-

New technology systems and the addition of cryptocurrency on tax forms are just some of the IRS developments to watch in 2024.

February 15 -

The IRS wants to help businesses know when they don't qualify for an Employee Retention Credit.

February 13 -

The Internal Revenue Service is looking for both corporate income and employment taxes for a four-year period.

February 13 -

The IRS is warning practitioners about a tactic that recurs every tax season.

February 13 -

SALT benefits; taxing blockchain tech; how to onboard; and other highlights from our favorite tax bloggers.

February 13

-

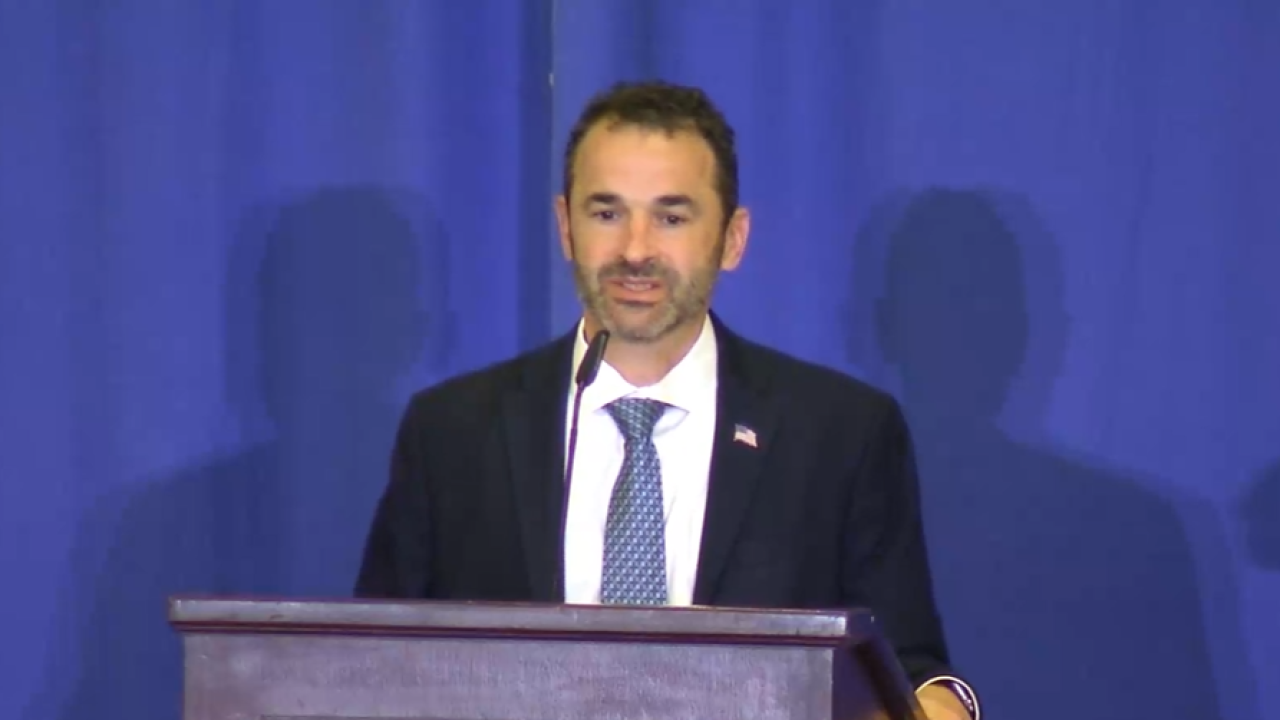

Jim Lee, the head of IRS Criminal Investigation, will step down April 6.

February 13 -

While passage in the Senate is uncertain, many of the changes could impact 2023 tax returns.

February 13 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

Hundreds of Internal Revenue Service employees and contractors continued to have access to at least one sensitive IRS computer system even after they stopped working there.

February 12 -

The Internal Revenue Service revised its frequently asked questions page on the Premium Tax Credit used for buying health insurance through the ACA marketplaces.

February 9 -

A provision paying for breaks for parents and business owners has earned widespread praise, but an expert says financial advisors should be on alert.

February 9 -

The American Institute of CPAs sent letters to the Treasury and the IRS asking for filing relief for taxpayers affected by major disasters and for more guidance on information returns for grantor trusts.

February 9 -

The Internal Revenue Service issued a warning about a new scam email this tax season pretending to come from tax software providers asking for the preparer's Electronic Filing Identification Number.

February 8 -

The Internal Revenue Service's Direct File free tax system has passed a key hurdle in the pilot test, passing muster with a dozen IRS employees successfully filing returns in as many states.

February 8 -

The IRS is pushing back tax filing and payment deadlines for those affected by storms, landslides and mudslides last August.

February 8 -

The Internal Revenue Service has posted a new page on IRS.gov explaining the Employer-Provided Childcare Tax Credit to provide more information about the tax break.

February 7 -

Avoidance above all; conferences to attend; creeping brackets; and other highlights from our favorite tax bloggers.

February 6

-

The Internal Revenue Service revised its frequently asked questions on the Form 1099-K to alleviate confusion this filing season.

February 6 -

A new analysis forecasts a higher return on investment from the Inflation Reduction Act of 2022, but only if the funding isn't reduced.

February 6 -

And what to do if your client hasn't received their abatement from the IRS.

February 6

-

The IRS is pushing back payment and filing deadlines for those impacted by storms and flooding in Maine.

February 5