An overwhelming majority of small business owners don’t understand how the Tax Cuts and Jobs Act will affect them, according to a new survey of the self-employed.

Processing Content

The survey, by the National Association for the Self-Employed, found that 83 percent of small business owners didn’t have a complete understanding of the impact the new tax reform law would have on their business. Over 90 percent of the 389 respondents felt the government did not adequately prepare them for the new tax system. Survey takers were split on whether they expected to pay more or less in overall taxes this year. Nearly 60 percent of survey respondents said they felt their taxes for this year would be more difficult to complete because of the new tax law. Over 90 percent believe the government should take additional measures to ease the tax burden.

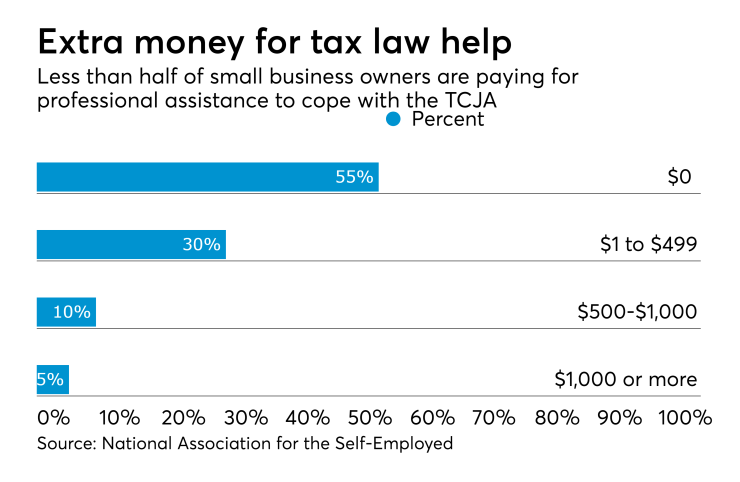

Around 30.33 percent of the respondents said they had spent up to $499 on outside professional assistance to prepare for the new tax law, while 9.51 percent said they had spent $500 to $1,000 on outside assistance, and 5.14 percent spent $1,000 or more. But more than half, 55 percent, said they had spent zero on outside help.

“The tax reform package signed into law last year is based on Americans reinvesting savings back into their business operations and helping to spur overall economic growth,” said NASE president and CEO Keith Hall in a statement Tuesday. “Small business owners must first have a full understanding of how this new tax law will impact their bottom line. Unfortunately, over 83 percent of respondents still don’t understand the impact the new law will have on their businesses and over 90 percent think the government didn’t adequately prepare them for the system.”

He believes additional IRS guidance is necessary and the government can take additional steps to effectively communicate the impact of the new laws on small business owners.

Intuit released the results of a separate survey of self-employed workers on Tuesday. It found 36 percent of self-employed workers admit they don't pay taxes, and nearly 1 in 10 self-employed workers don’t know about the recent tax reform. More than a fourth of self-employed workers think the tax reform will cause them to pay more in taxes, and 14 percent of self-employed workers are currently behind on their taxes.

A third survey by a small business advocacy group, the Main Street Alliance, also cast doubt on the new tax law last week. It found the majority of small business owners surveyed said they need more customers, as opposed to tax cuts, to hire and expand, and called for stability and strong public investment as the way to grow a business.

The Tax Cuts and Jobs Act provides a 20 percent deduction to pass-through businesses such as sole proprietorships and partnerships. However, many of the benefits of the deduction are not going to small businesses, according to a government report. Congress’s Joint Committee on Taxation released a report Monday indicating that 44 percent of the benefits of the 20 percent pass-through deduction will go to around 200,000 business owners whose incomes exceed $1 million. That amounts to approximately $17.8 billion. Another 8.9 percent, or about $3.6 billion, will go to 200,000 taxpayers who make between $500,000 and $1 million. The tax deduction is expected to cost the Treasury $40.2 billion this year and $60.3 billion in 2024, when $31.6 billion will be going to business owners making $1 million or more.