-

Britney Spears is disputing a $600,000 tax claim from the Internal Revenue Service.

December 29 -

Trump administration officials are confidently forecasting that Americans will see the largest refunds next filing season thanks to the tax cuts in the OBBBA.

December 29 -

The Treasury and the IRS are asking that taxpayers hold off on claims until they clarify the rules.

December 26 -

The IRS Criminal Investigation unit cited its top cases that led to multiyear prison sentences and multimillion-dollar financial settlements for tax crimes.

December 26 -

Comments on the proposed framework are due by March 22.

December 24 -

Postmarks and donations; tuning up your comp system; please, Santa…; and other highlights from our favorite tax bloggers.

December 23

-

Led by Elizabeth Warren, 17 senators sent a letter to Treasury Secretary Scott Bessent expressing their "serious concerns."

December 23 -

The new Form 211, Application for Award for Original Information, lets people report tax noncompliance digitally.

December 23 -

Amanda Reynolds filed a complaint asking the court to determine whether pets can be recognized as non-humans dependents.

December 19 -

No expertise needed; losing Trump benefits; excise taxes can't replace property taxes; and other highlights from our favorite tax bloggers.

December 17

-

There have been significant changes in the way in which the IRS is now dealing with R&D tax credits and viewing how they're documented.

December 16

-

The agency's Criminal Investigation unit also identified 112% more tax fraud from the previous year.

December 14 -

The IRS is reminding taxpayers and tax practitioners of the changes to the credit from this year's big tax legislation.

December 12 -

That guidance basically asks employers to use their best efforts to provide documentation; no penalties will be imposed on those who were unable to document qualified tips and overtime.

December 11 Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting -

The agency is also looking for feedback on the guidance by next March.

December 10 -

Extension battle goes on; flipping out; correcting clients' misinformation; and other highlights from our favorite tax bloggers.

December 9

-

The release coincides with a $6.25 billion donation from Michael Dell and his wife to kickstart the savings program.

December 4 -

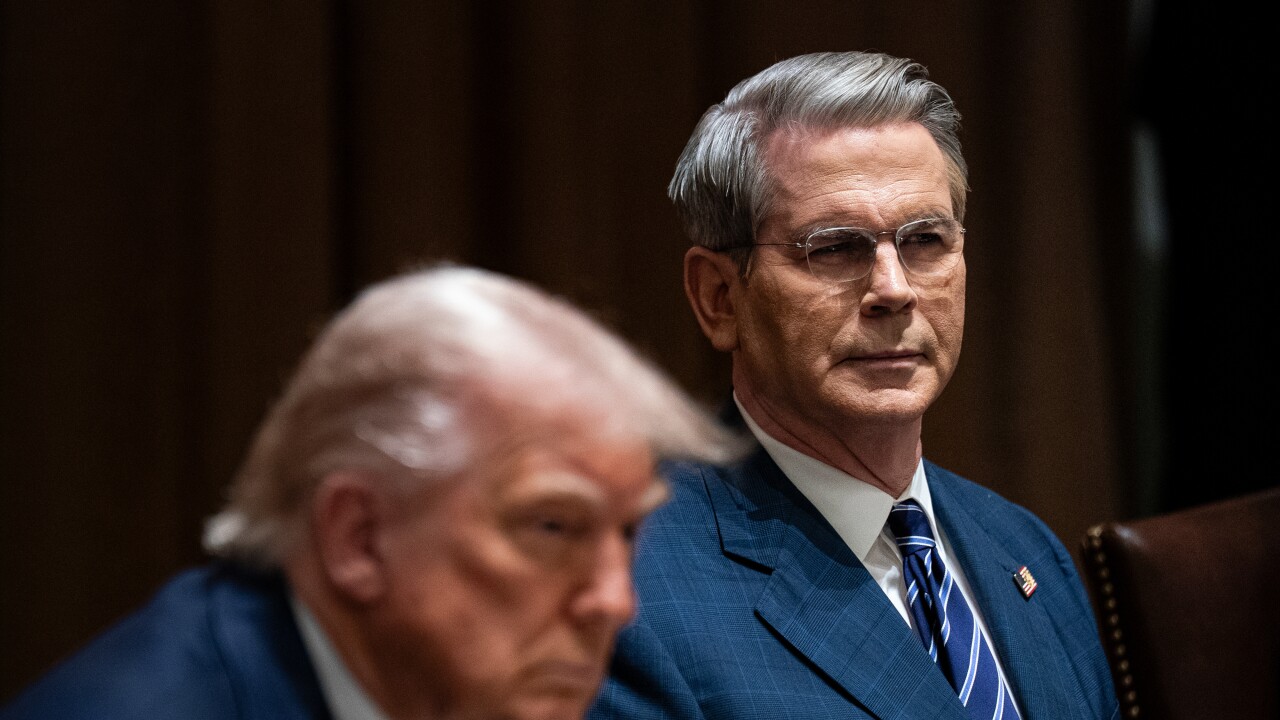

Trump's aides are discussing making the Treasury chief the top White House economic advisor, in addition to his current job, plus acting IRS commissioner.

December 4 -

Planning around SSI COLAs; holiday business deductions; complex decisions of inheritance; and other highlights from our favorite tax bloggers.

December 3

-

The House approved two pieces of legislation to keep IRS agents from levying fines and penalties without supervisory approval, and to strengthen taxpayer rights in proceedings before the Tax Court.

December 3