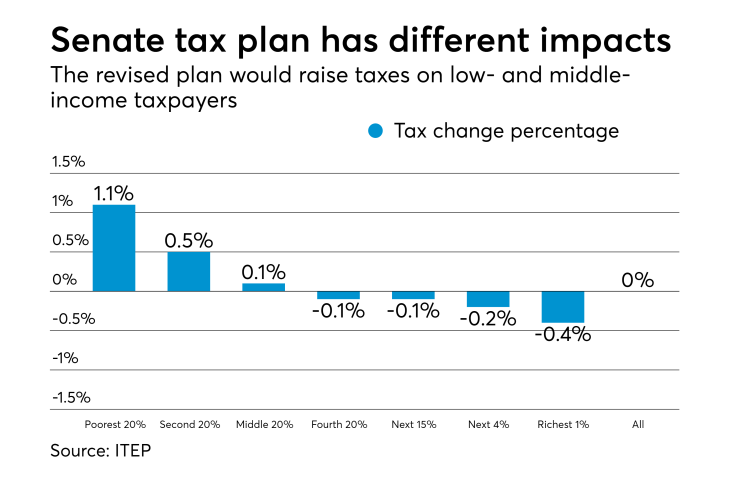

A new 50-state analysis of the tax reform bill passed last week by the Senate Finance Committee finds the plan would increase taxes on at least 29 percent of taxpayers by 2027 and cause the populations of 19 states to pay more in federal taxes than they do today.

The

The Senate bill includes a variety of phase-outs and temporary tax breaks designed to end within 10 years in order to fit in with Senate rules to avoid increasing the budget deficit beyond $1.5 trillion. Congress recently passed a budget resolution allowing an additional budget deficit of $1.5 trillion over 10 years to be passed with a simple majority vote. But in order to get a permanent tax cut of 20 percent for corporations in the legislation, many of the provisions for tax cuts on the individual side were made temporary. To extend the individual tax cuts, Congress would be forced to later add trillions more to the budget deficit.

The report projects that the top 1 percent would receive an average tax cut that would dwarf cuts received by taxpayers in the top 40 percent. The top 1 percent of taxpayers would receive an average tax cut of $9,080, while the top 5 percent (excluding the top 1 percent) would receive an average cut of $940.

Foreign investors would receive tax cut benefits outweighing tax cuts for all U.S. households by nearly three to one, according to ITEP’s projections.

Taxpayers in 19 states would pay more in net taxes than they would under current law. While many of the so-called Blue States that lean Democratic would face tax hikes because of the loss of the state and local income tax deduction, other states would also face tax hikes, including some in so-called Red States that lean Republican, in part due to the repeal of the individual mandate under the Affordable Care Act. Republican lawmakers have pointed out, though, that the money from premium tax credits is paid to insurance companies and not individual taxpayers.

“The reason some states are more affected than others in 2027 has to do partly with the fact that the tax credits that help people pay health insurance premiums under the Affordable Care Act are more significant in some states than others, and some of these credits would no longer be paid out because of the repeal of the health insurance mandate under the bill,” said the report. “Based on the most recent IRS data, 16 of the 18 states with the most significant total premium tax credits received in 2015 (measured as a share of the total income of people in the state) are among the states that would have overall tax increases in 2027. (The two exceptions are Vermont, which would have a net impact of about zero dollars in 2027, and the other is California.) The three other states receiving an overall net tax increase in 2027 would be North Dakota, Oklahoma and West Virginia.”

The analysis projects that in 2019, half the tax cuts would go to the top 5 percent of taxpayers. The plan would become even more regressive in later years. While the average taxpayer would receive a tax cut in the first year of the plan, the effects change significantly in later years under the plan.

The share of lower-income taxpayers facing a tax hike in 2027, the final year of the Senate tax plan, would rise, according to ITEP’s analysis, while the share of higher-income people facing a tax hike would go down. In 2019, 5 percent of the poorest 20 percent of taxpayers would face a tax hike, but by 2027, the share would increase to 32 percent. For the middle 20 percent it would be 9 percent in 2019 v. 37 percent in 2027. But for the wealthiest 1 percent of the population, it would be the opposite, with 29 percent of taxpayers in that group seeing a tax hike in 2019, as opposed to 10 percent in 2027.

Another think tank, the Tax Policy Center, released a separate