Regulation and compliance

Regulation and compliance

-

The Internal Revenue Service posted a fact sheet about its move away from paper checks to electronic payments for taxes and tax refunds.

4h ago -

The Internal Revenue Service and the Treasury released a set of questions and answers on the new deduction for overtime pay under the One Big Beautiful Bill Act.

January 23 -

Larger transactions and the resurgence of SPACs are reshaping the market, increasing the stakes for accurate, timely, and well-informed accounting decisions.

January 23 -

Notice 2026-13 provides safe harbor explanations that may be used by plan administrators for explaining eligible rollover distributions.

January 21 -

Here's why modern lease management is essential for financial planning, cross-departmental collaboration and compliance.

January 20 -

Rev. Proc. 2026-08 updates procedures for exemption from income tax on a group basis for 501(c) organizations that are under the control of a central organization.

January 20 -

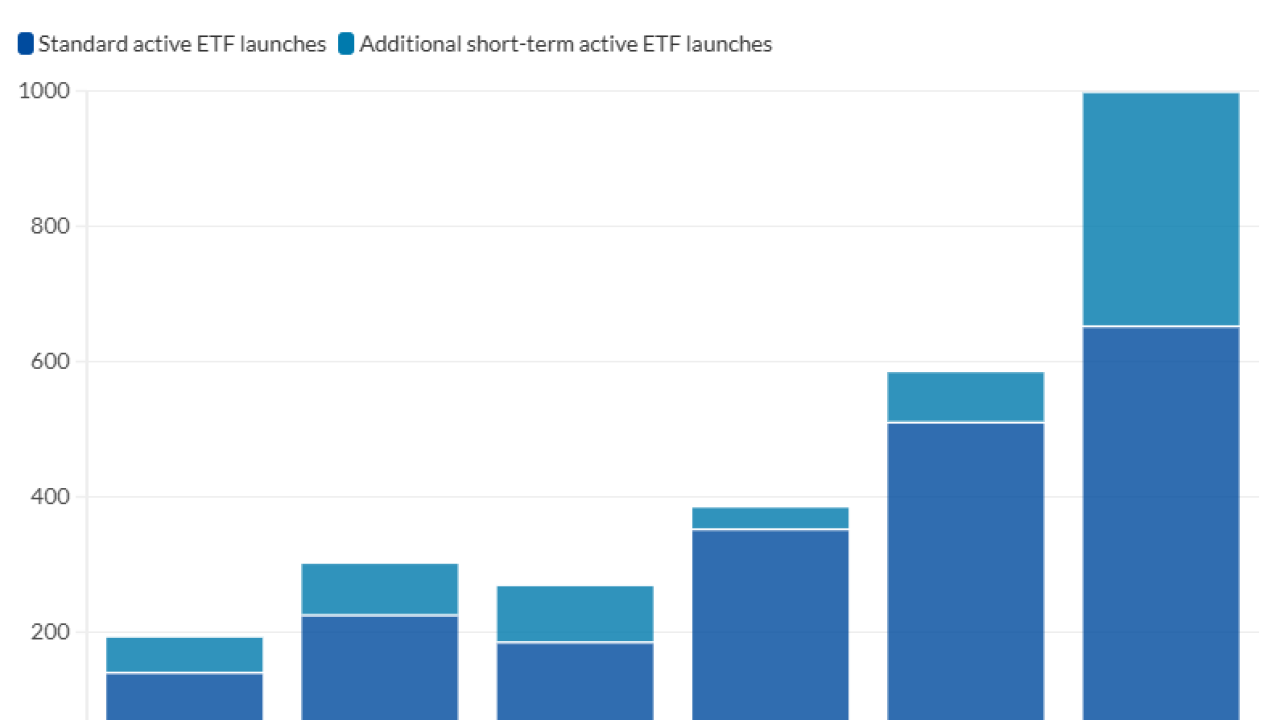

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Notice 2026-11 from the IRS provides guidance on the permanent 100% additional first-year depreciation deduction provided by the One Big Beautiful Bill Act.

January 15 -

-

The American Institute of CPAs updated the criteria for stablecoin reporting amid heightened focus on stablecoin oversight.

January 12 -

The SEC alleged the mining company failed to follow proper accounting rules to accurately record and value its assets.

January 12 -

Many of the most serious issues in financial reporting and tax compliance stem from ordinary mistakes in organizations that believe they are compliant.

January 9 -

The Treasury and the IRS issued proposed regulations to revise the threshold for when third-party settlement organizations need to perform backup withholding.

January 8 -

After a year of rolling policy shocks, the U.S. economy is set to get a lift from President Trump's tax-cuts package to keep the expansion on track in 2026.

January 5 -

The tax deduction applies to new cars assembled in the U.S. purchased from 2025 through the end of 2028.

January 2 -

The proposed regulations relate to the new deduction for interest paid on vehicle loans incurred after Dec. 31, 2024, to purchase new made-in-America vehicles for personal use.

December 31 -

Simply having a finance team with a traditional accounting skill set will not suffice in this new phase of the digital economy.

December 31 -

The updated framework under the OBBBA has created new opportunities for the sports and entertainment industries in rural areas and low-income urban areas.

December 30 -

Major tax legislation, IRS staffing issues, and plenty of client confusion promise a challenging tax season.

December 30 -

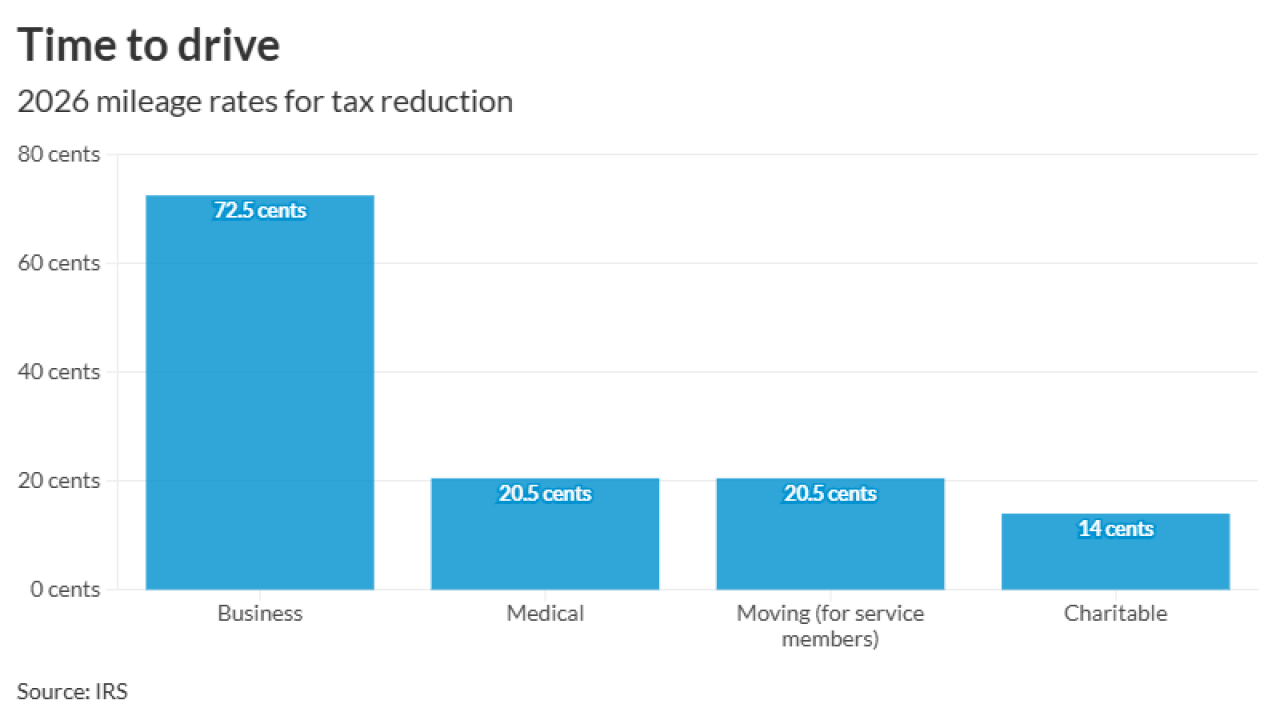

According to IRS Notice 2026-10, however, some other mileage rates will go down.

December 29