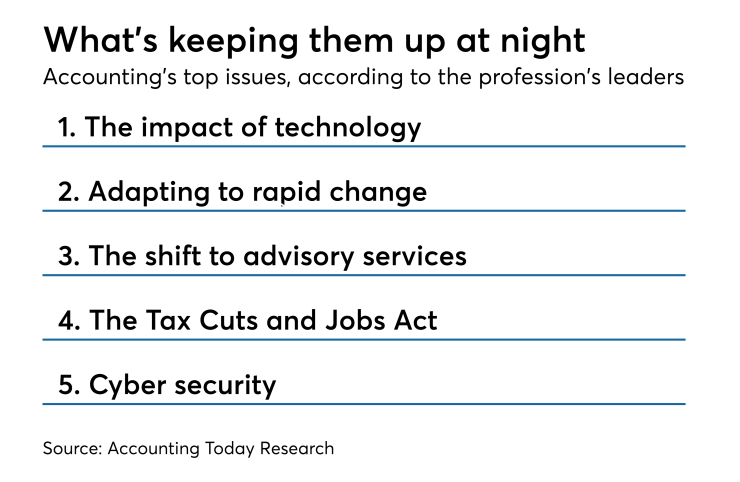

Staffing, succession planning, tax reform, cybersecurity, merger mania, commoditization of core services, the demand for more CPAs, and the search for relevance — as important as all these issues are to accountants, they pale in comparison to two overarching concerns in the minds of the profession’s leaders: the impact of new technologies, and accounting’s ability to adapt to the rapid pace of change.

In a recent Accounting Today survey of a wide range of practitioners, firm leaders, association heads, regulators, consultants and other thought leaders, those two concerns were most frequently cited as the biggest challenges facing the profession, raising a host of subsidiary issues that accountants will need to address in the coming months and years.

Come the revolution

At their broadest, developments in technology are having society- and economy-wide effects that will change the way we all conduct business and our lives. “Massive shifts in technology like data automation, blockchain and artificial intelligence are ushering in what some are calling the ‘Fourth Industrial Revolution’ and others (perhaps more accurately) are calling ‘the Transformation Economy,’” explained Joe Woodard, chief executive officer of Woodard Events and the organizer of the annual Scaling New Heights technology conference.

That will mean widespread changes to client demands, employment practices, and how businesses are run, but those technologies will also have very specific effects on accountants.

“The introduction of data analytics and innovative technologies, such as artificial intelligence, bots and drones, provides the opportunity for the greatest change in the accounting profession since the passage of the Securities Act of 1933 and the Securities Exchange Act of 1934,” explained D. Scott Showalter, chair of the Federal Accounting Standards Advisory Board, and professor of practice in the Poole College of Management at North Carolina State University. “No matter the discipline, whether audit, accounting, tax or advisory, all will be affected by these innovations.”

The concerns aren’t limited to the potential for technology to commoditize core services like the audit, bookkeeping and tax prep (though that certainly worries many); they also encompass the potential for those services and the entire role of accountants to be radically reshaped.

“Technology’s exponential advancement is impacting the profession in profound and unprecedented ways,” according to Maryland Association of CPAs chief communications officer Bill Sheridan. “Artificial intelligence, cognitive computing, blockchain, and even more mainstream technologies like cloud computing and social media are transforming what accounting and finance professionals do — and what they need to know. Our very existence depends on our ability to learn the skills that will let us work side-by-side with the machines and do the things they cannot yet do.”

There was little question among accounting’s leaders that advancements in technology were setting the pace, and that the profession needed to do its best to keep up.

“The relevancy of the accounting profession in the next decade will be largely impacted by how capable we are at visualizing and harnessing the potential benefits of new technology, and how willing we are to make the changes necessary to take advantage of the enhanced technology of tomorrow,” said David Vaudt, chairman of the Governmental Accounting Standards Board.

But while Vaudt saw this challenge playing out over a decade, others weren’t so sure there was even that much time. Citing the “exponential rate of change” that blockchain, AI and big data will bring to audit and accounting, IntrapriseTechKnowlogies managing director Donny Shimamoto warned, “Many accountants think it will be a slow change, but because it’s an exponential change curve, it will suddenly be here and people aren’t going to be ready. We need to start getting ready to use these technologies now by better understanding risk and controls (especially IT risk) and data analytics.”

Meanwhile, Janice Gray, vice chair of the National Association of State Boards of Accountancy, was concerned about limits on other relevant resources: “All of this change related to technology and artificial intelligence will affect small firms and require close monitoring,” she said. “With resources limited for small firms, it could affect their abilities to audit clients and thus further diminish the pool of auditors available to provide services to smaller clients in an economical manner.”

Despite widespread belief that advancements in technology represent a major challenge for accountants, there was an almost equally widespread belief that they could also offer solutions to many of the profession’s problems, and opportunities for significant growth.

That raised a red flag, however, for CPA Trendlines CEO (and former Accounting Today editor-in-chief) Rick Telberg, who warned against an over-reliance on non-human solutions.

“Too many firms are looking for solutions from new technology, software and apps, to the detriment of skills-building and process improvements that would better serve clients with broader and deeper services,” he said. “In short, firms are primarily using technology to reduce costs and increase productivity, instead of leveraging technology to get better at doing what clients want most — providing proactive insight, analysis and guidance. Technology can replace people, and it is; you can see it in hiring trends and in per-partner incomes. But technology cannot replace the judgment and wisdom that clients really want from their accountants. This techno-centric behavior is pushing aside the client-centric habits that have made accounting the great profession it remains today. The profession does so at its peril.”

Up the value chain

Telberg’s warning was well-taken by many of the leaders Accounting Today surveyed, who agreed that, in the face of all this technological change, the profession needs to double down on better serving clients, and to move up the value chain in terms of the services it offers.

“The challenge is to switch our roles from that of compliance worker to that of knowledge worker and consultant. By utilizing all of the new digital tools of AI and big data to advise clients, we can give them knowledge they can use, as opposed to just giving them back work products to meet regulatory requirements,” said David Bergstein, digital evangelist for the accountant segment at Intuit. “Accountants need to harness the current technology tools while remembering that we are uniquely qualified to provide answers because of our understanding of how the numbers work and how they are connected.”

Interestingly, the profession’s leaders were divided as to whether they viewed the move to become forward-looking consultants as taking advantage of a major opportunity, or as responding to a major threat.

“By automating parts of the business processes, AI grants accountants more time to serve as a strategic partner to clients and provide data-driven insights to inform business decisions,” said Jennifer Warawa, executive vice president of partners, accountants and alliances at Sage, firmly in the “opportunity” camp. “In the long-term, this emerging technology will empower accountants to provide a higher caliber of services to clients.”

Similarly enthusiastic was Matt Armanino, chief operating officer and managing partner-elect of Top 100 Firm Armanino. “There is a massive opportunity for us to become intensely client-focused and leverage our relationships to transform our businesses,” he said. “We must seek to be more than great tax advisors and consultants, or terrific auditors or accounting experts ... . We need to aspire to broaden the footprint of our relationships, to include not only our accounting technical expertise as a foundation, but to layer on capabilities around strategy, business transformation, IT consulting, data analytics, outsourcing, cybersecurity, and a myriad of other needs that our clients have.”

On the other hand, thanks to technology, “Traditional tax prep and audit work is going to start fading away,” warned Bonnie Buol Ruszczyk, president of BBR Companies. “The profession needs to position itself as knowledgeable business consultants, and those firms that are doing this will be in a better position to survive, and thrive.”

“Our old way of doing business may work for the clients we currently have, but it will not attract the clients of tomorrow,” said Roger Harris, president and COO of Padgett Business Services. “Clients can now take care of most of their compliance needs in many ways and will not turn to us for those services in the same numbers as they did before. ... We must move our companies to advisory and planning services and away from compliance work. ... We either accept the change facing our industry or we may face declining value in the eyes of our clients and successors.”

Either way, most agree that accounting must embrace technology to offer higher-value services — but that may require capabilities they don’t have.

“The profession is not ready — few accountants have the skills needed to make the transition,” said Acumatica CEO Jon Roskill. “They need to understand more about technology, automation, integration and business processes in order to serve their clients successfully.”

The new skill set

Many of Accounting Today’s respondents agreed with Roskill that the average accountant is not prepared for the future that is rapidly coming their way.

“As new tools augment our profession and streamline certain tasks, accountants will not only have to embrace new ways of working, but take on expanded roles — as data analysts and other specialists,” according to Deloitte CEO Cathy Engelbert. “Human capabilities such as judgment, insight, skepticism, courage and integrity will become more important than ever — and the profession will have to continuously cultivate these skills to keep pace with our clients and technological disruption, and continue to protect and create value for our capital markets.”

The pressure to re- or upskill themselves is only going to grow. “To avoid becoming obsolete, accountants must learn and develop new skills that will allow them to stay competitive and relevant in the field,” said IMA president and CEO Jeffrey Thomson. “Professionals should upskill with competencies that are not easily automated like decision support, data analytics and management and strategy.”

Not everyone was certain that the profession is ready to get ready. “The issue is, are we committed to upskilling ourselves, to invest in our personal skills so that we stay relevant?” asked Arleen Thomas, managing director for the Americas and CGMA global offerings at the AICPA. “Are we ready to embrace change, to tell a different story, and to work differently?”

Individual accountants will certainly bear the main responsibility for developing the new skills they need, and firms will need to support them in that. But more broadly, a number of leaders believe that the profession as a whole has to address how it trains and educates its members.

“The challenge is that our education system is doing a dismal job of preparing accountants to work deeply with technology,” lamented Blake Oliver, senior product manager at FloQast Inc.

“We need to determine how to best educate accounting students and professionals already in their accounting careers on how to build more skills outside of mastering technical accounting so we can better compete with people outside of our profession for the jobs we want to do,” said Elizabeth Pittelkow Kittner, controller at Litera and a member of the American Institute of CPAs’ Council.

“We have to change the way we train our accountants and the jobs that we provide them right out of school,” agreed Geni Whitehouse, founder of Even a Nerd Can Be Heard. “We must train them to be excellent communicators and seek candidates with high EQ (emotional intelligence), not just high IQs.”

Samantha Mansfield, director of professional development and community at CPA.com, offered a detailed prescription: “There needs to be innovation applied to redefining what a career path in accounting looks like and how professionals should build their experience,” she said. “With automation minimizing many entry-level roles, the profession needs to identify how young professionals gain experience and knowledge, so they can become valuable advisors. Though technology will augment their knowledge, the insights that come from years of experience and working with many industries will need to be developed in new ways. Techniques like mentoring will become key to developing additional understanding and skills needed to be successful.”

Resistance to change

If there was a single common thread to the issues that are top of mind for the profession’s leaders, it’s change — change in almost every aspect of accounting.

“This is not your grandfather’s or your father’s accounting profession, and in fact it is not even the accounting profession most of today’s practitioners have experienced,” warned Janice Maiman, executive vice president of communications, PR and content at the Association of International Certified Professional Accountants. “We are on the shores of a sea change as sweeping as any we have ever experienced in this profession.”

In the face of that transformation, many leaders expressed serious concern about the profession’s ability to manage change.

“As technology evolves by the minute, are firms and companies keeping up?” asked Mark Koziel, executive vice president — public accounting at the Association of International Certified Professional Accountants. “Firms that have the appropriate change management in their firms will continue to prosper, while those who fight the change will have a challenge competing.”

A number worried that firms were avoiding making any choice at all — not adapting, but not fighting either. “Not confronting the many changes head on and being complacent or taking a ‘wait-and-see’ approach is the No. 1 issue facing CPAs,” said Tamera Loerzel, a partner at ConvergenceCoaching. “CPAs must act now — both in their personal learning and skills development and in their firms and organizations. CPA leaders must place their bets on a few changes to drive now to stay relevant and competitive and meet the demands and needs of their clients and organizations.”

Ian Vacin, co-founder and vice president of education and partnerships at Karbon, had one word for the problem: “Inertia. The profession is changing rapidly, and those that can’t comprehend, realize and adjust to that change will be left behind.”

And Wesley Middleton, managing partner of MiddletonRaines+Zapata and author of “Violent Leadership: Be a Force for Change: Disrupt. Innovate. Energize,” worried that the pull of the past would prevent accountants from changing to meet the future. “As a profession we are struggling with letting go of the past and the way things have always been done to embrace an ever-changing economic model,” he said. “Our clients and our future leaders that we are recruiting to join this profession are demanding innovation and a change in mindset or we face irrelevance in the market. Although the movement is underway, I am amazed at the lack of widespread support and the lack of action for change in our profession. It is not only a technology disruption, it is a generational disruption that is occurring, causing us to rethink our cultures and our strategies for recruiting and retention, and forcing us to face uncomfortable questions about our purpose.”

Some respondents singled out particular areas where an unwillingness to change was holding the profession back. For Jason Blumer, founder and CEO of the Thriveal Network, “The most important issue is the accounting firm owner’s embrace of their entrepreneurial responsibility in running their firm well. Many firms are structured poorly and prevent growth, team care, and proper client service ... and the firm’s business model is often their greatest inhibitor towards healthy growth.”

For Information Technology Alliance president Stan Mork, the biggest concern was firms’ ability to determine “the most cost-effective way to implement emerging technologies to improve service delivery to clients. ... I’m concerned that many firms aren’t really planning for the digital transformation that is facing them in the very near future. ... It’s important that all firms, large and small, review how technology is going to change how they do business and determine how they are going to move forward.”

And with so much traditional accounting work likely to be automated in the near future, Transition Advisors CEO Terry Putney worried about whether accountants were prepared to maintain their profitability.

“Can firms transition from the traditional hours-times-rates system of pricing services to capture the value of technology as hours are reduced?” he asked. “The need to embrace value-pricing models may become the basis for financial survival in many firms.”

It is, of course, possible for accountants, accounting firms and the profession as a whole to change, and while dire warnings of the consequences of failing to do so were widely available, one respondent offered a three-point plan for moving forward.

“A ‘business as usual’ mindset is going to trip up many accounting professionals and their organizations,” said Natasha Schamberger, CEO and president of the Kansas Society of CPAs. “We know that these trends will not rest but we can swiftly adapt our roles and our teams through a keen sense of awareness, action and adventure:

- “Awareness: If we get in the habit of regularly looking up from the important work on our desks to evaluate the impact and opportunities these trends have, then we can quickly align our mindsets with new realities so we can continue our important work as critical advisors into the future.

- “Action: We can think forward but act now by designing a plan for our teams that responds to pertinent signals of change by evaluating where we are, where we need to go, and what daily progress looks like to get to there.”

- “Adventure: Let’s find our sense of adventure. We do not know exactly what to expect but that’s the thrill of exploring new possibilities!”