-

Bipartisan legislation would extend the deadline after guidance from the Treasury Department fell short.

March 19 -

NASBA and the AICPA announced the decision after test administrator Prometric closed its test centers across the United States and Canada for 30 days.

March 19 -

The American Institute of CPAs’s Financial Reporting Committee released working drafts of two pieces of implementation guidance for the Financial Accounting Standards Board’s long-duration insurance contracts standard.

March 16 -

The American Institute of CPAs has debuted SOC for Supply Chain, a risk management reporting framework that CPAs can use to provide assurance services as they face risks in their supply chain ranging from coronavirus to trade to other threats.

March 12 -

The president said he would allow individuals and businesses to “defer tax payments without interest or penalties” and he urged Congress to cut payroll taxes.

March 12 -

The American Institute of CPAs updated its auditor reporting standards to conform them with recently issued auditing standards.

March 10 -

The American Institute of CPAs has submitted comments to the Internal Revenue Service and the Treasury Department asking them for more guidance on the qualified business income deduction in the Tax Cuts and Jobs Act.

March 9 -

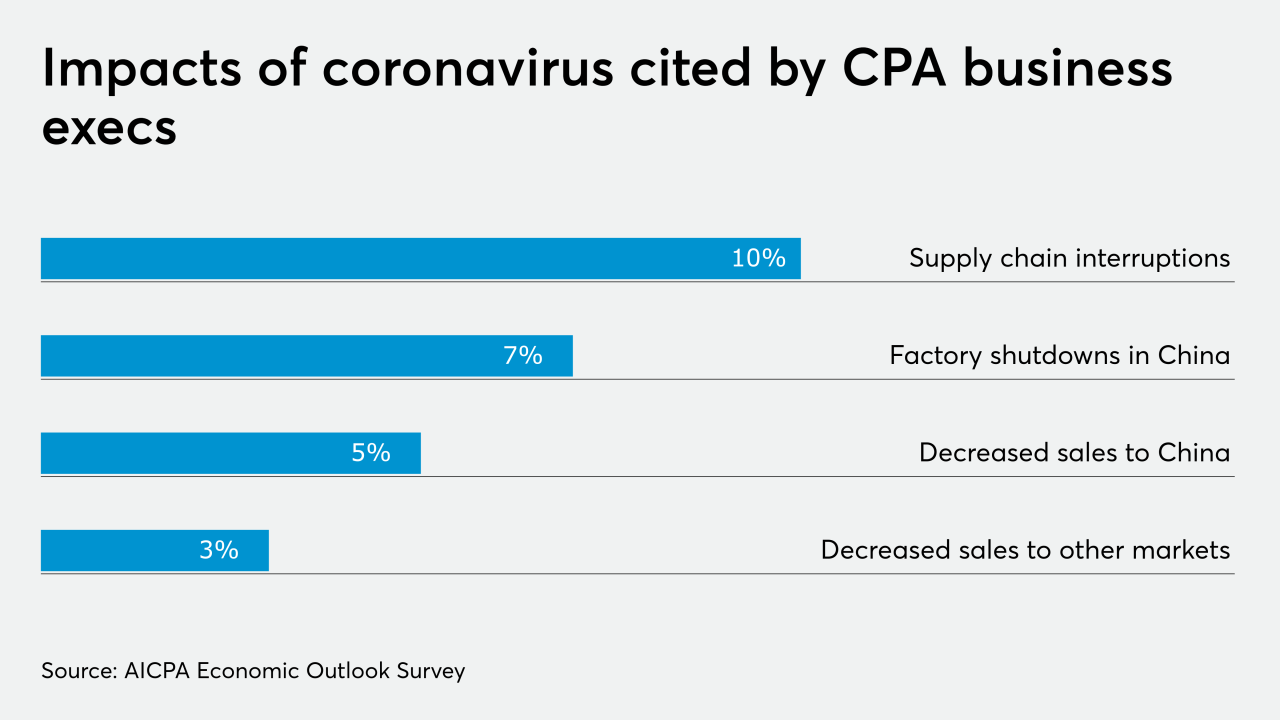

CPAs who are also business executives are concerned about the potential global fallout from the outbreak.

March 5 -

The AICPA is also urging the IRS to expand and clarify its cryptocurrency guidance.

March 4 -

CPA financial planners are noticing scams perpetrated against their elderly clients, according to a new survey by the American Institute of CPAs.

March 4