-

The Internal Revenue Service is still dealing with a backlog of unprocessed mail from 2020, hurting its efforts to provide help with COVID-19 relief payments and this year’s tax season.

February 18 -

The Treasury Department said Friday it plans to launch an all-out effort to deliver Economic Impact Payments to people who haven’t yet received the two rounds of stimulus payments that they should have received last year or this month.

January 22 -

Tax-refund delays and stimulus-payment hiccups could spill into the upcoming tax season as the Internal Revenue Service continues to face challenges related to the coronavirus pandemic and as Congress considers yet another round of direct payments.

January 13 -

With the filing season upon us, a raft of brand new challenges await ahead of the April 15 deadline.

January 13 Tax & Accounting Professionals business of Thomson Reuters

Tax & Accounting Professionals business of Thomson Reuters -

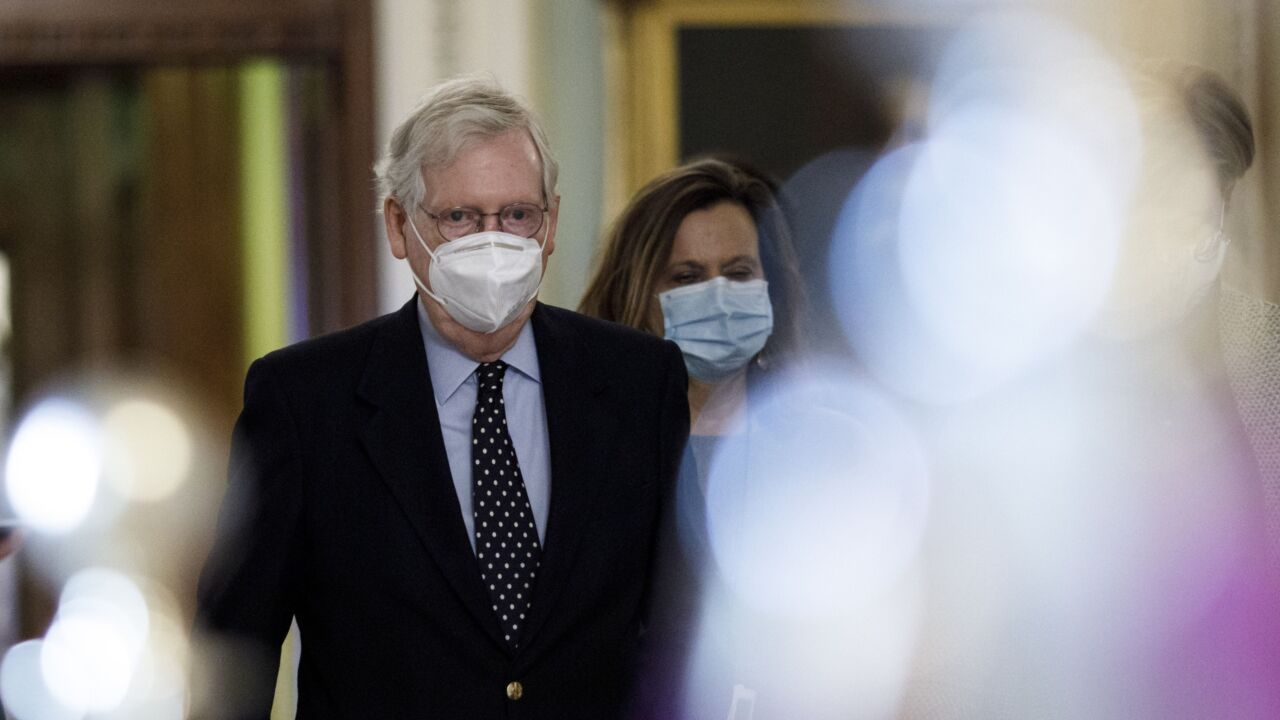

President-elect Joe Biden’s plan to pass a multitrillion-dollar economic stimulus package early in his administration faces challenges in a closely divided U.S. Senate, with a potential impeachment trial for Donald Trump that could add to delays.

January 11 -

The Internal Revenue Service is once again depositing the latest round of Economic Impact Payments in the wrong bank accounts in a replay of problems experienced last year by many taxpayers.

January 6 -

Senate Majority Leader Mitch McConnell on Wednesday closed off chances that the Senate would pass anytime soon a House bill that would give most Americans $2,000 stimulus payments.

December 30 -

The initial direct deposits of the second round of economic impact payments are already going out to taxpayers.

December 29 -

Senate Majority Leader Mitch McConnell on Tuesday blocked an attempt by Democrats to force quick action increasing direct stimulus payments to $2,000 as President Donald Trump warned that failing to act now amounted to a “death wish” by Republicans.

December 29 -

Republicans will likely block Democrats’ attempts to have the Senate follow the House in boosting stimulus payments for most Americans to $2,000, even though President Donald Trump backs the bigger checks.

December 29 -

President Donald Trump signed a bill containing $900 billion in pandemic relief, the White House said, triggering the flow of aid to individuals and businesses and averting the risk of a partial government shutdown on Tuesday.

December 27 -

Lawmakers across the political spectrum urged President Donald Trump to sign the $900 billion coronavirus stimulus bill passed with bipartisan support last week, as millions of Americans face a loss in benefits.

December 27 -

House Republicans blocked Democrats’ attempt to meet President Donald Trump’s demand to pay most Americans $2,000 to help weather the coronavirus pandemic.

December 24 -

The House and Senate are set to vote Monday on $900 billion in pandemic relief aimed at boosting the U.S. economy into the early spring, combined with $1.4 trillion to fund regular government operations for the rest of the fiscal year.

December 20 -

The Internal Revenue Service reminded taxpayers Thursday that they only have until Nov. 21 at 3 p.m. Eastern Time to register for an Economic Impact Payment of $1,200 or more.

November 19 -

The Internal Revenue Service is giving taxpayers more time until Nov. 21 to register their dependents for the $500 per child Economic Impact Payments provided under the CARES Act.

October 26 -

The Internal Revenue Service is giving taxpayers until the end of the year before it stops its temporary procedures for faxing in Forms 1045 and 1139 for claiming tentative tax refunds.

October 15 -

Internal Revenue Service commissioner Chuck Rettig heard complaints from lawmakers about their constituents missing stimulus payments.

October 7 -

At the center of President Donald Trump’s dispute with the IRS is a $72.9 million tax refund. He can thank his predecessor for that benefit.

October 1 -

The details published about Donald Trump’s tax returns were a revelation to the public but not to a small group of attorneys who work for a little-known congressional panel.

September 29