Cryptocurrency

Cryptocurrency

-

The Internal Revenue Service has been leading the charge on investigations of Bitcoin users, with more on the way now that it has access to information from at least 14,000 customers of Coinbase.

June 27 -

Practitioners share their clients’ need for education on bitcoin and its ilk.

June 5 -

The American Institute of CPAs wants additional guidance about Bitcoin taxes.

May 30 -

Processing Bitcoin and other cryptocurrency payments is just the tip of the iceberg when it comes to the ways that blockchain-based technologies could disrupt the accounting profession.

May 30 -

Facebook dinged in California; New York State of workaround; SEC spoof; and other highlights from our favorite tax bloggers.

May 22 -

Forget Bitcoin -- accountants need to learn everything they can about the technology that underlies it.

May 7 -

If you thought trading Bitcoin was wild, try figuring out how to pay taxes on it.

April 12 -

Initial coin offerings have raised billions of dollars for startups while attracting criminals and authorities around the globe. Now, the young market may get some help cleaning up from the Big Four consulting firms.

April 11 -

Cryptocurrency investors are grappling with how to properly report their transactions to the IRS with the April 17 tax filing deadline fast approaching.

April 5 -

The tax treatment of bitcoin and its ilk raises major questions.

April 2 -

The Internal Revenue Service warns virtual currency users they need to disclose gains on their tax returns.

March 23 -

More rush regulation; figuring reasonable compensation; software versus you; and other highlights from our favorite tax bloggers.

March 20 -

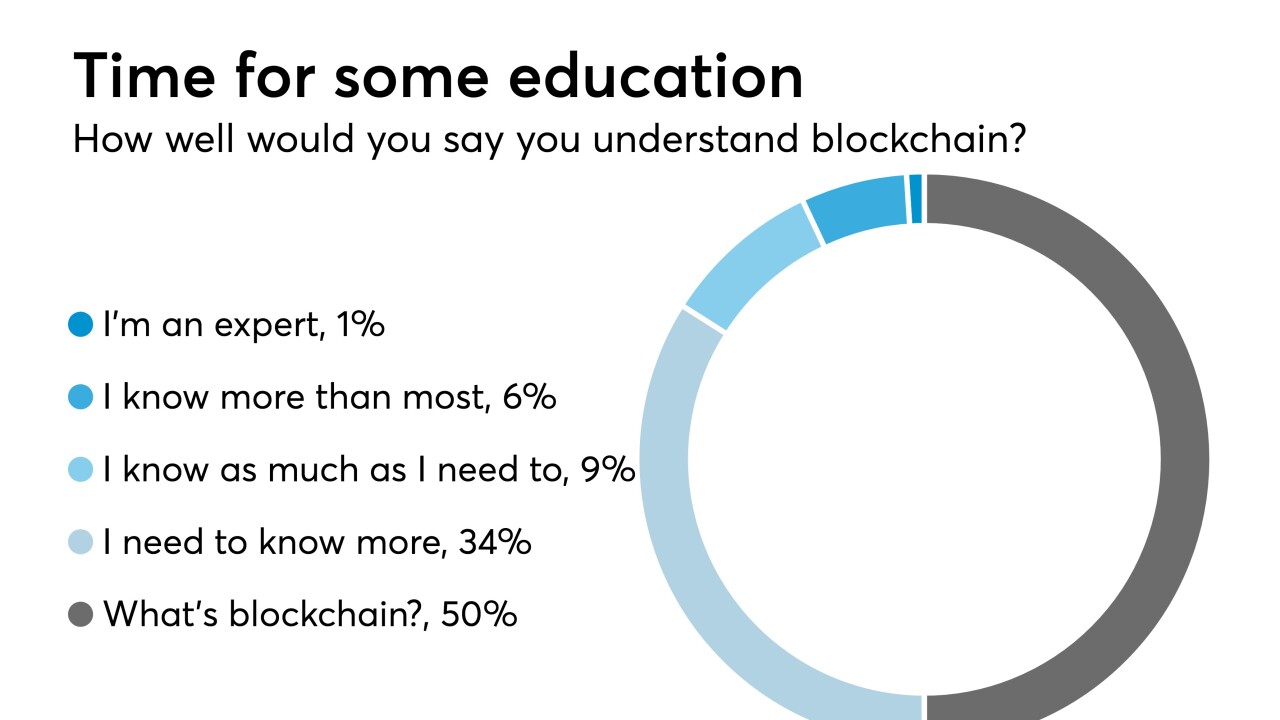

Blockchain is one of the hottest topics in the accounting and financial services field, but a substantial amount of uncertainty remains.

March 13 -

Clients may face unexpected tax consequences from transactions with these digital assets.

March 13 -

This year may bring a barrage of questions from clients about cryptocurrency. Here's how to be ready for them.

February 26 -

Blaming Woodrow Wilson; why to benchmark; the Advocate speaks; and other highlights from our favorite tax bloggers.

February 21 -

The Association of Certified Fraud Examiners appointed a new CEO and president, Bruce Dorris, succeeding longtime leader Jim Ratley, who will be retiring.

February 9 -

The Internal Revenue Service, fresh off its success in uncovering U.S. assets hidden in Swiss banks, has assigned elite criminal agents to investigate whether Bitcoin and other cryptocurrencies are being used to cheat the taxman.

February 9 -

In the coming years, the industry will play a significant role in driving the adoption of this world-changing technology.

February 7 -

Tax professionals need to be ready when clients have questions.

February 2