-

The debate about the cap on federal deductions for state and local taxes has flipped the tables for lawmakers.

June 25 -

Americans gave less money to charities last year partly because the Republican tax law changes made many people ineligible for tax breaks that can inspire donations.

June 18 -

New York, New Jersey and Connecticut have been fighting a new cap on state and local tax deductions ever since it was included in the 2017 Republican tax overhaul.

June 13 -

Sen. Ron Wyden, D-Ore., introduced the legislation in response to the recent college admissions scandal.

June 6 -

Good news for taxpayers in New York, New Jersey and California. Lawmakers are going to start talking about rolling back a new limit on a popular break for state and local taxes.

June 6 -

The legislation would correct a problem in the Tax Cuts and Jobs Act that makes it difficult for performing artists to deduct their work-related expenses.

June 5 -

The Tax Court has held that the generous tips and gifts that a Catholic evangelist considered to be part of his efforts to spread the gospel were not deductible charitable contributions.

June 5 -

Four days before the filing deadline, the IRS quietly added 21 questions to its website page of frequently asked questions about issues related to Section 199A, the new 20 percent deduction for pass-through businesses.

May 24 Kaplan Financial Education

Kaplan Financial Education -

The revenue procedure updates the depreciation deductions allowed for owners of passenger automobiles, trucks and vans placed in service in 2019.

May 22 -

Small businesses across America are asking the same question: Am I operating in the correct entity to maximize tax savings?

May 21 1st Global

1st Global -

Planning for the deduction can yield significant tax savings.

May 14 Seward & Kissel LLP

Seward & Kissel LLP -

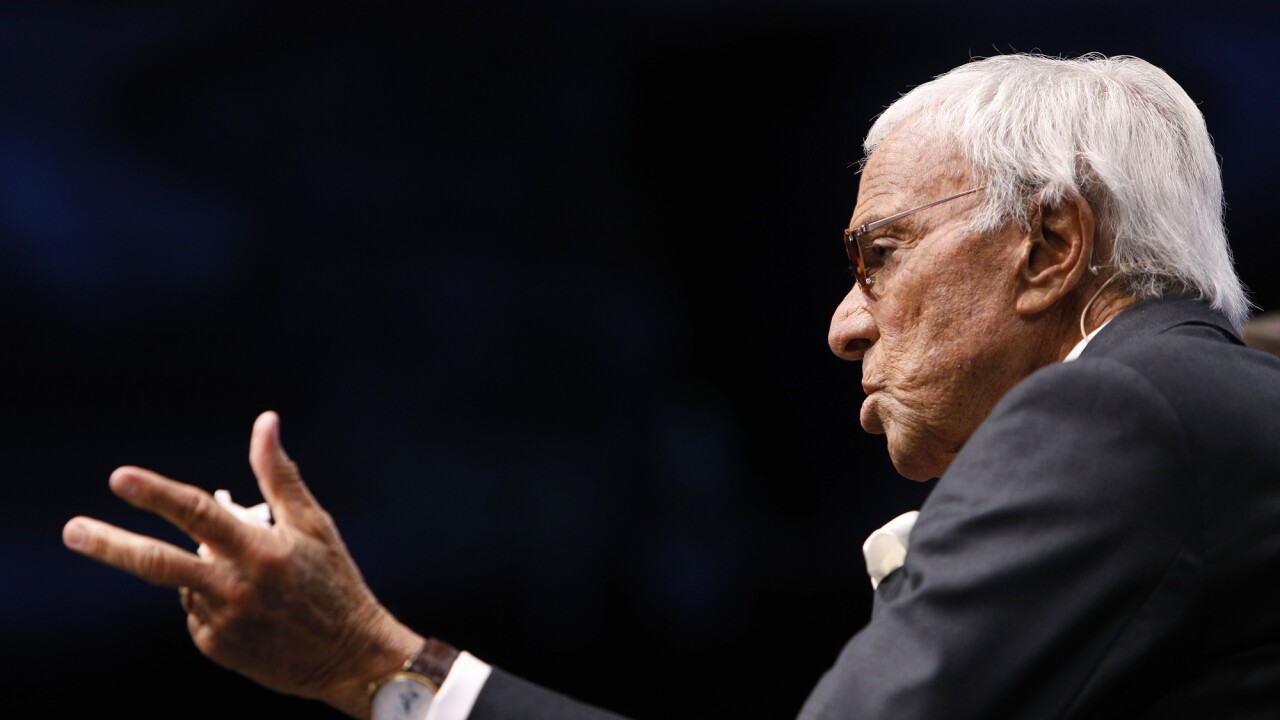

A decade ago, Angelo Mozilo was the face of the housing bust that preceded the financial crisis. Now the former chief executive officer of Countrywide Financial Corp. is predicting another drop, and for some homeowners it may be even worse.

May 10 -

President Donald Trump earned a large amount of interest income two decades ago that was used in tandem with then-burgeoning losses to help him avoid paying federal taxes, according to newly published tax details.

May 9 -

The Internal Revenue Service has issued a notice setting the inflation-adjusted maximum value of a vehicle provided by an employer to an employee for personal use.

May 8 -

President Trump complains that large corporations, such as Amazon.com, are shirking their tax responsibilities. Yet for at least a decade, Trump paid none or very little in federal income taxes by exploiting some of the same generous tax breaks.

May 8 -

President Donald Trump said that New Yorkers could have thwarted a provision in his tax law that limits state and local tax deductions, one of the most controversial changes in the 2017 overhaul that contributed to Republican losses in the 2018 midterms.

April 29 -

The Democratic presidential candidate and New Jersey senator released 10 years of tax returns, showing he faced a new cap on deductions of state and local taxes.

April 25 -

A TIGTA report examines the impact of the Tax Cuts and Jobs Act on the service, and how it was implemented.

April 22 -

The Democratic presidential candidate made a mistake on deducting medical expenses in 2013 and 2014.

April 16 -

One thing that all business trips have in common is turning in receipts for travel and expenses, but what should or shouldn’t employees be expensing?

April 15