and getting those reports out nearly a year sooner so that investors, audit committees, and others have access to valuable information more quickly;

- Taking more formal actions to modernize standards and rules than any Board since the PCAOB was created, finalizing seven projects, covering 24 rules and standards;

- Delivering record-setting sanctions, sending a clear message that there will be strong consequences for anyone who puts investors at risk;

- Partnering with staff to make the PCAOB a better place to work, leading to a 30-percentage point increase in the number of PCAOB staff who say they would recommend the PCAOB as a great place to work;

- Reimagining stakeholder outreach, reconstituting the Investor Advisory Group and the Standards and Emerging Issues Advisory Group and creating the first-ever standalone Office of the Investor Advocate; and

- Awarding the highest amount of merit-based scholarships to accounting students in PCAOB history.

Several proposed standards attracted the opposition of auditing firms, however, including