-

The amount of total assets under management in donor-advised funds grew 9.7 percent to more than $85 billion last year, as an 80-year-old vehicle for philanthropy and charitable giving continues to grow in popularity.

November 28 -

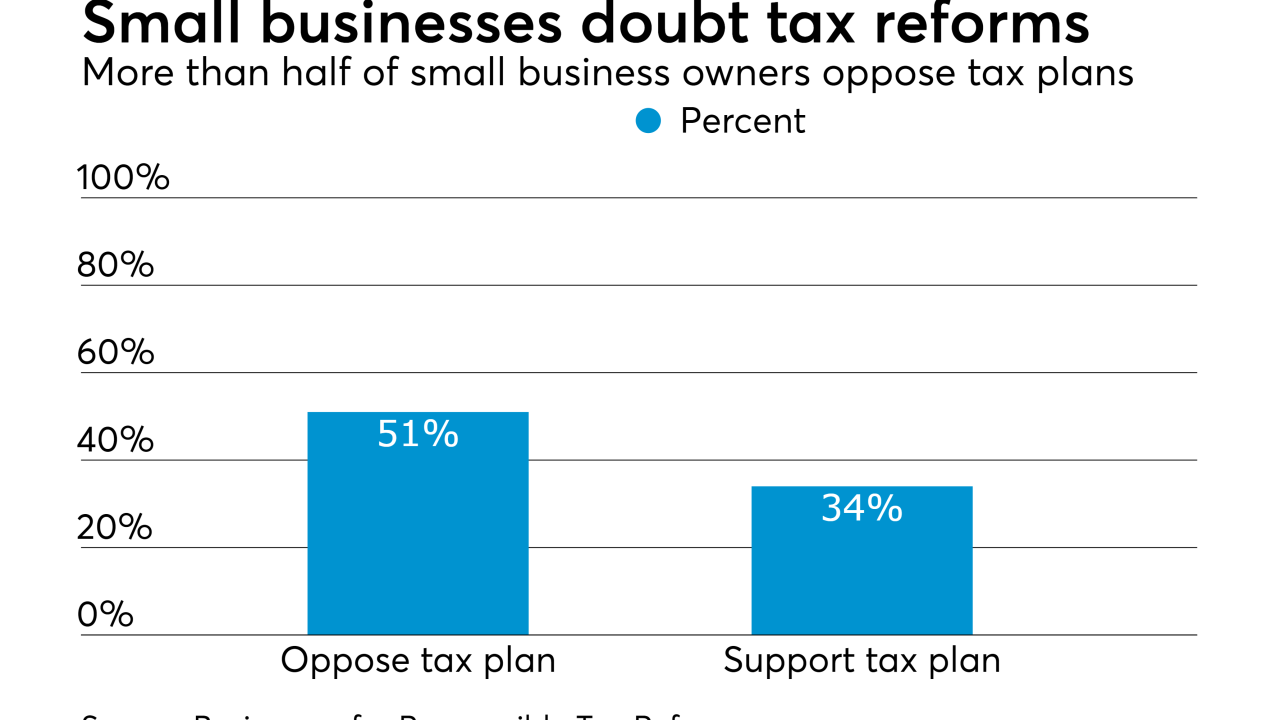

A majority of small business owners oppose the tax reform plans now being considered by Congress, according to a new survey.

November 27 -

A new revenue procedure provides a safe harbor allowing taxpayers to deduct costs for fixing deteriorating foundations.

November 27 -

Republican lawmakers are scrambling to lock up the votes needed to finalize a tax bill that can make it to President Donald Trump’s desk by the end of the year, without the benefit of an important estimate of its possible economic benefits.

November 27 -

Even Bruce McGuire, founder of the Connecticut Hedge Fund Association, understands if wealthy Northeasterners flee the region due to changes in the tax code.

November 27 -

As 2017 draws to a close, the uncertain tax and legislative environment means that year-end tax planning is more important than usual. To help individuals and businesses prepare for filing season, Grant Thornton LLP has some tips.

November 26 -

A new 50-state analysis of the tax reform bill passed last week by the Senate Finance Committee finds the plan would increase taxes on at least 29 percent of taxpayers by 2027 and cause the populations of 19 states to pay more in federal taxes than they do today.

November 20 -

As the Republican-controlled Congress tries to push through tax reform this year, one group of Americans may question why it’s coming up a scoop short.

November 20 -

The Republican tax-overhaul effort is in for a marathon debate on the Senate floor at the end of this month, with dozens of doomed Democratic amendments. But the real action will be elsewhere, behind closed doors.

November 20 -

Senator Susan Collins said the Republican tax plan passed by the Senate Finance Committee on Thursday “needs work.”

November 20 -

For more than 30 years, colleges and universities have leaned on an obscure tax rule that allows sports boosters to make tax-deductible contributions to their teams. Athletic fundraisers around the country say that’s an advantage that generates millions in annual revenue—and one that’s threatened by Republican tax legislation.

November 17 -

The Republican tax plan isn’t designed to help rich New Yorkers, but Wall Street can certainly look forward to some advantages, said Treasury Secretary Steven Mnuchin.

November 17 -

The House passed tax reform legislation Thursday by a vote of 227-205, with 13 Republicans voting against the bill, as the Senate Finance Committee continued debating and marking up a significantly different version of the bill.

November 16 -

Treasury Secretary Steven Mnuchin is mounting a cross-country roadshow to persuade businesses and the Republican faithful to put their weight behind a proposed tax overhaul from the Trump administration that so far lacks broad public support.

November 16 -

House Speaker Paul Ryan said temporary provisions in the GOP tax bill won’t really go away in a few years—he predicted that future Congresses will preserve them, and he didn’t mention the impact that would have on the federal deficit.

November 14 -

The American Institute of CPAs is reacting to Senate Republicans’ tax reform plan with its own set of priorities.

November 13 -

Senate Majority Leader Mitch McConnell is about to face a legacy-defining test of whether he can keep his unruly caucus in line to deliver President Donald Trump’s coveted goal of “massive tax cuts” in 2017.

November 13 -

The Senate tax-writing committee plans to start hammering out the details of its tax cut proposal on Monday. The House may vote on its bill as soon as Thursday. Here are the latest developments, updated throughout the day.

November 13 -

The Senate tax-writing committee plans to start hammering out the details of its tax cut proposal on Monday. The House may vote on its bill as soon as Thursday. Here are the latest developments, updated throughout the day.

November 13 -

Republican tax writers in the House and Senate scoured the U.S. tax code Thursday and shook the couch cushions for loose change, as one member put it, in an all-day struggle to find ways to pay for the deep tax cuts their leaders and President Donald Trump have promised.

November 10