-

The proposed regulations will provide a rule for determining the source of borrow fees paid in securities-lending transactions and sale-repurchase transactions.

October 23 -

The Internal Revenue Service spelled out some of the services that will be limited or unavailable during the government shutdown.

October 22 -

The Senate passed the Internal Revenue Service Math and Taxpayer Help Act despite the government shutdown, sending it to President Trump for his signature.

October 22 -

Notice 2025-57 explains how businesses should report interest to car purchasers so they can deduct it under the OBBBA.

October 22 -

Using AI to teach accounting; CPAs and financial statements; TIGTA on joint returns; and other highlights from our favorite tax bloggers.

October 21

-

The American Institute of CPAs is asking for more flexibility for taxpayers who wish to claim tax deductions for overtime and tip income under the OBBA.

October 21 -

Enforcement activity and Tax Court cases are at a standstill, and practitioners should expect backlogs and slowdowns.

October 21 -

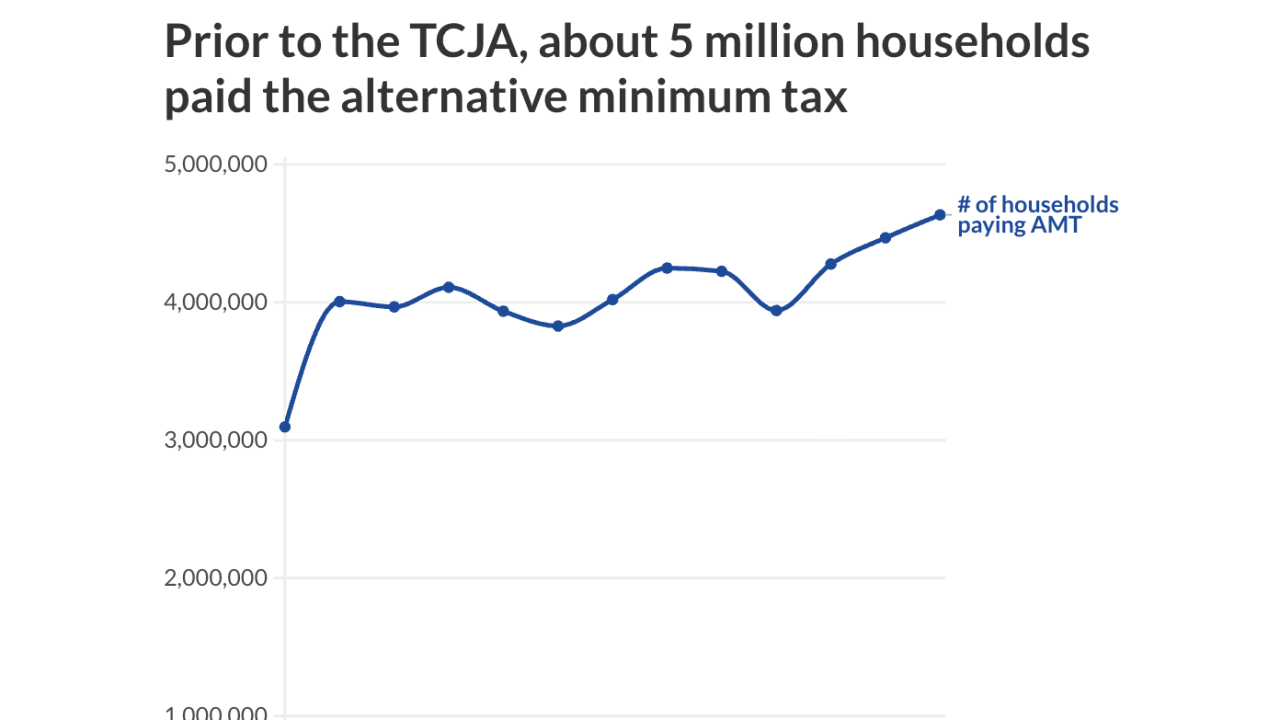

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

Gary Shapley and Joseph Ziegler reached settlements with the IRS and the Justice Department, and their lawsuit against Biden's attorney was dismissed by a judge.

October 17 -

A review of over 800 calls found that the overwhelming majority of phone interactions with Internal Revenue Service reps were courteous and professional.

October 15 -

Prosecutors agreed to dismiss the indictment against Ver, who admitted that he failed to pay all the taxes that he owed to the IRS on the sale of Bitcoin after he renounced his U.S. citizenship.

October 14 -

Shutdowns and tax obligations; 529 money and the CPA exam; gig questions; and other highlights from our favorite tax bloggers.

October 14

-

Despite the government shutdown, the IRS is reminding taxpayers and tax professionals that 2024 tax returns that were put on extension are still due.

October 14 -

Taxpayer Advocate Erin Collins warns about the potential downsides for some taxpayers of the IRS moving entirely to electronic payments.

October 14 -

Notice 2025-55 provides relief in connection with the new excise tax imposed on certain remittance transfers under the One Big Beautiful tax bill.

October 13 -

At the Internal Revenue Service, which sits within the Treasury Department, the administration plans to fire about 1,300 workers.

October 12 -

Rev. Proc. 2025-32 from the Internal Revenue Service detailed a number of changes, including a rise in the standard deduction to $32,200 for married couples filing jointly.

October 9 -

The Internal Revenue Service is taking steps to make sure taxpayers and tax preparers can reflect OBBBA changes in 2025 tax returns.

October 9 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

The remaining 39,870 staff will work on preparing for next year's filing season, modernizing the agency and implementing President Trump's new tax law.

October 8 -

Preparations for next tax season look likely to continue, even as the Internal Revenue Service began furloughing almost half its workforce.

October 8